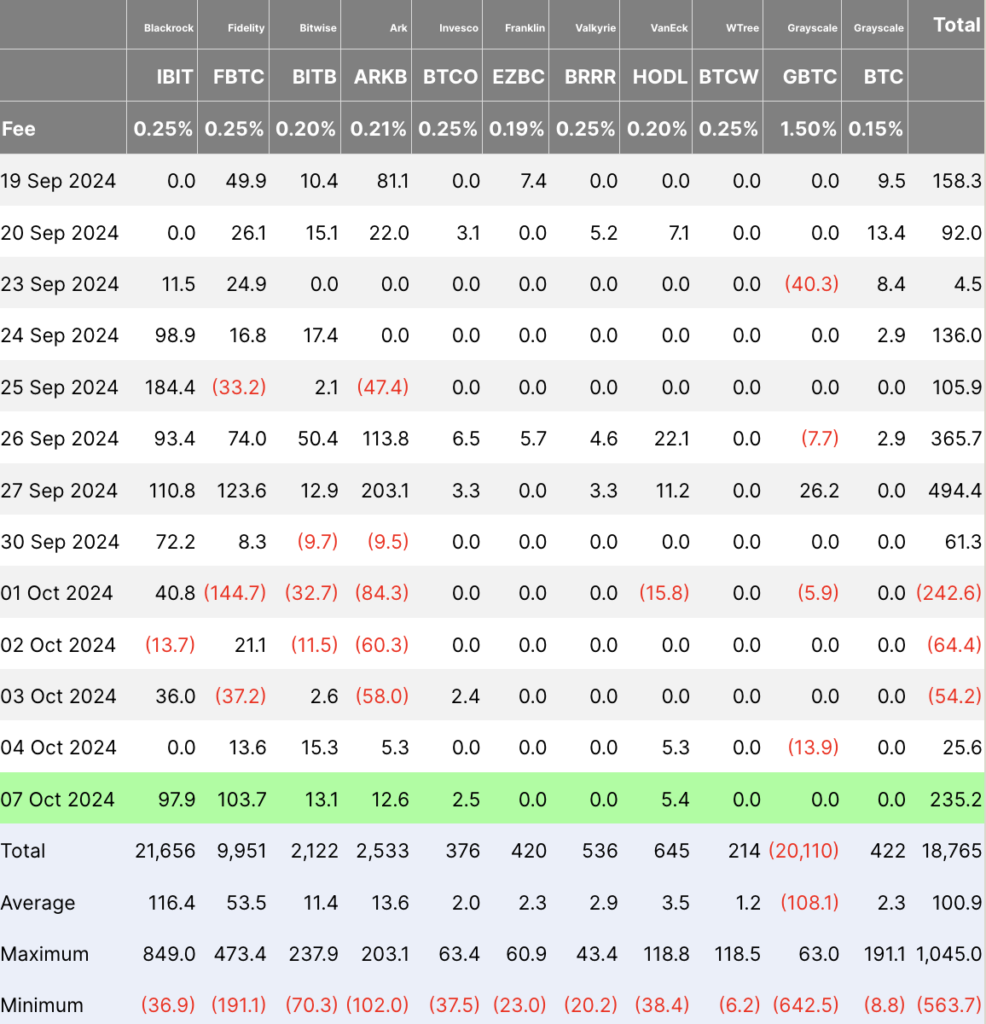

On Oct. 4, Bitcoin ETFs recorded modest net inflows of $25.6 million. Fidelity’s FBTC ETF saw an inflow of $13.6 million, while Bitwise’s BITB ETF added $15.3 million. Ark’s ARKB ETF brought in $5.3 million, as did VanEck’s HODL ETF. However, these gains were partially offset by Grayscale’s GBTC, which saw outflows of $13.9 million. Other ETFs remained flat, including those from BlackRock, Invesco, Franklin, Valkyrie, and WisdomTree.

By Oct.7, Bitcoin ETFs experienced a substantial influx of $235.2 million, marking a sharp rise in institutional activity. Fidelity’s FBTC ETF posted $103.7 million in inflows, while BlackRock’s IBIT ETF followed with $97.9 million. Bitwise’s BITB ETF and Ark’s ARKB ETF recorded inflows of $13.1 million and $12.6 million, respectively. Invesco’s BTCO ETF added $2.5 million, and VanEck’s HODL saw an additional $5.4 million. No outflows were reported across any of the major ETFs on this date.

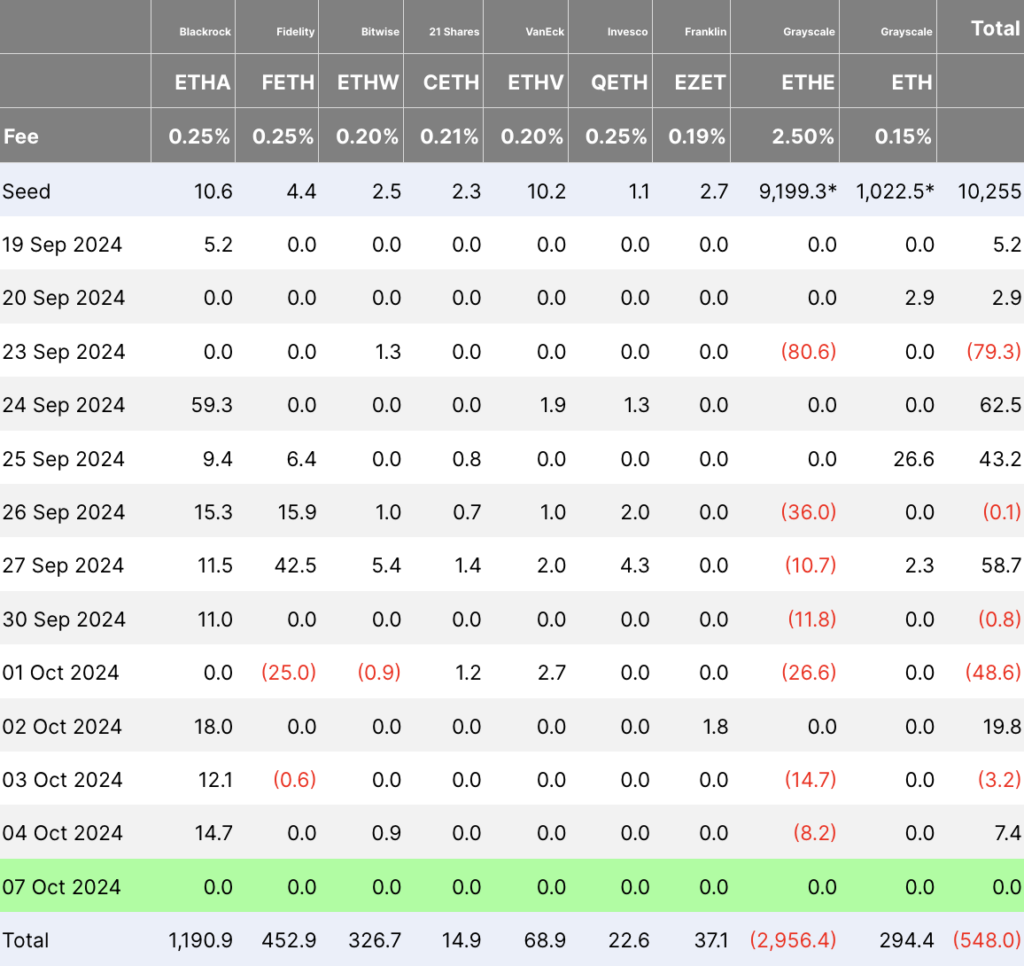

For Ethereum ETFs, Oct. 4 saw a total net inflow of $7.4 million. BlackRock’s ETHA ETF led with $14.7 million, while Grayscale’s ETHE experienced outflows of $8.2 million. Minor inflows of $0.9 million were recorded for Bitwise’s ETHW ETF, while other ETFs saw no significant activity.

On Oct. 7, Ethereum ETFs saw no major inflows or outflows, and all products reported flat flows.

Substantial inflows into Bitcoin ETFs on Oct. 7 indicate renewed confidence in the market, especially following a quieter session on Oct. 4. Ethereum ETFs, while positive on Oct. 4 due to BlackRock’s inflows, saw no further movement on Oct. 7, signaling a temporary pause in institutional interest in Ethereum.

The post Bitcoin ETFs see $260 million inflow since Friday while Ethereum inflows remains modest appeared first on CryptoSlate.