Onchain Highlights

DEFINITION: Bitcoin Dominance, denotes Bitcoin’s market capitalization as a percentage of the total market cap of all cryptocurrencies. It’s calculated by dividing Bitcoin’s market cap by the total cryptocurrency market cap.

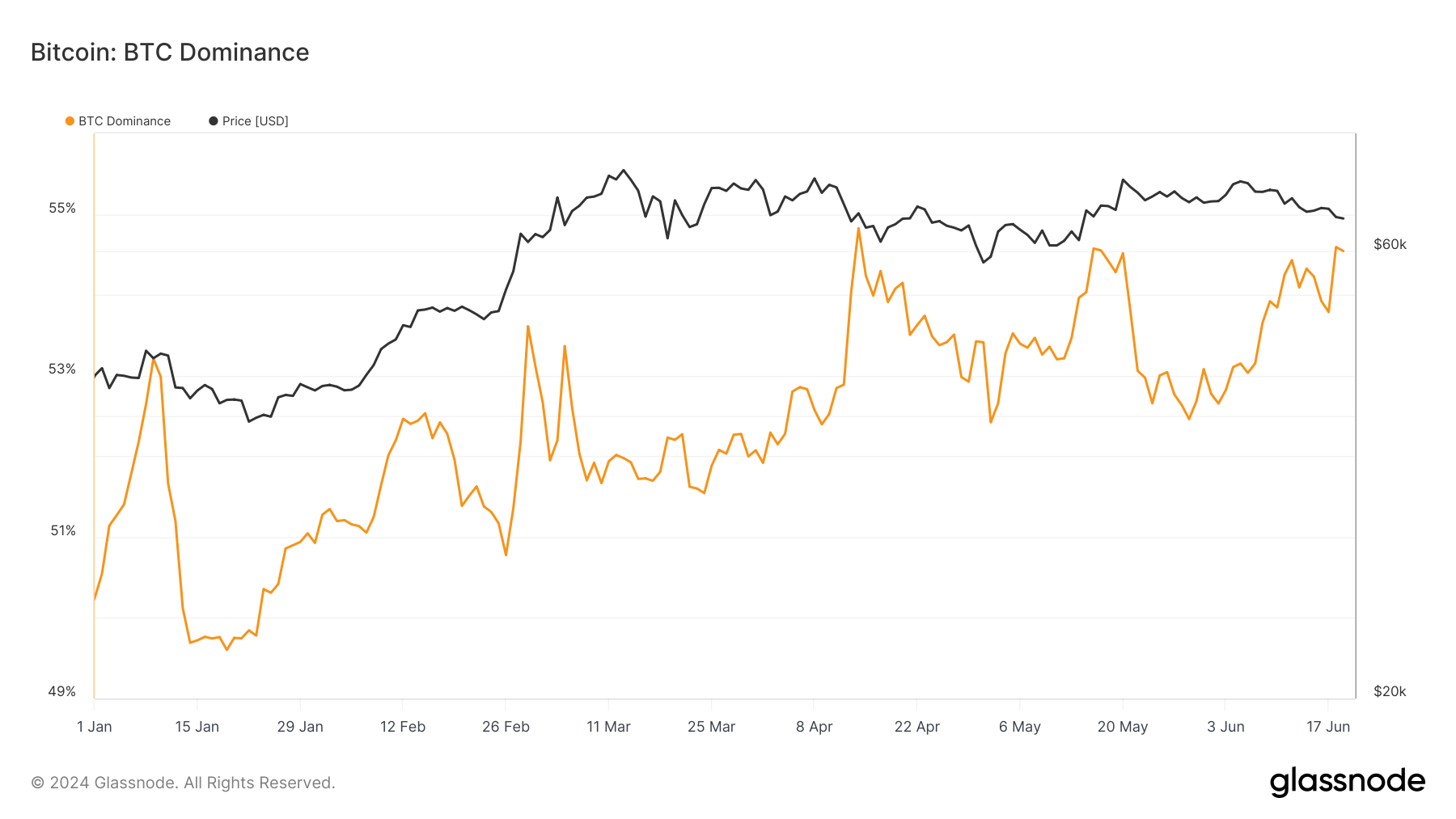

Bitcoin’s dominance in the digital assets market has fluctuated significantly in 2024, reflecting broader market dynamics and investor sentiment shifts. Early in the year, Bitcoin dominance experienced a decline from 53% to below 50%, coinciding with a period of volatility in its price, which hovered around $40,000. This trend reversed in mid-February, with Bitcoin regaining ground and its dominance climbing as high as 55% by mid-April, reflecting renewed investor confidence following the halving event in April 2024.

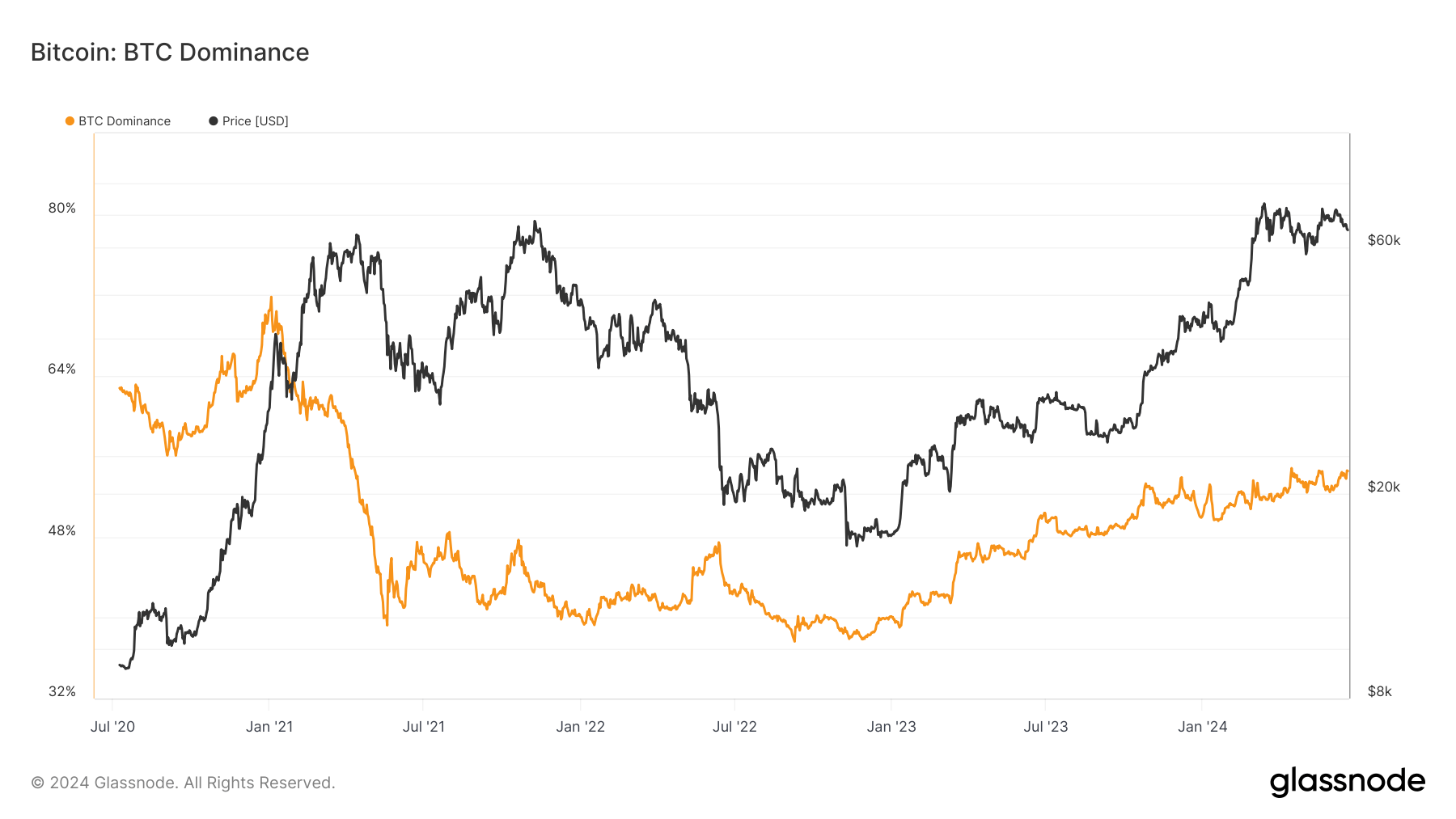

Historically, Bitcoin’s market dominance has seen substantial variations. In late 2020, Bitcoin dominance was around 65%, experiencing a steady decline to about 40% by mid-2021 as alternative cryptocurrencies gained traction. However, a resurgence was noted from mid-2022, stabilizing around 50% to 55% through to early 2024. The latest data shows Bitcoin dominance stabilizing around 55% in June 2024, with Bitcoin prices consolidating near $65,000.

The post Bitcoin dominance rebounds to 55% by mid-2024 appeared first on CryptoSlate.