Quick Take

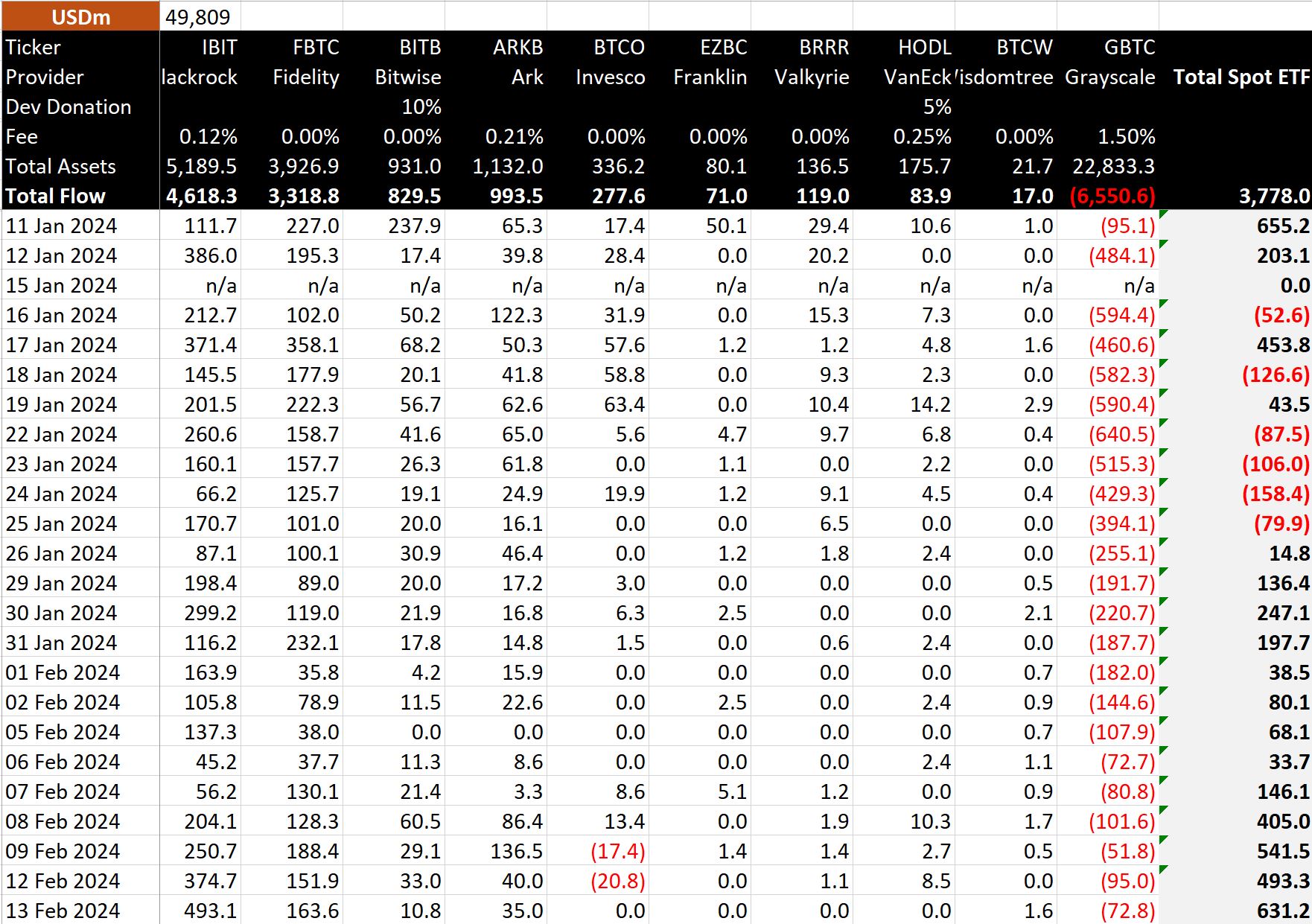

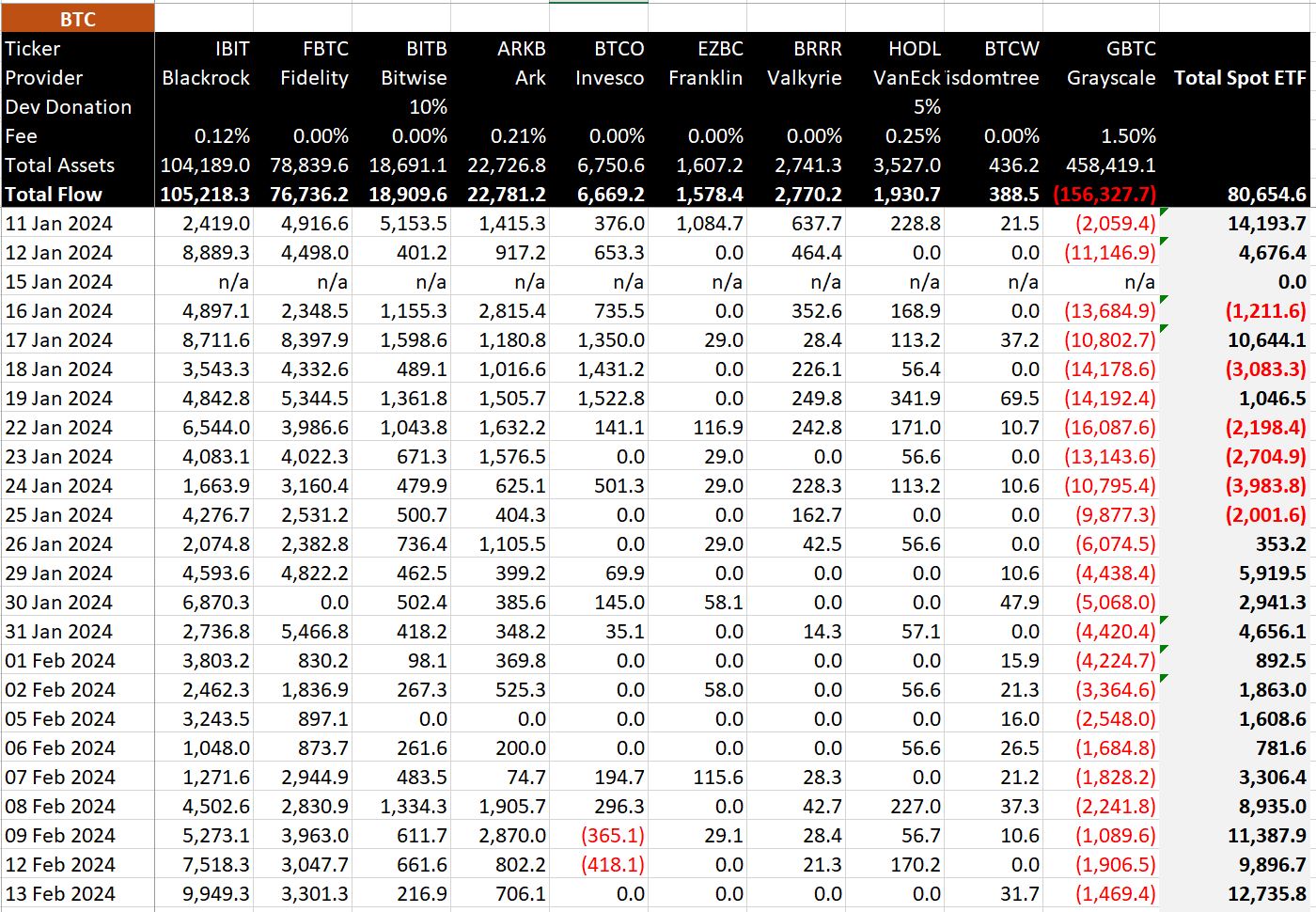

The Bitcoin ETF market exhibited a continued surge in net inflows on Feb. 13; the trading day saw a total positive net flow of $631 million across all providers, with a total net inflow of 12,736 BTC, according to BitMEX Research.

BitMEX data shows that BlackRock IBIT marked a notable achievement with a huge $493 million influx, catapulting the BlackRock IBIT ETF to an impressive total of $4.6 billion. This surge also increased BlackRock’s Bitcoin holdings in ETF to 105k BTC.

Simultaneously, Fidelity FBTC ETF reported healthy growth, with a net inflow of $164 million, pushing its total net inflow to a robust $3.3 billion. In contrast, the BTCO ceased its outflows, indicating a potential stabilization.

As BitMEX reported, GBTC continued with relatively smaller outflows of $73 million, escalating its total outflows to a staggering $6.6 billion. Despite these outflows, the total net inflows across the Bitcoin ETF market reached $3.8 billion, equivalent to roughly 81,000 BTC. The Newborn Nine now holds roughly 236,982 BTC.

The post Bitcoin ETF market sees $631 million inflow in one day appeared first on CryptoSlate.