Quick Take

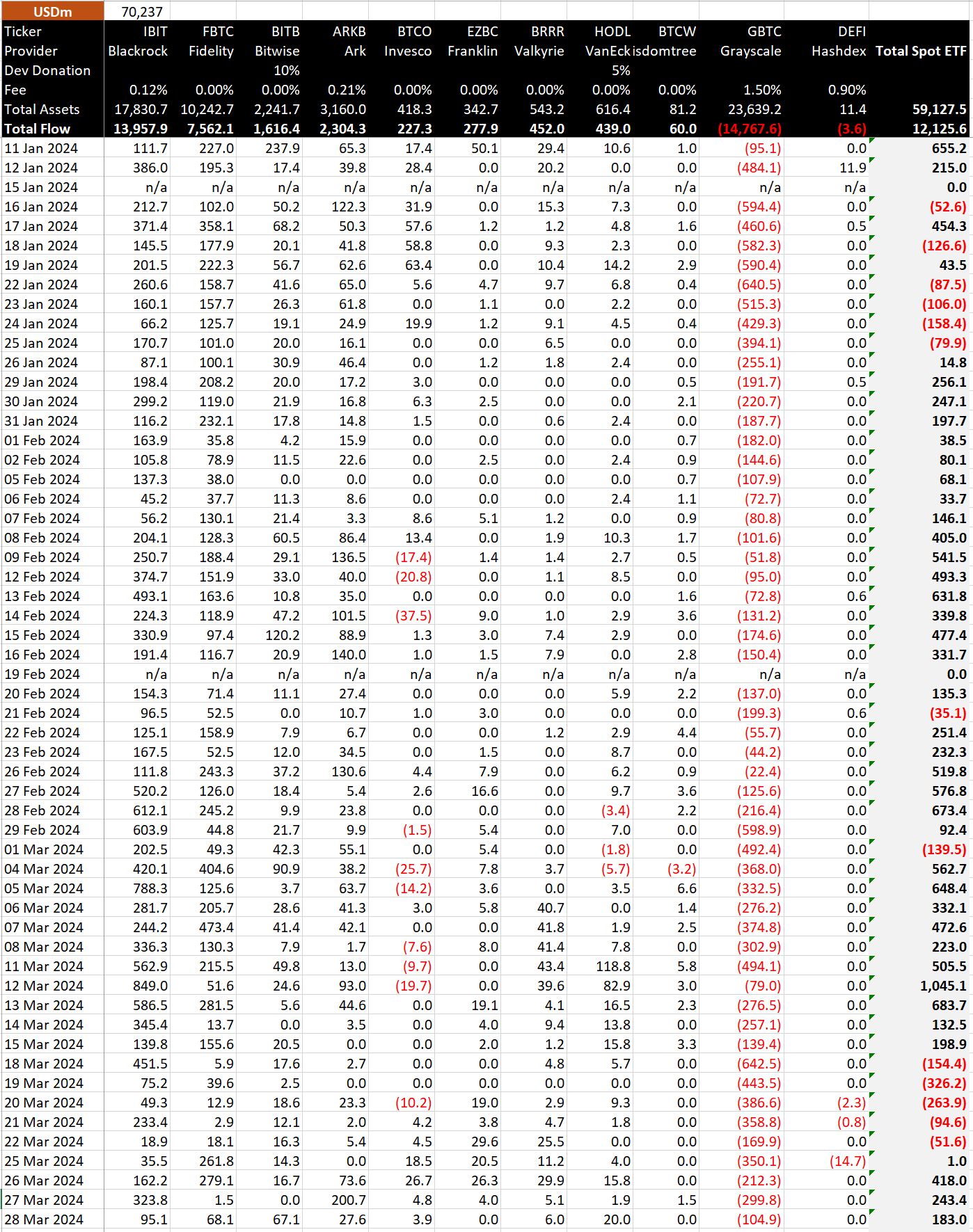

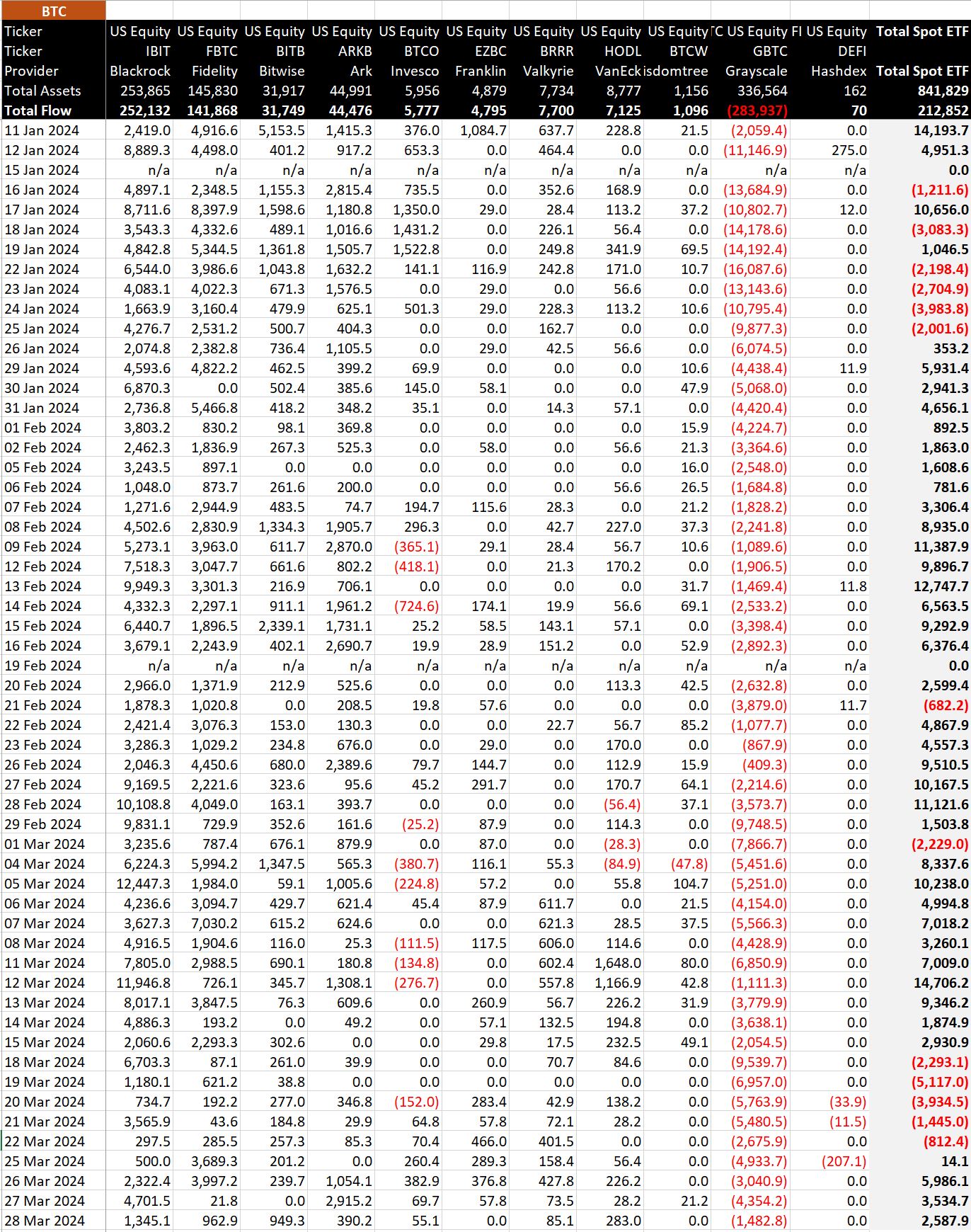

BitMEX data shows that the Bitcoin (BTC) exchange-traded funds (ETFs) witnessed another day of net inflows on March 28, totaling $183.0 million, equivalent to 2,587.9 BTC. This marks the fourth consecutive day of inflows.

While the Grayscale Bitcoin Trust (GBTC) experienced outflows of $104.9 million, equivalent to 1,482.8 BTC, this figure represents the smallest outflow since March 12, potentially indicating a sales pressure slowdown. Despite the outflows, GBTC has now seen a total of $14,767.6 billion, equivalent to 283,937 BTC in outflows, according to BitMEX.

Bitwise ETF (BITB) had a particularly strong day, attracting $67.1 million in inflows, equivalent to 949.3 BTC, marking its strongest day since March 4. Bitwise has now accumulated $1,616.4 billion in inflows, equivalent to 31,749 BTC.

The VanEck ETF (HODL) also saw significant inflows of $20 million, equivalent to 283 BTC, its strongest day since March 12. HODL has now amassed $439 million in inflows, equivalent to 7,125 BTC.

BitMEX data shows that Bitcoin ETFs have witnessed a total net inflow of $12,125.6 billion, equivalent to 212,852 BTC.

The post Bitcoin ETFs surpass $12 billion in net inflows as GBTC selling slows appeared first on CryptoSlate.