Quick Take

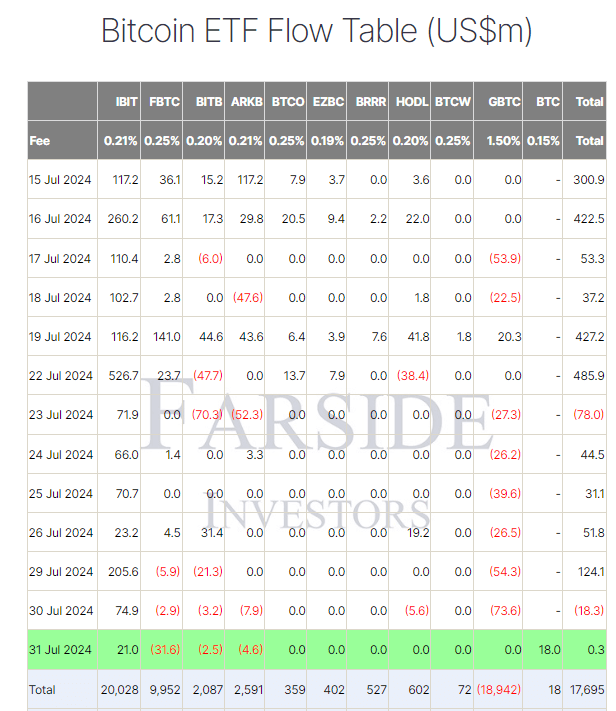

Farside data reveals that Bitcoin exchange-traded funds (ETFs) experienced a minimal net inflow of just $0.3 million, marking the most negligible net inflow since these ETFs began trading on Jan. 11. BlackRock’s IBIT continued to attract investments with a $21.0 million inflow. However, three out of the top four issuers faced outflows once again: Fidelity’s FBTC recorded a $31.6 million outflow, Bitwise’s BITB saw a $2.5 million outflow, and ARK’s ARKB had a $4.6 million outflow.

A notable development came from Grayscale, GBTC, which experienced no outflows. July 31 marked the inaugural trading day for Grayscale’s new mini trust BTC, which attracted an $18.0 million inflow; the fund was initially provided with 10% of GBTC’s Bitcoin assets. This mini trust launched with the lowest fees among all ETFs at just 15 basis points and saw $27 million in trading volume, ranking it sixth among ETFs in volume traded according to Soso Value. Overall, ETF inflows have reached $17.7 billion.

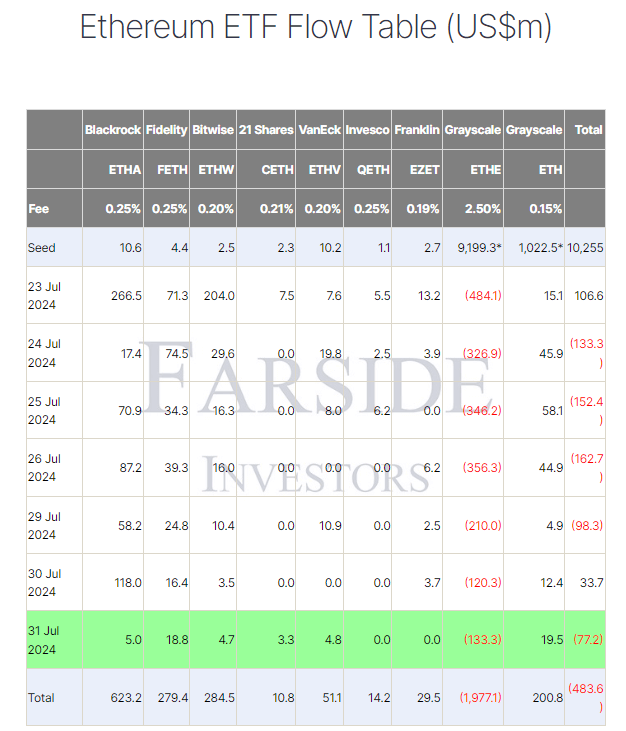

In contrast, Ethereum ETFs continued to see outflows totaling $77.2 million on July 31. Grayscale’s ETHE contributed significantly with an additional $133.3 million outflow, bringing its total outflows to $2.0 billion. Inflows remain muted, with total outflows now amounting to $483.6 million.

The post Bitcoin ETFs see smallest net inflow on record, Grayscale mini BTC positive appeared first on CryptoSlate.