Onchain Highlights

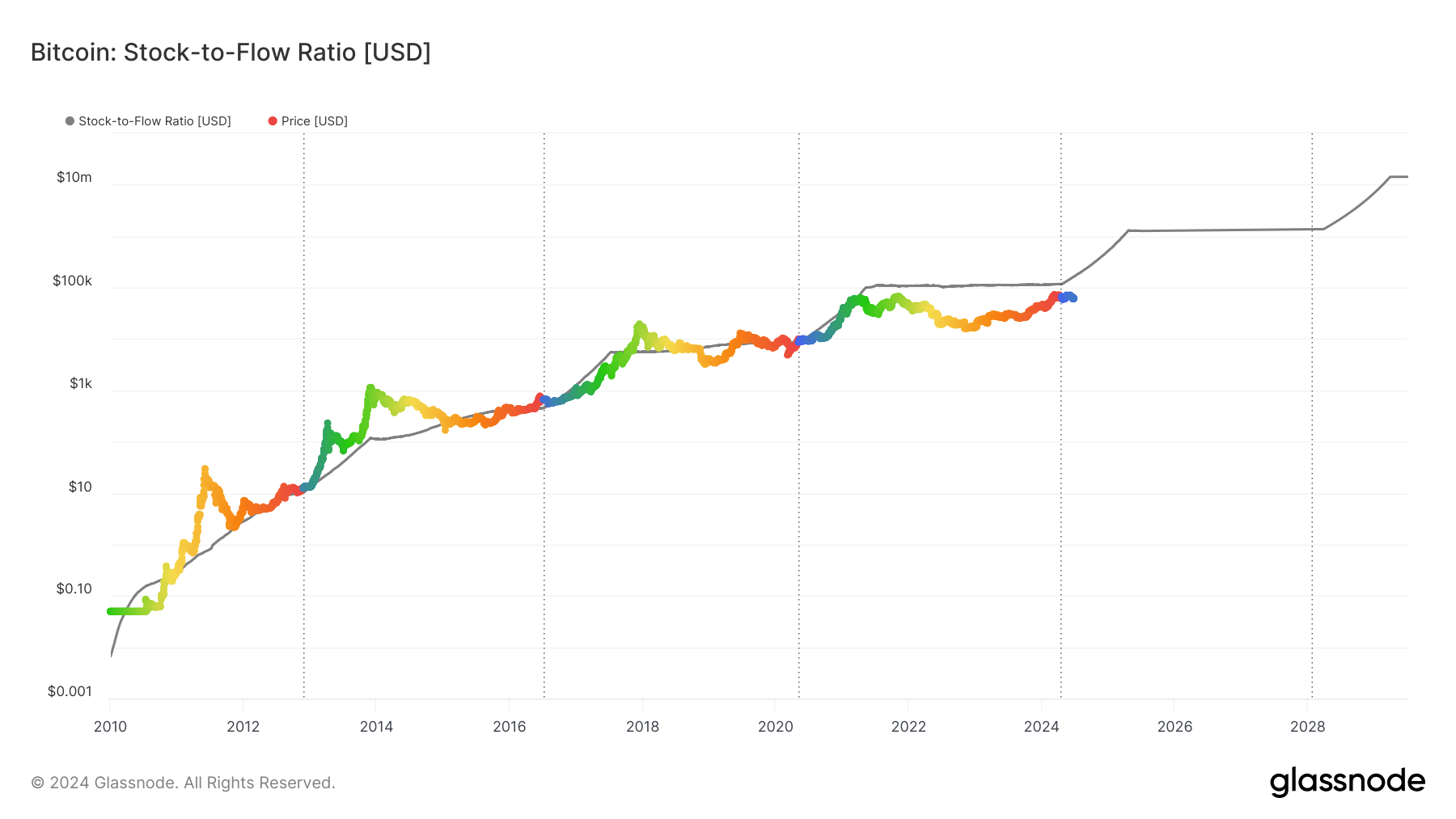

DEFINITION: The stock-to-flow (S/F) Ratio is a popular model that assumes scarcity drives value. It is defined as the ratio of the current stock of a commodity (e.g., the circulating Bitcoin supply) to the flow of new production (e.g., newly mined bitcoins). Bitcoin’s price has historically followed the S/F Ratio, which is why it’s a popular model used to predict future Bitcoin valuations.

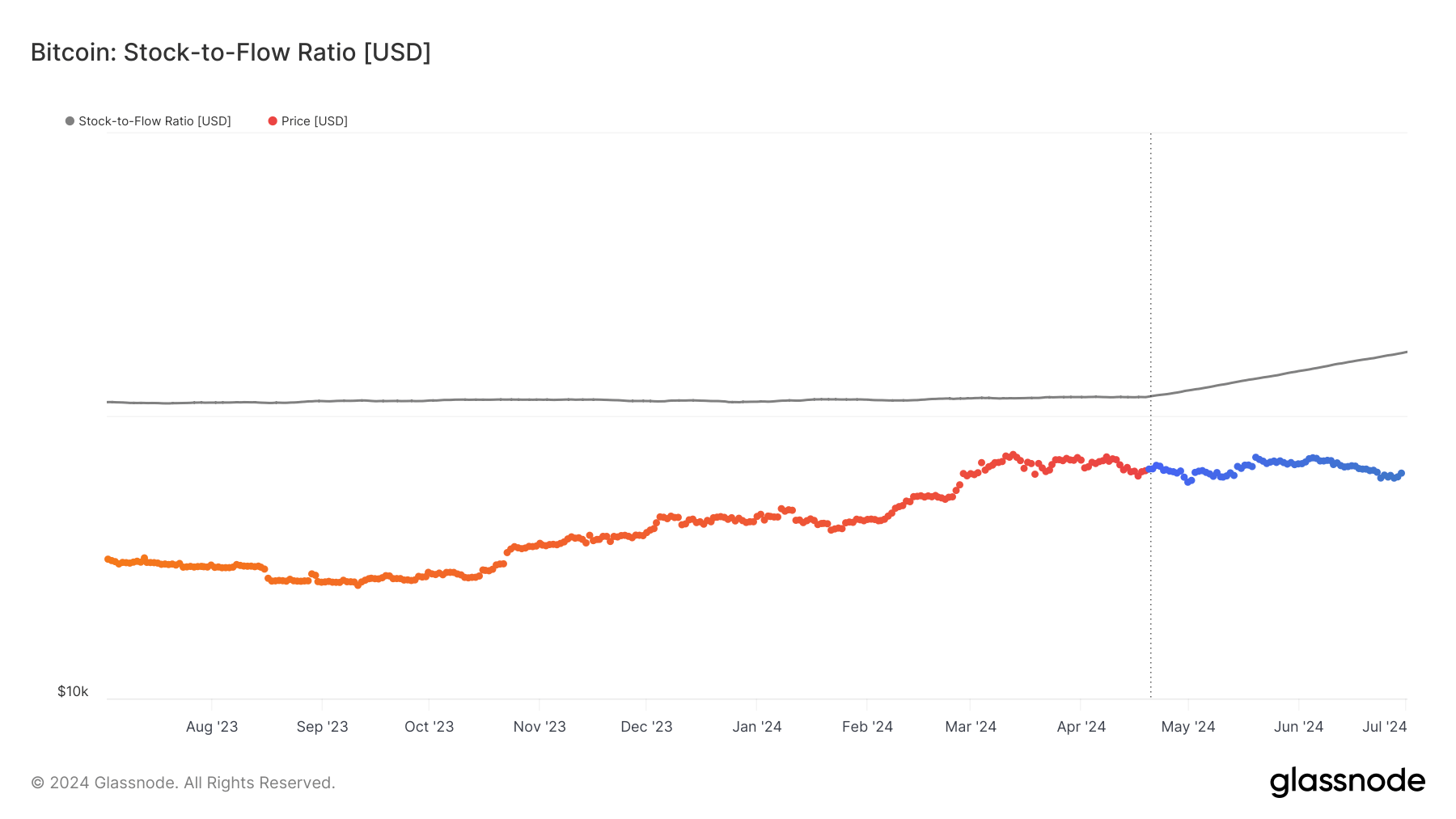

Bitcoin’s stock-to-flow ratio chart has so far illustrated a historical correlation between scarcity and value. However, recent data from Glassnode showed a deviation from this model over the past few years. Despite the April 2024 halving, which reduced the flow of new Bitcoin and increased scarcity, Bitcoin’s price has not aligned as closely with the projected stock-to-flow values as it did in previous cycles.

This deviation suggests that other market factors are influencing Bitcoin’s price beyond the stock-to-flow model’s scarcity premise. While halvings have historically boosted prices by highlighting Bitcoin’s limited supply, current market conditions reflect a more complex interplay of influences, including regulatory developments and macroeconomic trends.

The recent trend emphasizes the necessity for investors to consider a broader range of factors when assessing Bitcoin’s future price trajectory. The stock-to-flow ratio remains a valuable tool, but its predictive power has been tempered by the market’s maturity and complexity.

The post Bitcoin deviates from stock-to-flow model appeared first on CryptoSlate.