Onchain Highlights

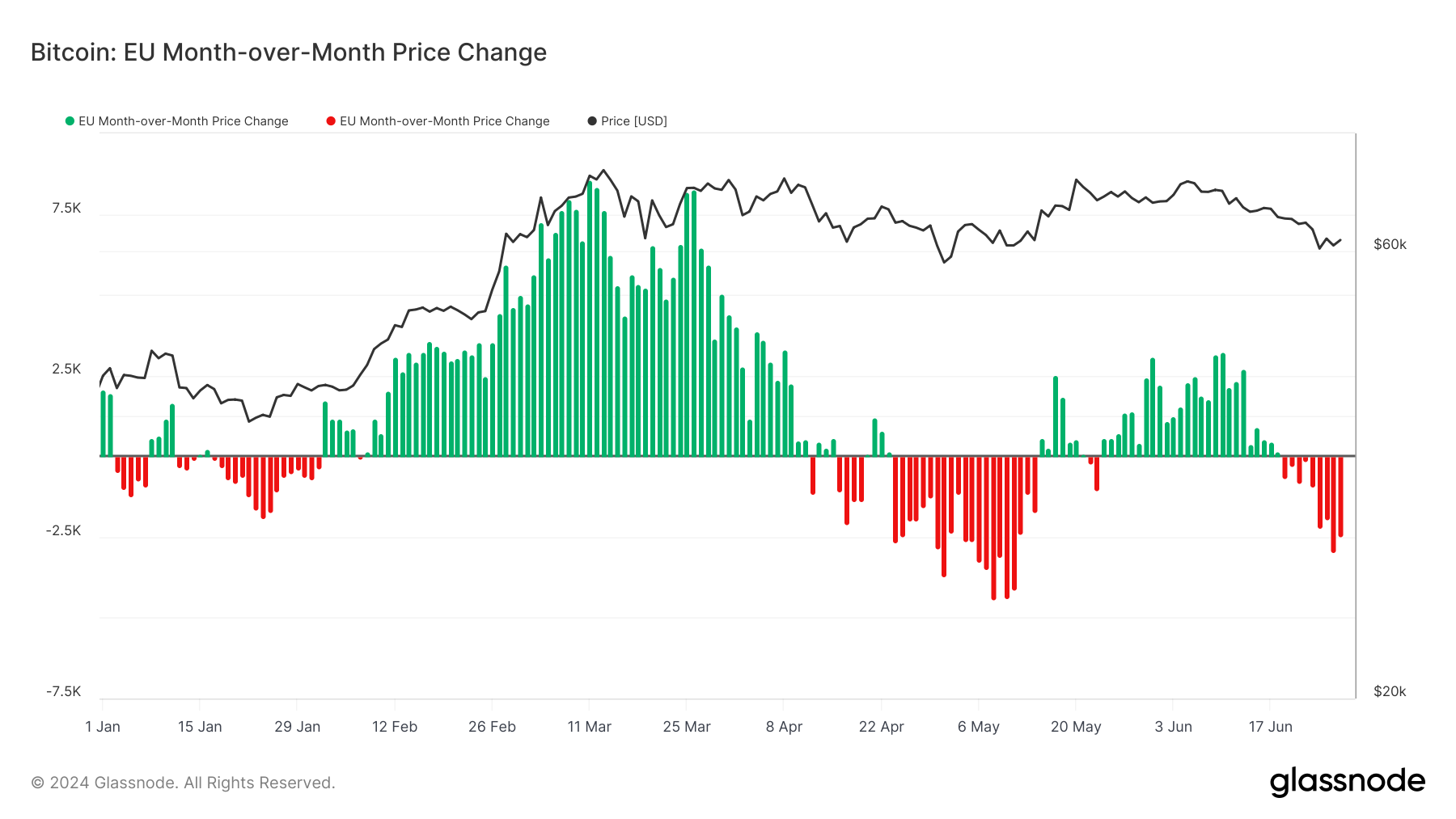

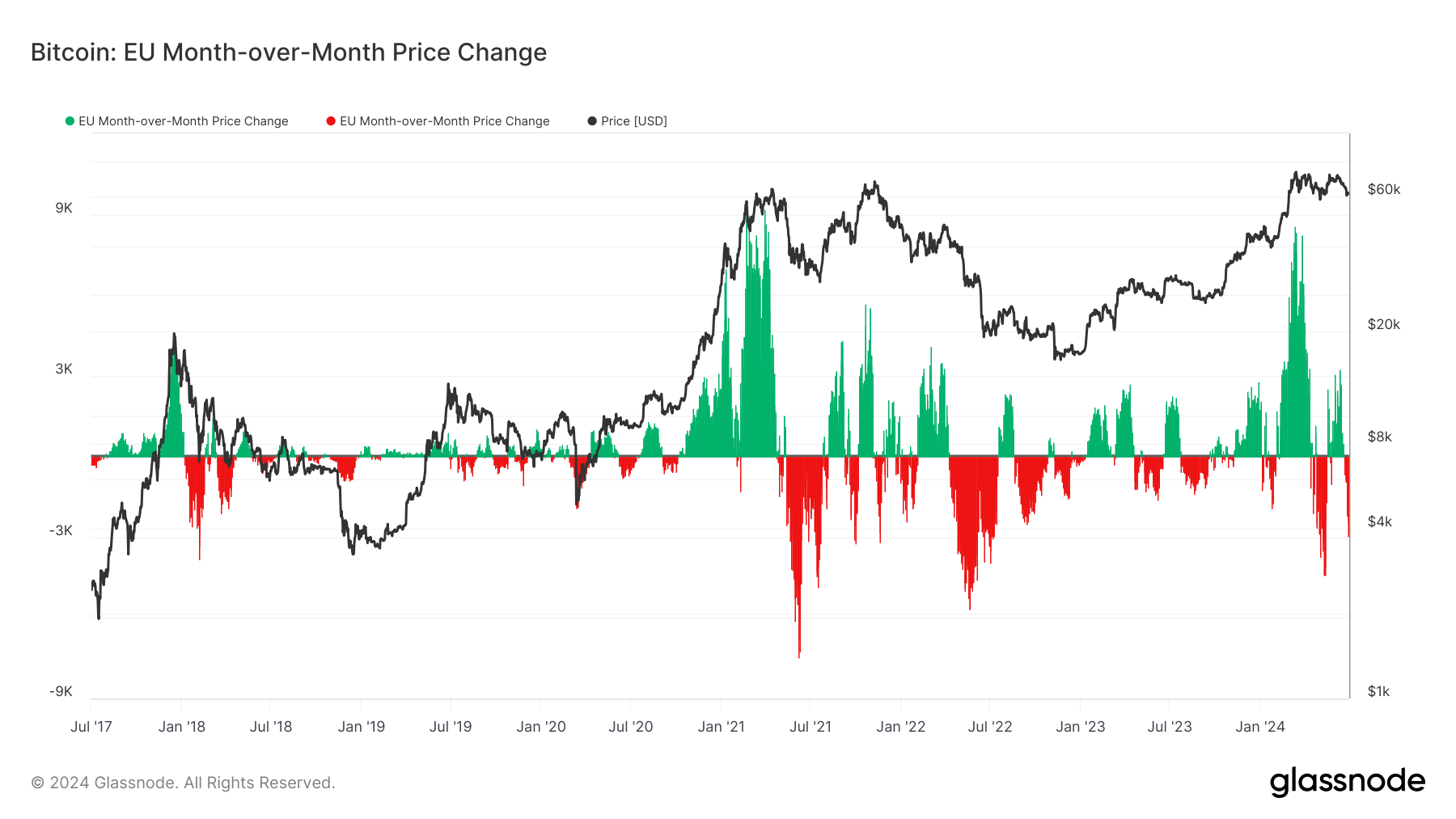

DEFINITION: This metric shows the 30-day change in the regional price set during EU working hours, i.e., between 8 A.M. and 8 P.M. Central European Time (07:00-19:00 UTC), respectively, and Central European Summer Time (06:00-18:00 UTC).

Bitcoin’s month-over-month price change in the EU region shows significant fluctuations over recent months. Analyzing the first half of 2024, the data reveals a marked increase in volatility post-halving in April.

From early January to mid-March, Bitcoin’s price during EU trading hours was in a noticeable uptrend, with several periods of positive momentum. However, following the halving event, the trend shifted dramatically. The charts illustrate a sharp decline in May, reflecting increased selling pressure and a sustained downward movement with a brief respite in early June.

Historical data offers additional context, highlighting similar volatility patterns following major events. For instance, the 2017 and 2021 bull markets saw significant month-over-month price swings, particularly during key regulatory developments and market corrections. The current trend aligns with these historical patterns, suggesting that post-halving market conditions continue influencing Bitcoin’s price action within the EU trading window.

The post Bitcoin experiences heightened volatility in EU trading hours post-April halving appeared first on CryptoSlate.