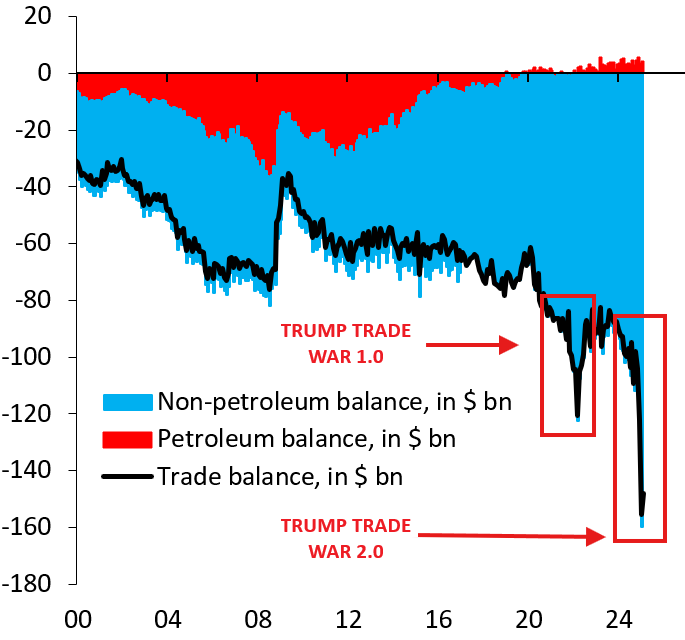

The US has recorded an unprecedented two-month goods trade deficit totaling $301 billion amid corporate efforts to front-run anticipated tariffs, according to an analysis by the financial commentary outlet The Kobeissi Letter.

The trade imbalance reached historic levels in January and February, with monthly deficits of $153.3 billion and $147.9 billion, respectively, far surpassing the previous peak during the initial phase of the Trump administration’s trade conflict.

The severity of these deficits reflects heightened uncertainty over tariff policies affecting approximately $240 billion in annual auto imports, nearly half of which originate from Mexico.

The resulting import surge, particularly industrial supplies such as oil, LNG, steel, and gold, has significantly widened the non-petroleum goods deficit, emphasizing structural vulnerabilities within the US trade framework.

As The Financial Times highlighted, US financial markets have diverged from global equities concurrent with trade disruptions.

Since President Trump’s January inauguration, US stocks, represented by the MSCI USA index, have declined nearly 2% year-to-date. In contrast, global equities, measured by the MSCI World ex USA Index, have advanced approximately 9%.

The divergence accentuates investor concerns over sustained economic disruptions and tariff implications on corporate profitability and growth.

Amid these developments, physical gold purchases in the US surged, driving inventories up over 100% year-to-date and pushing gold prices to approximately $3,100 per ounce. This increase signals widespread hedging against prolonged economic uncertainty reminiscent of historical recessionary behaviors.

With Bitcoin highly correlated with the US markets and decoupled from gold, the US economy could drastically affect Bitcoin performance over the next few months. Unlike gold, Bitcoin does not perform like a risk-on asset.

While many Bitcoiners see Bitcoin as the future of the global economic system, its price will be heavily reliant on US economics in 2025.

The post Bitcoin faces US market correlated pressure as 2025 trade deficit hits record $301 billion appeared first on CryptoSlate.