After weeks of intense selling pressure, Bitcoin (BTC) has entered a consolidation phase, trading below the $85K mark and above $80K. Bulls now face a critical test, as they must push BTC above $90K to prevent bears from driving prices lower.

Bitcoin is currently down over 29% since reaching its all-time high (ATH) in January, sparking growing speculation about a potential bear market. Sentiment remains cautious, with traders unsure whether BTC has bottomed or if further downside is ahead.

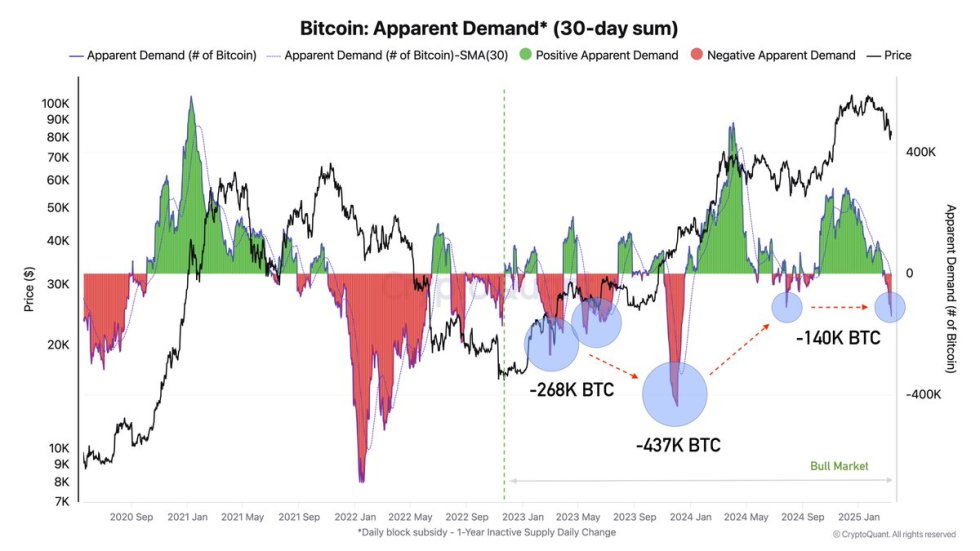

CryptoQuant data reveals that the current phase of negative demand suggests BTC distribution, a pattern that has historically led to temporary corrections, has not always signaled a full trend reversal. According to the data, Bitcoin demand has declined by approximately -140K BTC, which is significantly lower than previous crisis outflows of -268K BTC and -437K BTC.

While this localized selling pressure adds uncertainty, analysts suggest that the scale of the current decline does not threaten the broader bull market. The coming days will be crucial as Bitcoin must hold its current range and reclaim key resistance levels to confirm a recovery or risk further losses if bears remain in control.

Bitcoin Bull Cycle Isn’t Over

The crypto and the US stock markets are both struggling amid macroeconomic uncertainty and trade war fears, creating a challenging environment for investors. Bitcoin (BTC) is now down nearly 20% since the start of the month, and the bearish trend appears likely to continue as sentiment remains weak.

Despite this negative short-term outlook, market fundamentals remain strong. Institutional adoption continues to grow, and US President Donald Trump’s plans to create a strategic Bitcoin reserve could be a major catalyst for future price action. Many analysts argue that while current conditions are bearish, they don’t necessarily signal the end of the bull market.

Top analyst Axel Adler supports this view, sharing insights on X suggesting that BTC’s decline is part of a normal market cycle rather than the start of a prolonged downturn. According to Adler, the current phase of negative demand indicates BTC distribution, a trend that has historically led to temporary corrections but has not always signaled a full trend reversal. Demand has dropped by approximately -140K BTC, significantly less than previous crisis outflows of -268K BTC and -437K BTC.

Adler also notes that despite the current localized selling pressure, this decline does not threaten the broader bull market. Instead, it appears to be a short-term profit-taking event following Bitcoin’s all-time high (~$109K) and a reaction to macroeconomic factors.

Adding to market uncertainty, the Federal Reserve continues to maintain tight monetary policy, while inflation data has exceeded expectations, prompting markets to adjust their rate forecasts. This has increased pressure on risk assets, including BTC, leading to further volatility and cautious investor sentiment.

Price Struggles Below Key Moving Averages – Bulls Fight To Reclaim $85K

Bitcoin is currently trading at $84,300, struggling to regain momentum after weeks of selling pressure. The price is now below the 200-day exponential moving average (EMA) at $85,500 but remains slightly above the 200-day moving average (MA) around $84,000. Bulls must hold this support and reclaim the $85K level to prevent further downside.

For a confirmed recovery rally, BTC needs to break through $85K and push above $90K as soon as possible. Reclaiming these levels would signal renewed bullish momentum, potentially reversing the current downtrend and leading to a retest of higher resistance zones.

However, if BTC fails to reclaim the 200-day MA and EMA, it could face stronger selling pressure, leading to a possible drop below the $80K level. Losing this key psychological support would likely trigger panic selling, forcing BTC into lower demand zones and extending the current bearish phase.

With market conditions still uncertain, bulls must act quickly to push BTC above resistance and prevent further downside risks. The next few trading sessions will be crucial in determining Bitcoin’s short-term direction.

Featured image from Dall-E, chart from TradingView