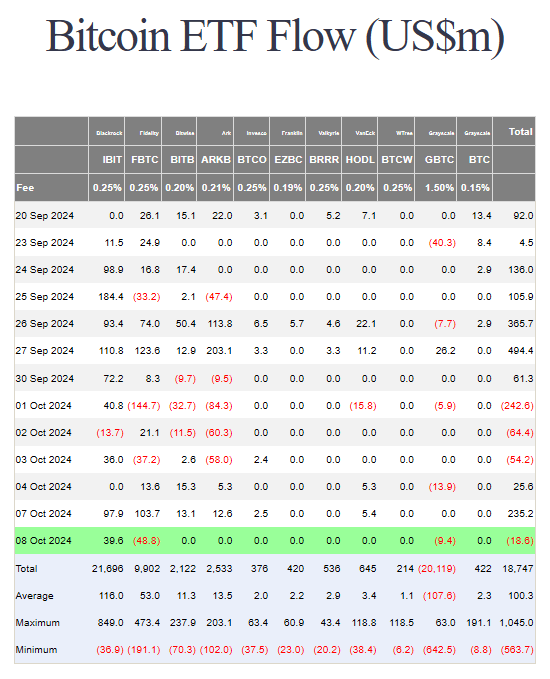

Bitcoin’s exchange-traded funds (ETFs) are once again generating headlines due to an extraordinary increase in inflows. An investment of $235.2 million in Bitcoin ETFs occurred on October 8, indicating a substantial increase in investor appetite. This surge, based on data from Farside Investors, follows a relatively uneventful beginning to the month, but it indicates a resurgence in investor confidence in the cryptocurrency market.

Fidelity And BlackRock Lead The Way

This was led by Fidelity’s Bitcoin ETF (FBTC) with a $103.7 million inflow. iShares Bitcoin Trust (IBIT), managed by BlackRock, received $97.9 million of inflows. Bitwise ETF BITB and ARK Invest ETF Arkb also joined with $13.1 million and $12.6 million respectively. The combined trading volume of all Bitcoin ETFs steadily grew to over a cool $1.22 billion up from just the other day.

Given the erratic Bitcoin values, the comeback in ETF inflows is especially remarkable. Bitcoin was trading at roughly $62,485 at the time of writing, somewhat declining from its previous high of $66,000 to show some bearish pressure. Notwithstanding the recent price drop, the strong demand for Bitcoin ETFs shows that institutional investors are ready to profit from possible future increases.

Bitcoin Edges Ethereum ETFs

Unlike the optimistic sentiment connected with Bitcoin ETFs, Ethereum’s ETFs tell a different story: Ethereum exchange-traded funds (ETFs) were on low inflows of $7.4 million on October 6 and had no new activity on October 7. This stagnation is quite different from the active movement within Bitcoin ETFs. Analysts point out that this difference could point to changing investor tastes or worries on Ethereum’s market dynamics.

The lack of inflows into Ethereum ETFs brings even more questions about whether, at present, there is any better overall market sentiment toward altcoins. Investor interest in Ethereum has subsided somewhat, as indicated, though the phenomenon of Bitcoin draws enormous volumes of institutional capital.

Market Sentiment And Future Outlook

Recent increases in Bitcoin ETF inflows reflect the direction of a larger market trend resulting from conjecture over possible Federal Reserve rate reduction. Many investors think this move will strengthen the market and keep prices on the ascent. If history has anything to teach us, it is that such financial easing usually encourages additional investment in risk assets including cryptocurrency.

Bloomberg analyst Eric Balchunas emphasizes that, given the excellent performances of both FBTC and IBIT, they are going to be very important for the future of Bitcoin ETFs. They may even touch “stud level” with over $10 billion in assets under management. And by the end of 2024 in the fourth quarter, this institutional interest is on the rise which may well bring us the bull run.

Ethereum’s ETFs are presently experiencing stagnation, despite the fact that Bitcoin ETFs are experiencing a resurgence that is characterized by significant inflows and increased trading volumes. Investors are closely monitoring the market as they prepare for potential changes that may result from evolving market dynamics and changes in monetary policy. As they jointly navigate these turbulent waters, the next few weeks will be critical for both Bitcoin and Ethereum.

Featured image from Zerocap, chart from TradingView