Quick Take

- Short-term holders are defined as a holder of Bitcoin (BTC) for less than 155 days.

- This cohort bought the local top — above $30,000 — and is selling the dip at a loss.

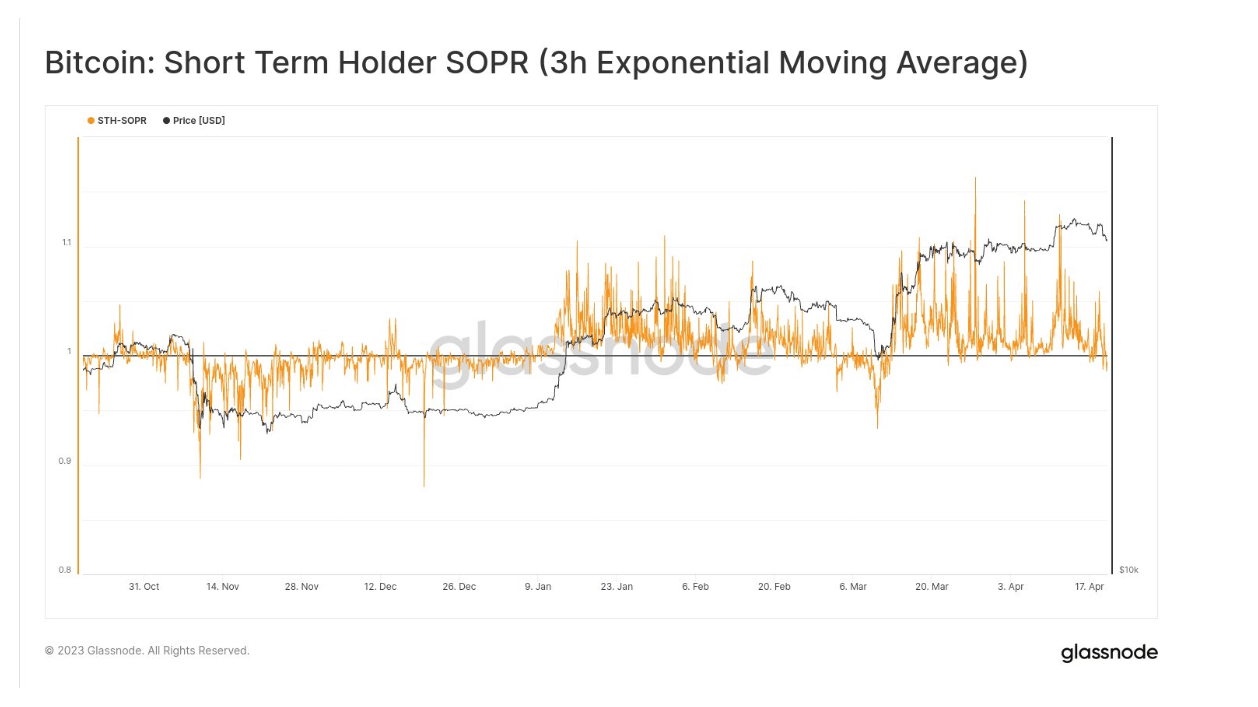

- Bitcoin bull markets are denoted by Spent Output Profit Ratio (SOPR) — a sustained rally above one indicates a bull market — and when it goes under one for a brief amount of time, this cohort is washed out — selling at a loss. We must resume the above one to see a sustained rally.

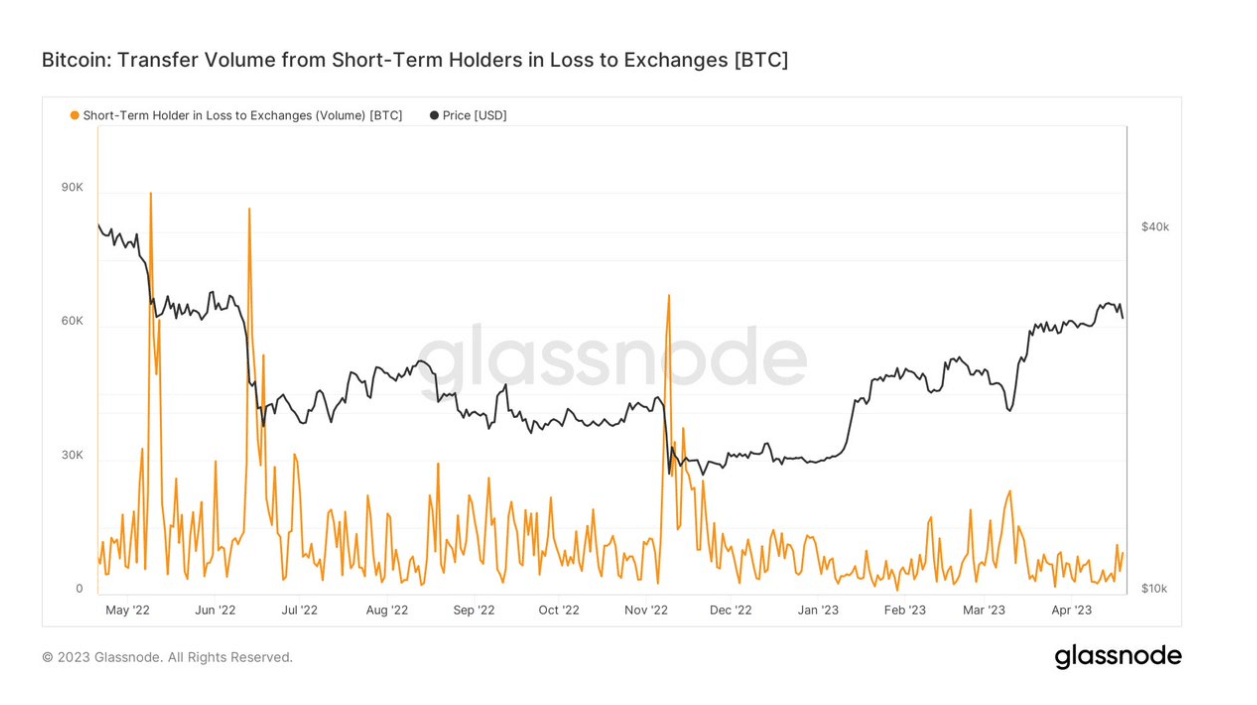

- In addition, short-term holders selling Bitcoin at a loss to exchanges are slightly elevated.

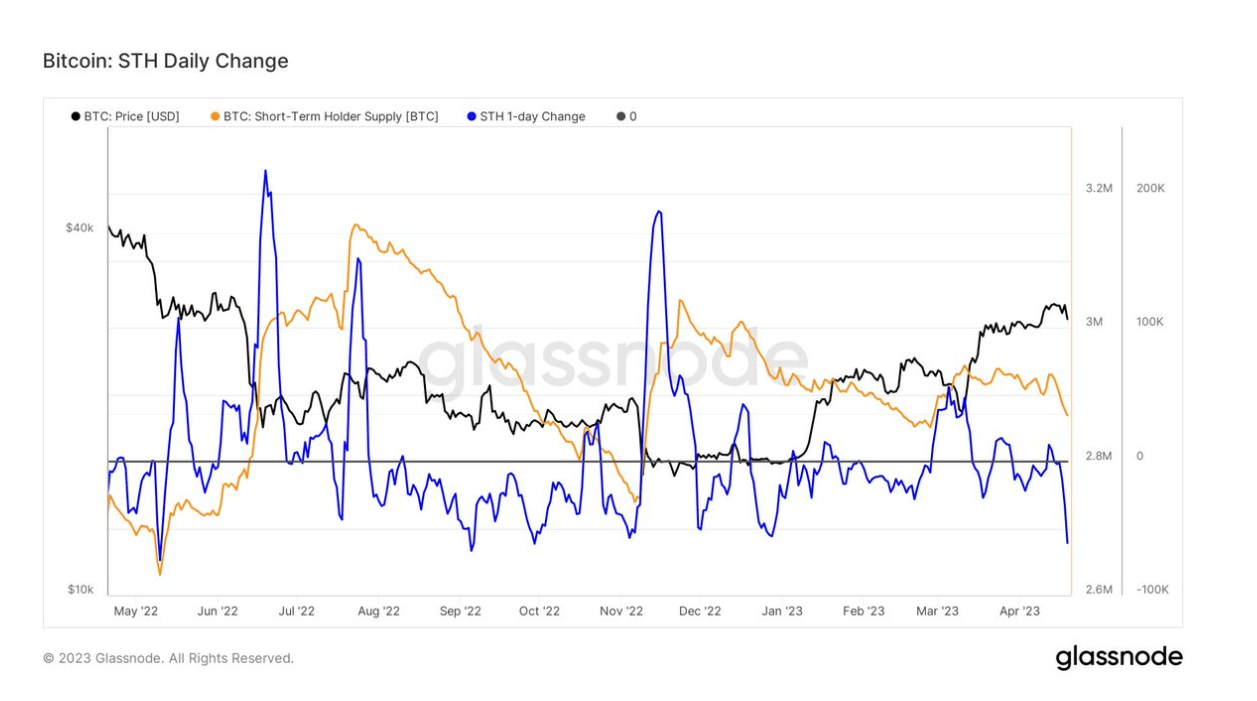

- While, over a 7-day moving average, the short-term holder supply has decreased notably — one of the most dramatic changes in the past year.

The post Bitcoin drops below $29K as short-term holders panic sell at a loss appeared first on CryptoSlate.