The movement, or lack thereof, of Bitcoin in the market can provide significant insights into the behavior of investors and the overall health of the market. When there’s little movement of Bitcoin, it often indicates a robust holding sentiment among investors.

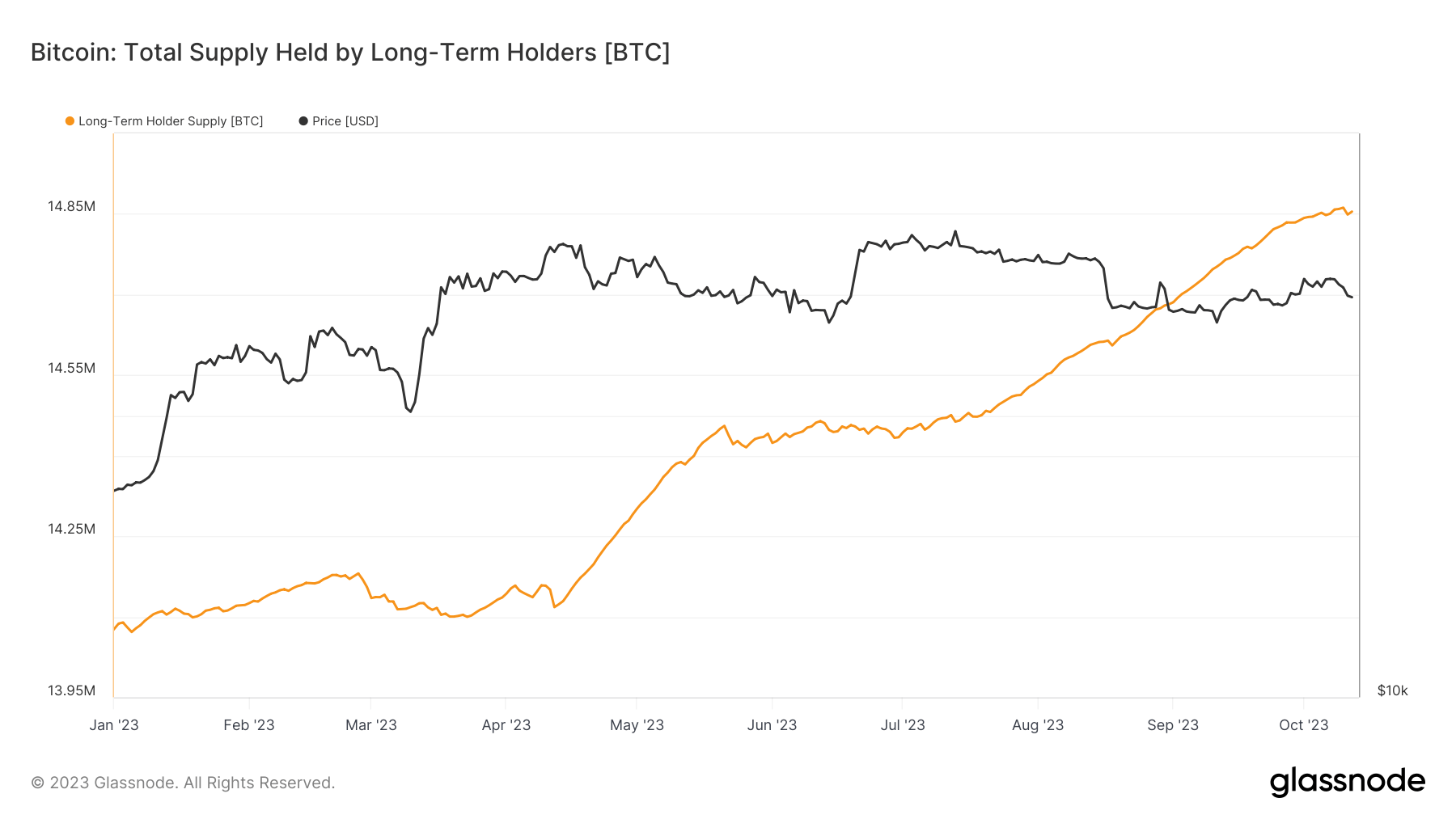

Long-term holders, i.e., addresses that have held onto their assets for longer than 155 days, play a pivotal role in shaping the market dynamics. Their behavior is crucial to monitor as it can signal market confidence, potential price movements, and overall market stability.

As of recent data, the amount of BTC held by long-term holders has been on a steady rise since the beginning of the year. It has now reached an all-time high of over 14.85 million BTC.

To put this into perspective, 76.1% of the circulating supply has not been transacted in the last 5 months or more.

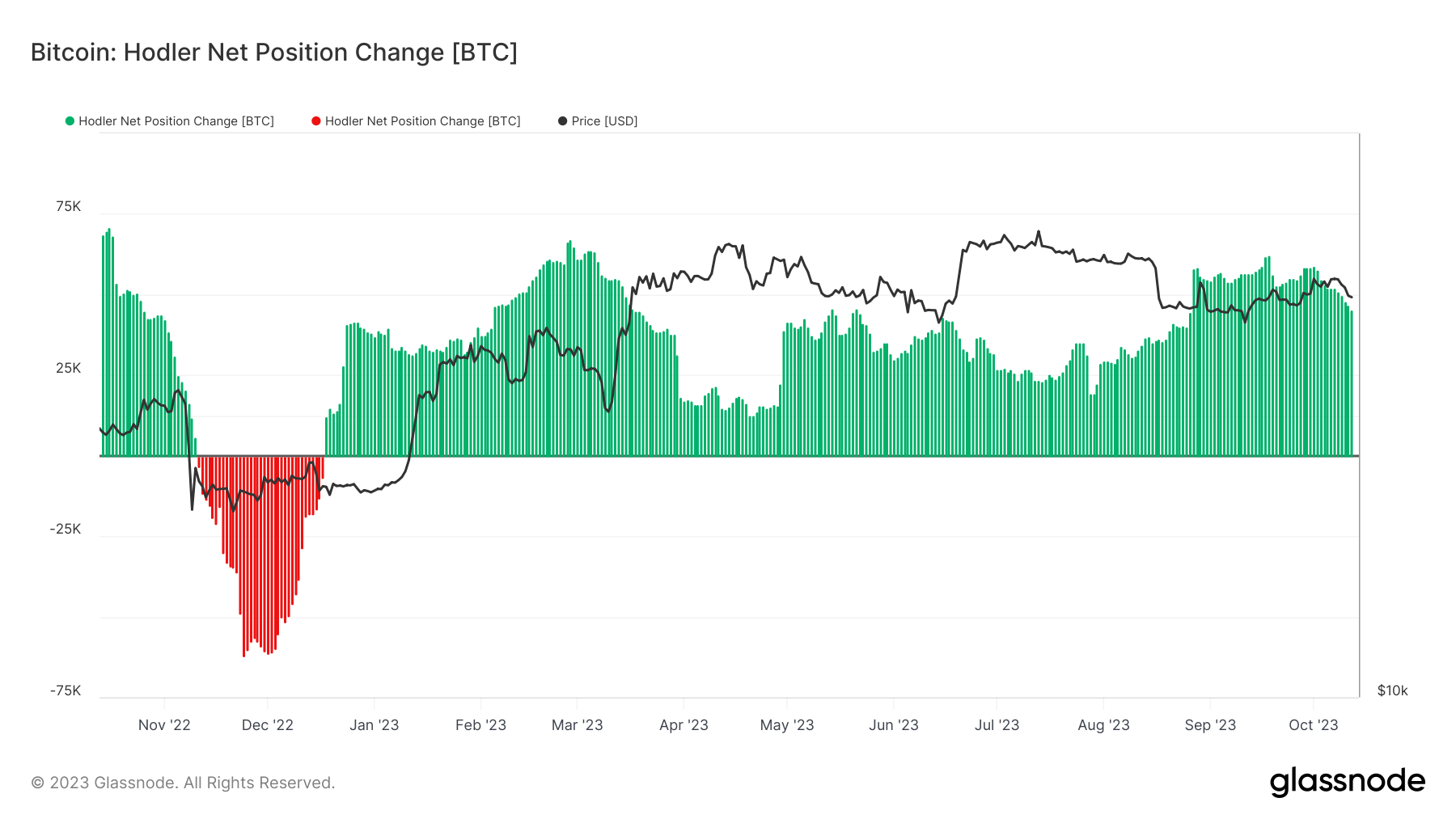

Another metric that sheds light on this phenomenon is the ‘hodler net position change.’ This metric provides insights into the market’s coin dormancy, showing the change in the part of Bitcoin’s supply held by entities that are the least likely to sell. It offers a sustained regime of coin dormancy, with over 50,000 BTC per month being “vaulted” by hodlers.

Vaulting refers to storing or holding onto coins without intending to transact or selling them in the near future. This behavior indicates a tightening supply and a widespread reluctance among hodlers to transact.

The increasing trend of hodling and the dormancy of coins suggest a few things. First, there’s a strong sentiment of confidence among long-term holders in the future value of Bitcoin. This tightening supply can lead to increased demand, potentially driving up the price of Bitcoin. However, it also means that the market is currently strapped for liquidity, making it harder for new investors to buy or for current holders to sell.

The post Bitcoin data shows a growing trend of dormancy as hodlers remain strong appeared first on CryptoSlate.