The post Bitcoin ETF Inflows Surge: Is a New Bull Run on the Horizon? appeared first on Coinpedia Fintech News

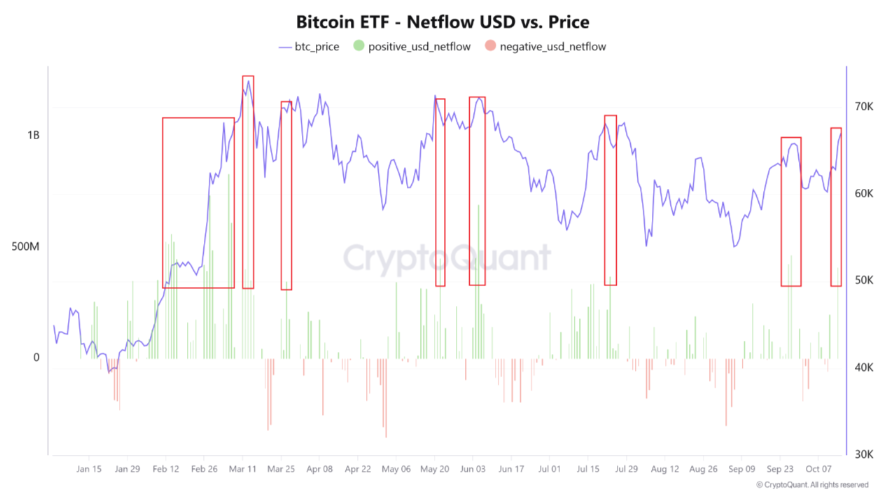

Spot Bitcoin ETFs in the US just saw a massive net inflow, soaring past $555 million. However, this is the biggest inflow since June 5, showing a strong comeback in investor interest in Bitcoin. Right now, Bitcoin’s price has jumped nearly 3%, reaching $67,140. Recent insights from CryptoQuant reveal a key link between ETF netflows and Bitcoin’s price. Knowing this could help investors spot trends as more retail traders dive into Bitcoin through ETFs.

Bitcoin ETF Netflows & Price Connection

According to CryptoQuant’s verified author Amr Taha, Bitcoin ETFs, or exchange-traded funds, are becoming increasingly popular with retail investors. Taha’s analysis reveals that large net flows into Bitcoin ETFs often coincide with significant changes in Bitcoin’s price.

For example, certain areas marked in red illustrate a direct link between substantial netflows and price movements. However, it’s essential to note that positive netflows exceeding $400 million in Bitcoin ETFs do not always guarantee lasting price increases.

In fact, Taha points out that there have been many instances where such inflows have been followed by price corrections.

Bitcoin Price Analysis

Bitcoin is currently showing interesting movements on its weekly chart, forming a descending channel. This pattern indicates that Bitcoin is breaking through a series of lower highs, which suggests strong momentum.

If this trend continues, Bitcoin could face little resistance as it moves toward the $70,000 mark. On the daily chart, Bitcoin is only 10% away from reaching its all-time high. However, it is facing resistance at two important price levels: $70,011 and $68,849.

Additionally, indicators like the MACD (Moving Average Convergence Divergence) reveal positive momentum in Bitcoin’s price on the daily chart. The RSI (Relative Strength Index) is at 63, which is above the neutral level of 50, indicating that Bitcoin is in a strong position.