With Bitcoin ETFs seeing previously unheard-of inflows of $18 billion between July 15 and July 19, 2024, the focus turned clearly on them. Investor excitement peaked around this time, and spot Bitcoin ETFs reached fresh highs.

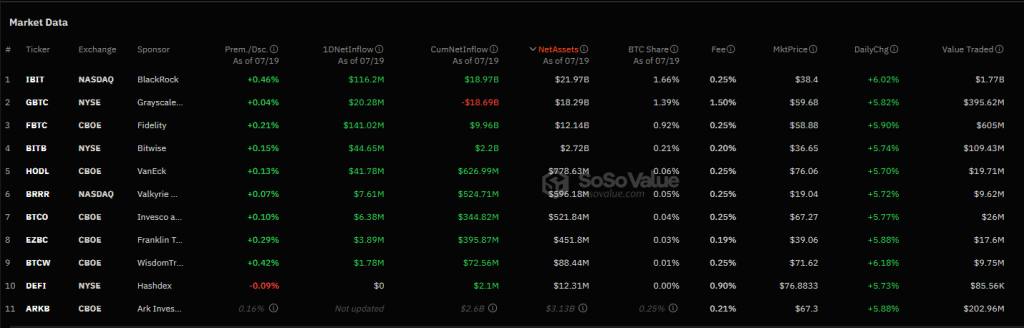

The market saw an eye-watering $424 million inflow on July 16 alone, the largest of the year. Two main participants led this explosion: BlackRock’s iShares Bitcoin Trust (IBIT) with $141 million in inflows and Fidelity’s Wise Origin Bitcoin Fund (FBTC), with $116.2 million in inflows both separately.

The fervour was not restricted to only these titans. With inflows of $44.5 million and $41.7 million respectively, Bitwise Bitcoin ETF (BITB) and VanEck’s HODL also made noteworthy contributions. Grayscale’s GBTC added $20 million and even reversed its prior negative flow trend. This great involvement reflects a broad-based faith in Bitcoin’s future and points to a strong and growing interest in Bitcoin ETFs.

Institutional Powerhouses Lead The Charge

It is difficult to overlook how predominately institutional investors are driving this surge. Particularly FBTC and IBIT have become shining lights of investor confidence, attracting a lot of money with their solid performance and reputation.

As big-scale investors try to profit on Bitcoin’s future via controlled and safe investment vehicles, the huge inflows into these funds point towards increased institutional engagement in the Bitcoin market.

The success of Bitcoin reflects this institutional flood as well. Trading at $66,580, the bitcoin’s price rose by 5% over the last 24 hours and by an amazing 14% over the week. This increasing momentum highlights how investor mood may influence notable price swings as it implies a good link between ETF inflows and the market performance of Bitcoin.

Bullish Forecasts For Bitcoin

The market looks bright as Bitcoin ETFs draw significant inflows keep happening. Both historical records and present trends indicate more improvements. On March 14, 2024, Bitcoin hit an all-time high of $73,630; while recent swings, its present price of $66,541 demonstrates endurance. Technical indications point to a strong bullish attitude and a Fear & Greed Index value of 74, thereby setting the stage for Bitcoin to maybe grow to $87,880 by August 20, 2024.

With Bitcoin dominating its rivals, the forecasts sit against a 10% rise in the worldwide crypto market. The technical data, which include 4.90% price volatility over the last 30 days and a recent 53% of green days, support the positive predictions. Given the direction of Bitcoin seems to be for more upward movement, investors should keep alert to changes in the market.

All things considered, institutional titans and motivated by Bitcoin’s outstanding price performance, the current increase in Bitcoin ETF inflows presents a positive image for the cryptocurrency sector. With optimistic predictions and great investor confidence, the next weeks might be crucial for Bitcoin as it negotiates fresh highs.

Featured image from Regtechtimes, chart from TradingView