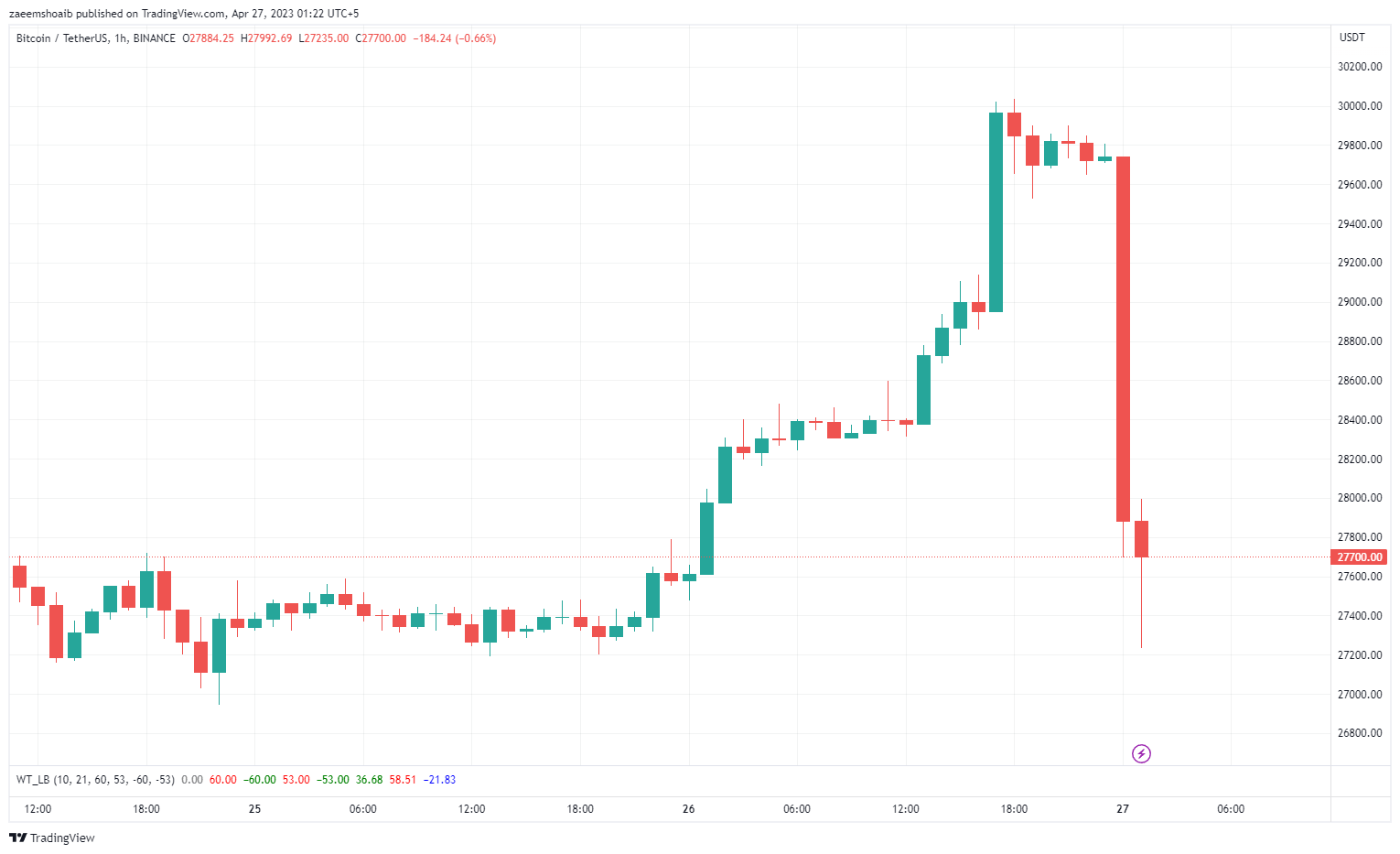

Bitcoin (BTC) fell to about $27,235 almost immediately after hitting a price of $30,000, leading to more than $170 million in liquidations.

The largest cryptocurrency by market cap rallied toward $30,000 earlier in the day, which led to more than $70 million in liquidations for short traders in the last 24 hours.

Nearly $200 million liquidated

According to Coinglass, the crypto market saw $195 million liquidated in the past four hours, with more than 77,000 traders being liquidated.

Bitcoin saw $72.05 million in the past hour, while Ethereum saw $28.75 million. Other assets such as Dogecoin, Arbitrum, Chainlink, XRP, Litecoin, and Solana experienced less than $4 million in liquidations.

The largest liquidation occurred on BitMEX on XBT, valued at $5.05 million.

Bitcoin drops to $27k again

The price of Bitcoin is also down to $27k again after a rally over the last three days, based on CryptoSlate data, after it dropped from a high of almost $31k on April 14 down to as low as $26,960 on April 24.

BTC was priced at $27,510 as of 8:30 p.m. UTC. The price of Bitcoin is down overall by almost 2.5% over the past 24 hours.

Other leading assets have also lost value. Ethereum (ETH) is down almost 2%, while Binance Coin (BNB) is down 2.3% and XRP is down 4.7%, while Dogecoin (DOGE) is down 3.6%.

Jump Trading deposits to exchanges

Arkham Intelligence tweeted that Jump Trading, a prominent market maker, deposited $26.6M worth of BTC to various exchange deposit addresses in the past hour.

Most of these funds were sent to Binance, with Jump Trading transferring $23.7M to their BTC deposit address.

The post Bitcoin drops to $27k range again, liquidating $200M appeared first on CryptoSlate.