Bitcoin ETFs ended last week on another positive note with $997.70 million in net inflows and demand reaching its highest level in six months. Undoubtedly, these ETFs have marked the turning point for Bitcoin and other cryptocurrencies since the beginning of the year, as it opened up the cryptocurrency to inflows from every side.

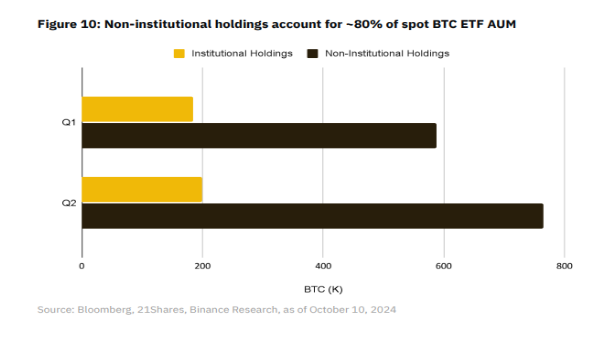

Interestingly, data has shown that retail investors are responsible for most of the demand for Spot Bitcoin ETFs, accounting for 80% of the total assets under management.

Bitcoin ETFs Changing The Narrative

According to Bloomberg data, Bitcoin ETFs have dominated the ETF landscape in 2024, claiming the top four positions for inflows among all ETFs launched this year. Specifically, out of the 575 ETFs introduced thus far, 14 of the top 30 are new funds focusing on Bitcoin or Ethereum. The standout performer is the BlackRock IBIT fund, which has attracted over $23 billion in year-to-date inflows.

Last week was another example of the positive performance in Spot Bitcoin ETFs, despite the coin’s consolidation below the $68,000 price level. According to flow data from SosoValue, weekly inflows started on a positive note on Monday, October 21, with $294.29 million entering the funds and ended the week with $402.08 million in inflows on Friday, October 25.

Interestingly, Spot Bitcoin ETFs now hold about 938,700 BTC in 10 months since launch and are steadily approaching the 1 million BTC mark. Although these ETFs have opened doors for institutional investors, a recent report from crypto exchange Binance indicates that retail investors are the primary drivers of this surge in demand, accounting for 80% of the holdings in Spot BTC ETFs.

Originally intended to provide institutional investors access to BTC, Spot Bitcoin ETFs have now become the preferred choice for many individual investors looking to take advantage of the regulatory clarity they offer. Nonetheless, there has been a steady demand from the institutional side, with institutional holdings rising by 30% since Q1.

Among institutional investors, investment advisers have emerged as the fastest-growing party, with their holdings increasing by 44.2% to reach 71,800 BTC this quarter.

What’s Next For Spot Bitcoin ETFs?

Thanks to the rapid growth of Bitcoin exchange-traded funds, an impressive 1,179 institutions, including financial giants such as Morgan Stanley and Goldman Sachs, have joined the crypto’s cap table in less than a year. For comparison, Gold ETFs were only able to attract 95 institutions in their first year of trading.

This upward trajectory of institutional investments in Bitcoin is poised to continue into the foreseeable future, which bodes well for the overall price outlook of Bitcoin. As these ETFs attract more institutional capital, they are likely to produce second-order effects like increased BTC dominance, improved market efficiency, and reduced volatility that could significantly benefit the cryptocurrency ecosystem.

At the time of writing, Bitcoin is trading at $67,100.

Featured image from Reuters, chart from TradingView