Inflows into crypto-related investment products continued for the third consecutive week, with $1.2 billion flowing into the sector, according to CoinShares’ latest weekly report.

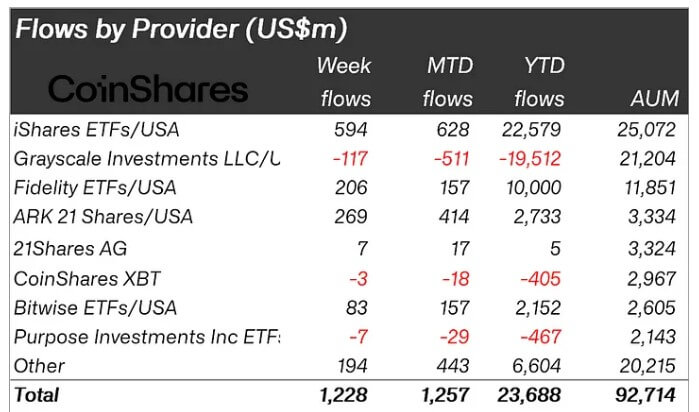

James Butterfill, CoinShares’ head of research, attributed the strong inflows to expectations of a dovish US monetary policy and positive market momentum. These factors pushed total assets under management up 6.2% to $92.7 billion.

The US Securities and Exchange Commission approved options trading for BlackRock’s spot Bitcoin ETF, which also lifted market sentiment. Despite these inflows, weekly trading volume in the sector dipped by 3.1%.

Bitcoin’s dominance continues

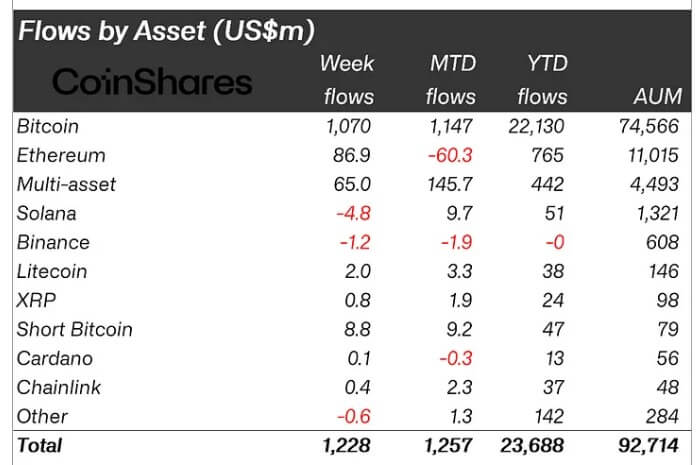

The CoinShares report showed that Bitcoin continued to dominate the flows, with investors pouring in $1 billion to BTC-related investment products.

This can be linked to its strong price performance and also the improved inflows to spot Bitcoin ETF products last week. Notably, the funds run by Bitwise, BlackRock, Fidelity, and Ark 21 Shares all saw positive performance during the reporting period.

However, Grayscale’s crypto funds continued their net outflow trend, dropping its total assets to $21.2 billion.

Meanwhile, BTC’s recent uptrend to around $65,000 fueled an $8.8 million inflow into short-Bitcoin products, as some investors expect the current rally to fade.

Regionally, sentiment was divided. The US led with $1.2 billion in inflows, while Switzerland trailed with $84 million. In contrast, Germany and Brazil experienced outflows of $21 million and $3 million, respectively.

Ethereum breaks a negative streak.

Ethereum-related products ended a five-week outflow streak, bringing in $87 million—the first significant inflow since early August.

Data from SosoValue showed that spot Ethereum ETFs saw the second-highest weekly flows since their launch in July.

On the other hand, large-cap alternative digital assets had mixed results. Litecoin and XRP recorded inflows of $2 million and $0.8 million, respectively. Meanwhile, Solana and Binance faced outflows of $4.8 million and $1.2 million.

The post Bitcoin dominance drives $1.2B inflows in crypto investment products appeared first on CryptoSlate.