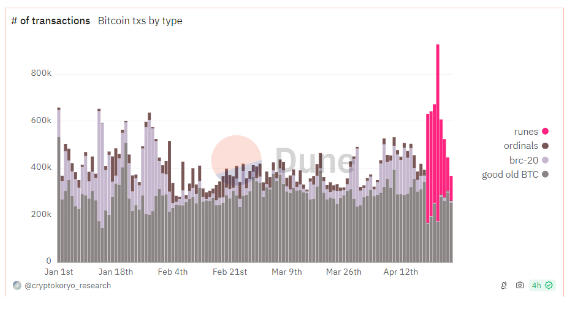

The Bitcoin network has witnessed a surge in trading activity in the days after the halving, as shown by on-chain data. Although the just concluded halving brought a lot of attention to Bitcoin, the recent surge in trading activity can be attributed to something else.

According to data from on-chain analytics platform IntoTheBlock, the number of daily BTC transactions has grown rapidly in the past few days to reach a new high of 927,000 thanks to a new token standard called Runes.

Bitcoin Daily Transactions Reach New All-Time High

Bitcoin’s price has been skyrocketing since the beginning of the year with interest in the top cryptocurrency exploding. All that new interest means more people buying, selling, and trading BTC, which has led to a huge increase in the number of daily transactions.

Despite the increase in activity, the number of daily transactions failed to break above the 724,000 record for the past four months, until recently this week.

The main catalyst for this activity surge is the recent launch of the Runes token standard on the Bitcoin blockchain. The Runes Protocol is a new token standard on BTC that gives users a more efficient way of creating fungible tokens.

The additional functionality provided by Runes opens up new possibilities for Bitcoin, allowing users to create non-fungible tokens more efficiently than the existing BRC-20 token system.

The Runes token standard surged immediately among developers and users after launch, constituting over 68% of Bitcoin transactions recorded. According to Dune’s analytics dashboard, the number of Runes transactions surged to 753,000 on Tuesday, April 23. As a result, the total number of transactions on the day crossed over 927,000 to break the 724,000 record set in December 2023.

Bitcoin hit a new all-time high in daily transactions!

Following the launch of Runes, The number of Bitcoin transactions has increased rapidly, hitting 927,000 on Tuesday. This breaks the previous high of 724k set in December of 2023 pic.twitter.com/30JXbrLmdR

— IntoTheBlock (@intotheblock) April 26, 2024

On the other hand, the hype surrounding the Runes token standard seems to have faded so quickly. The number of transactions on Runes has now fallen to 104,800 in the past 24 hours, constituting 26% of the total number of transactions.

Bitcoin Price Prediction

At the time of writing, Bitcoin is trading at $63,711 with a price resistance now around $64,500. Bitcoin’s price trajectory can be very tough to predict. Many Bitcoin analysts and traders are still looking forward to a bullish effect of the just concluded halving on the price of the cryptocurrency. A Bitcoin bull flag has just been formed which suggests the possibility of an uptrend very soon.

However, crypto expert Peter Brandt believes Bitcoin might have already reached its top in the current market cycle. His theory is based on the exponential decay thesis which shows that the percentage gain of Bitcoin price has reduced in succeeding market cycles.

Featured image from Pexels, chart from TradingView