Quick Take

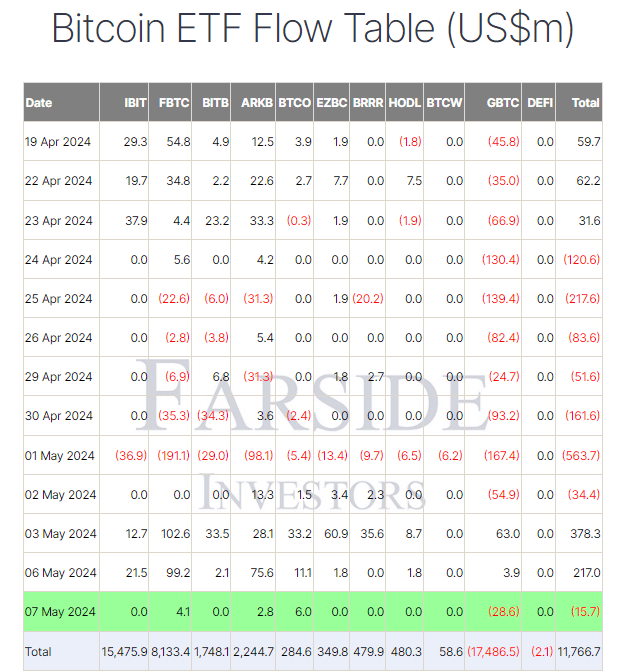

US Bitcoin ETFs saw an outflow of $15.7 million on May 7, marking the first day of outflows since May 2. According to data from Farside, Grayscale’s GBTC was responsible for the negative trend, as it recorded $28.6 million in outflows. This takes GBTC’s total outflows to over $17.48 billion since the launch of spot Bitcoin ETFs on Jan. 10.

Aside from the outflows from Grayscale’s GBTC, inflows to other ETFs were relatively small. Invesco’s Galaxy Bitcoin ETF (BTCO) saw the highest inflow of the day of just $6 million, bringing its total net inflow to $284.6 million.

Fidelity’s FBTC and ARK’s ARKB saw inflows of $4.1 million and $2.8 million, respectively, bringing their total net inflows to $8.13 billion and $2.24 billion, respectively. However, despite relatively modest flows over the past few days, the overall inflow into US ETFs remains substantial, reaching $11.76 billion.

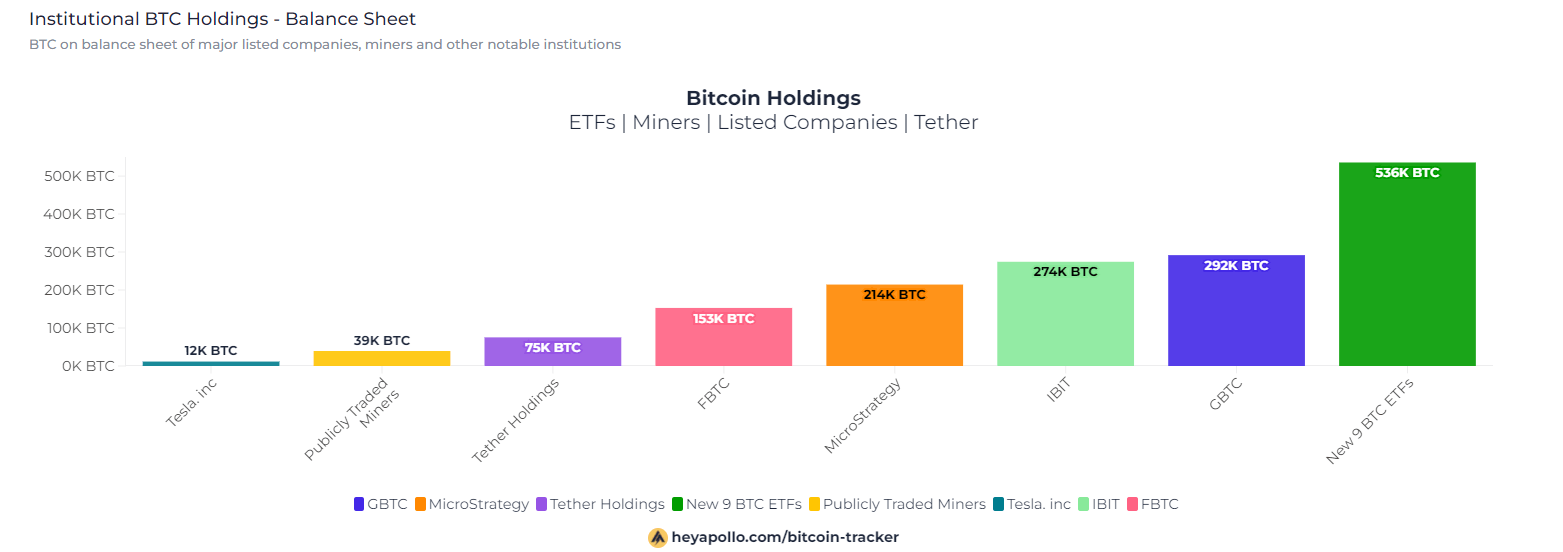

According to Hey Apollo, GBTC holds 292k BTC, IBIT holds 274k BTC, and the “Newborn 9” has a combined 536k BTC.

The post Bitcoin ETFs in the US see $15.7 million in outflows appeared first on CryptoSlate.