Bitcoin has fallen below the $25,000 level during the past day as on-chain data shows signs of elevated activity from the whales.

Bitcoin Whale Transaction Count Has Shot Up Recently

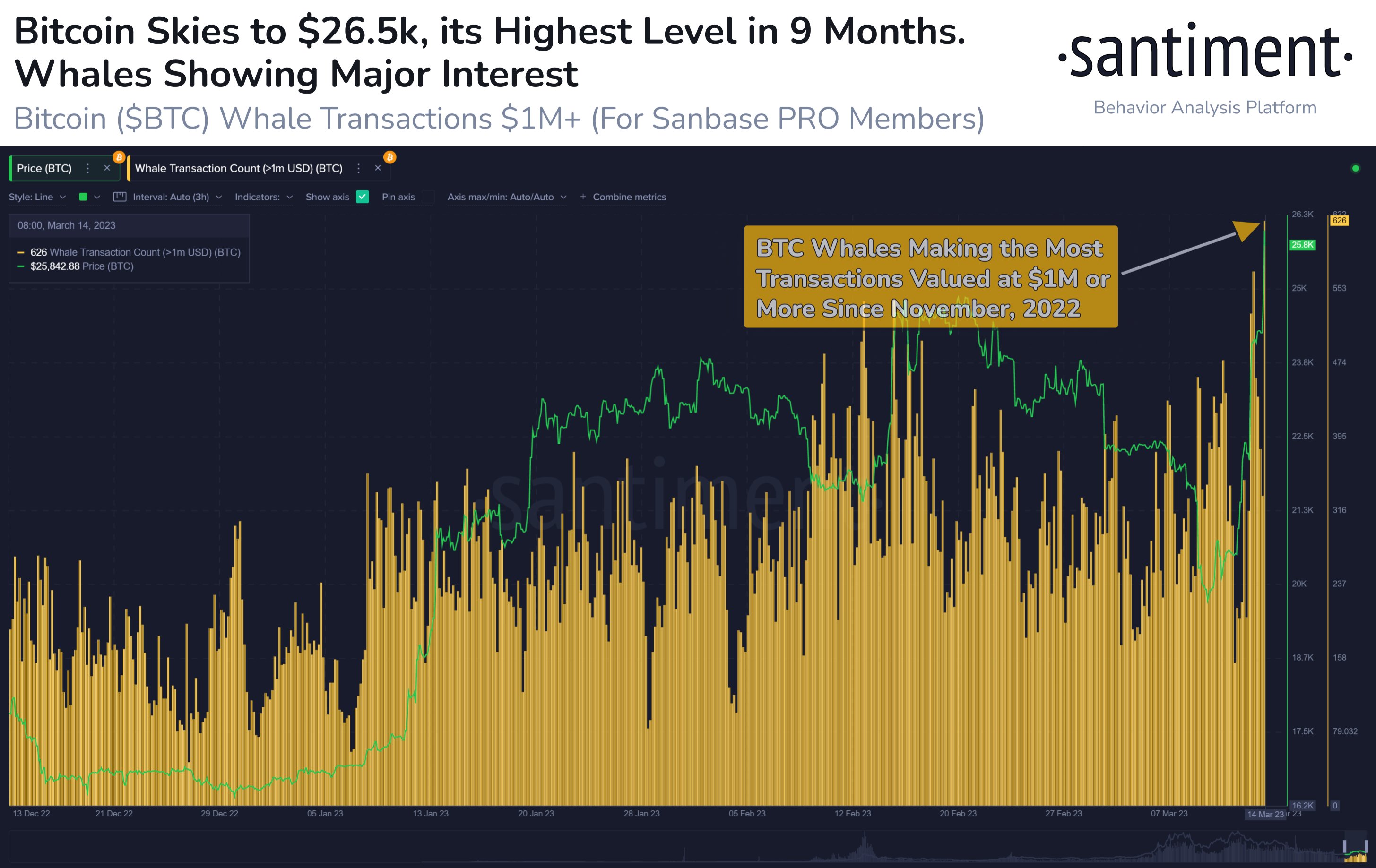

According to data from the on-chain analytics firm Santiment, whale activity surged to the highest level in four months yesterday. The relevant indicator here is the “whale transaction count,” which measures the total amount of transfers taking place on the Bitcoin blockchain that are worth at least $1 million in value.

When the value of this metric is high, it means a large number of whale transactions are occurring on the network right now. Such a trend shows that these humongous holders have an active interest in trading the cryptocurrency currently.

Since the sheer scale of coins involved in whale transactions can be quite large, a sizeable number of them happening at once can cause noticeable ripples in the price of the asset. Because of this reason, high whale transaction count values can foreshadow high volatility for the asset in the near term.

On the other hand, when the indicator has low values, it means whales aren’t showing much activity at the moment, and thus, they may not have too much interest in BTC. Naturally, this kind of trend can precede a calmer market.

Now, here is a chart that shows the trend in the Bitcoin whale transaction counts over the last few months:

As shown in the above graph, the Bitcoin whale transaction count observed a big boost in its value as the latest surge in the price of the cryptocurrency took shape.

The indicator’s value hit the highest value since November 2022, about four months ago, as the BTC price peaked around the $26,500 level, a 9-month high for the asset.

As the whale transaction count can’t differentiate between selling and buying transfers, elevated values of the indicator alone are often not enough to say what kind of behavior these investors are showing exactly, only that they are active currently.

Though, some information can perhaps be deduced by looking at the accompanying price trend. For example, during the price plunge a week or so back, the whales made a large number of transfers, following which the asset hit a local low and climbed out in a sharp rise, suggesting that the transactions may have been for accumulating at the low prices.

In the current case, however, the asset’s value has gone downhill since whale transactions have spiked, with the price now under the $25,000 mark, which may imply that a decent chunk of these transactions might have been made for selling purposes.

If this is the case, it would turn out that these Bitcoin whales possibly saw the latest price surge as just a quick profit-taking opportunity and not a push toward a long-term rise.

BTC Price

At the time of writing, Bitcoin is trading around $24,700, up 12% in the last week.