Quick Take

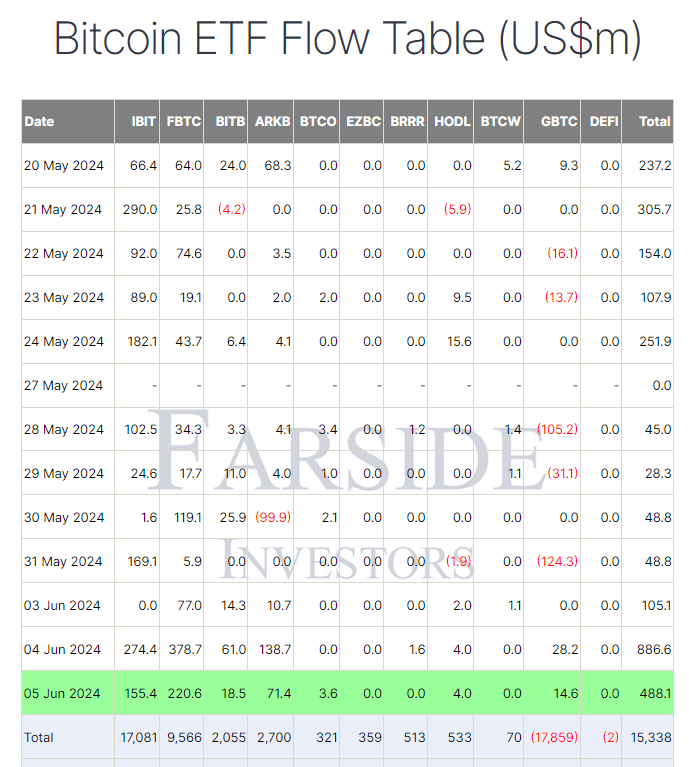

According to Farside data, Bitcoin (BTC) exchange-traded funds (ETFs) experienced substantial inflows on June 5, with a notable accumulation of $488.1 million. This marks 17 consecutive trading days of inflows, tying the record for the longest streak. Over the past two days alone, inflows have surged to an impressive $1.4 billion.

Farside data shows that Fidelity FBTC led the inflows with $220.6 million, bringing its total net inflow to $9.6 billion. BlackRock’s IBIT ETF followed closely with $155.4 million, pushing its total inflow to $17.1 billion. ARK’s ARKB ETF saw $71.4 million in inflows, increasing its total to $2.7 billion, while Bitwise’s BITB ETF recorded an $18.5 million inflow, reaching a total of $2.1 billion. Despite an inflow of $14.6 million, Grayscale’s GBTC continues to face a total net outflow of $17.9 billion. Cumulatively, Bitcoin ETFs have seen inflows totaling $15.3 billion.

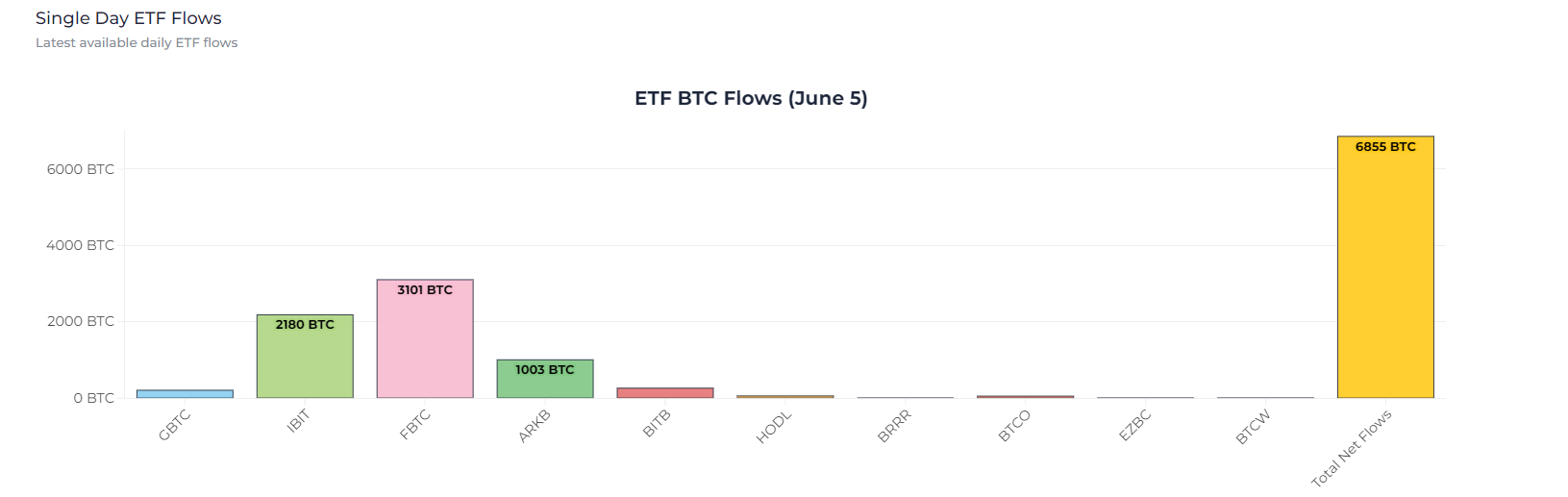

In Bitcoin terms, June 5 saw the accumulation of 6,855 BTC, according to heyapollo data.

The post Bitcoin ETFs see $1.4 billion in 2 days amid 17-day inflow streak, tying record appeared first on CryptoSlate.