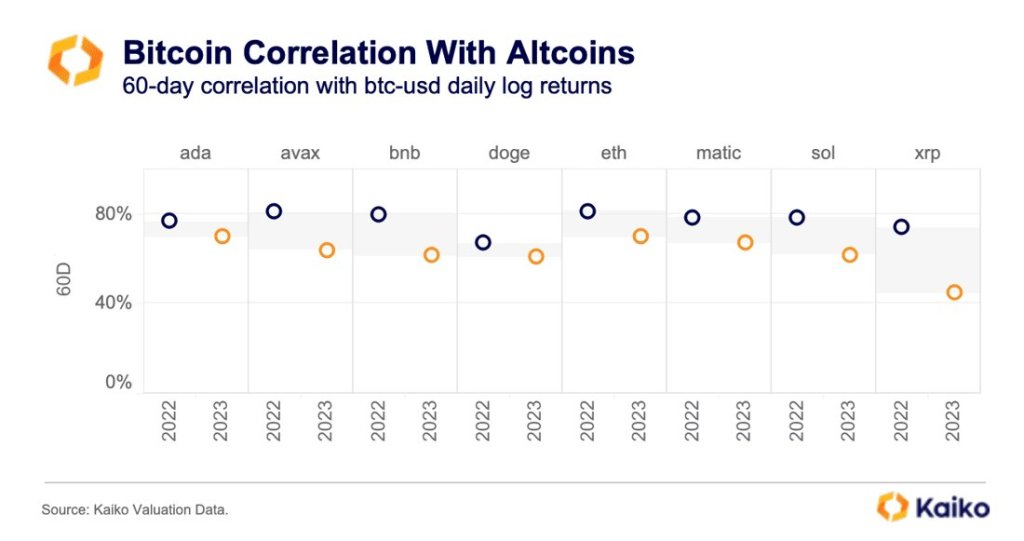

In the last two months, Bitcoin (BTC), the world’s most valuable cryptocurrency, has been increasingly decoupling from XRP, the native currency of the XRP Ledger (XRPL), and BNB, the coin priming the broader Binance ecosystem. While this pans out, Dogecoin (DOGE) and Cardano (ADA) remain mostly correlated with Bitcoin.

XRP, BNB Decoupling From Bitcoin

While rising de-correlation suggests that the market is maturing and becoming more sophisticated, secondary factors could make some of the top altcoins decouple and chart their courses away from the tight grasp of Bitcoin.

Sharing data from Kaiko, a blockchain analytics firm, @cryptobusy on X notes that the correlation between Bitcoin, XRP, and BNB has been contracting in the last two months. Meanwhile, BTC, Dogecoin, and Cardano prices have been moving in sync despite fundamental factors of each project impacting price action over this period.

The drop in correlation indicates that altcoins are increasingly gaining more market share from Bitcoin. This drop in Bitcoin dominance happens especially whenever certain altcoins move independently and are not influenced by how Bitcoin trends.

In most cases, like it has been the case in Q4 2023, a spike in Bitcoin prices triggers altcoin demand, lifting them as a result. Besides Cardano and Dogecoin, for instance, Solana (SOL) and Tron (TRX) are two altcoins that have been rallying and tracking Bitcoin.

Additionally, the drop in correlation could mean the altcoin scene is maturing, and more investors are keen on picking out projects that offer more utility, not just BTC proxies. With more investors, altcoins tend to be more liquid, drawing even more capital.

BNB, XRP, BTC Impacted By Fundamental Factors

Even so, there could be more that explains the decoupling, especially with BNB and XRP. Seismic fundamental events have impacted BTC, XRP, and BNB ecosystems in the last two months.

The United States Securities and Exchange Commission (SEC), for instance, is likely to approve multiple spot Bitcoin ETFs filed by several heavyweights, including BlackRock and Fidelity, in the coming weeks. Hopes of the regulator authorizing these derivatives tracking spot BTC prices have catalyzed demand, lifting the coin to new 2023 highs.

Meanwhile, a United States court ruled in favor of XRP being a utility when sold to retailers. The case initially forced prices higher, but the coin tracked lower throughout late Q3 2023 and 2024, only steadying as BTC rallied.

At the same time, BNB was negatively impacted by Changpeng Zhao, the founder of Binance, resigning in November 2023. The Department of Justice also fined Binance with a $4.3 billion penalty as a settlement.