Analyzing Bitcoin and fiat trading pairs on centralized exchanges often reveals performance disparities that remain invisible when focusing on global or average prices. It shows how liquidity, geopolitical and economic concerns, and market sentiment affect performance.

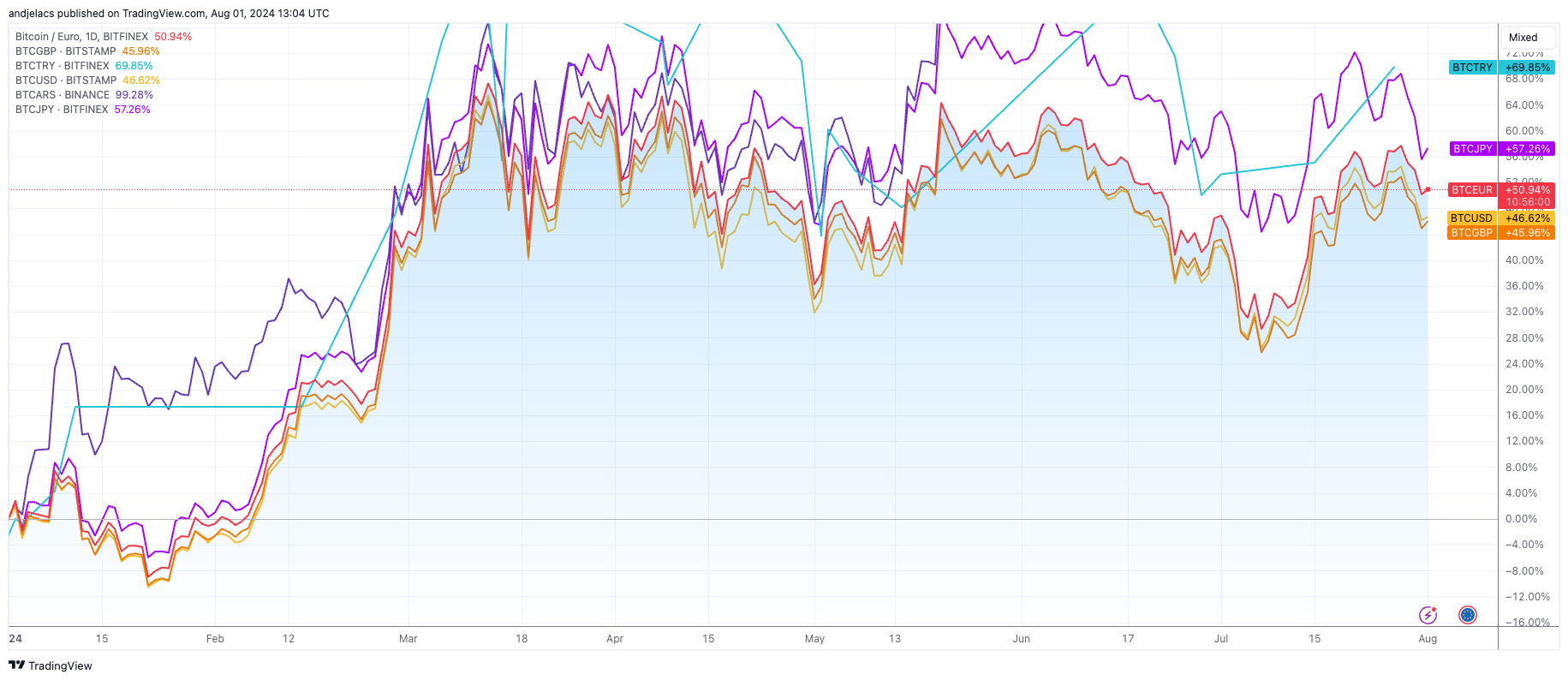

Looking at the year-to-date (YTD) performance of dominant fiat pairs, we can see that BTCARS has seen an impressive 98.27% increase. BTCTRY has gained 69.85%, BTCJPY is up 55.01%, BTCEUR has grown by 49.85%, BTCUSD by 45.62%, and BTCGBP by 45.07%.

In contrast, the three-month performance shows BTCARS leading with a 19.64% increase, while BTCEUR, BTCUSD, BTCGBP, BTCJPY, and BTCTRY have all posted negative returns, ranging from -1.16% to -6.50%.

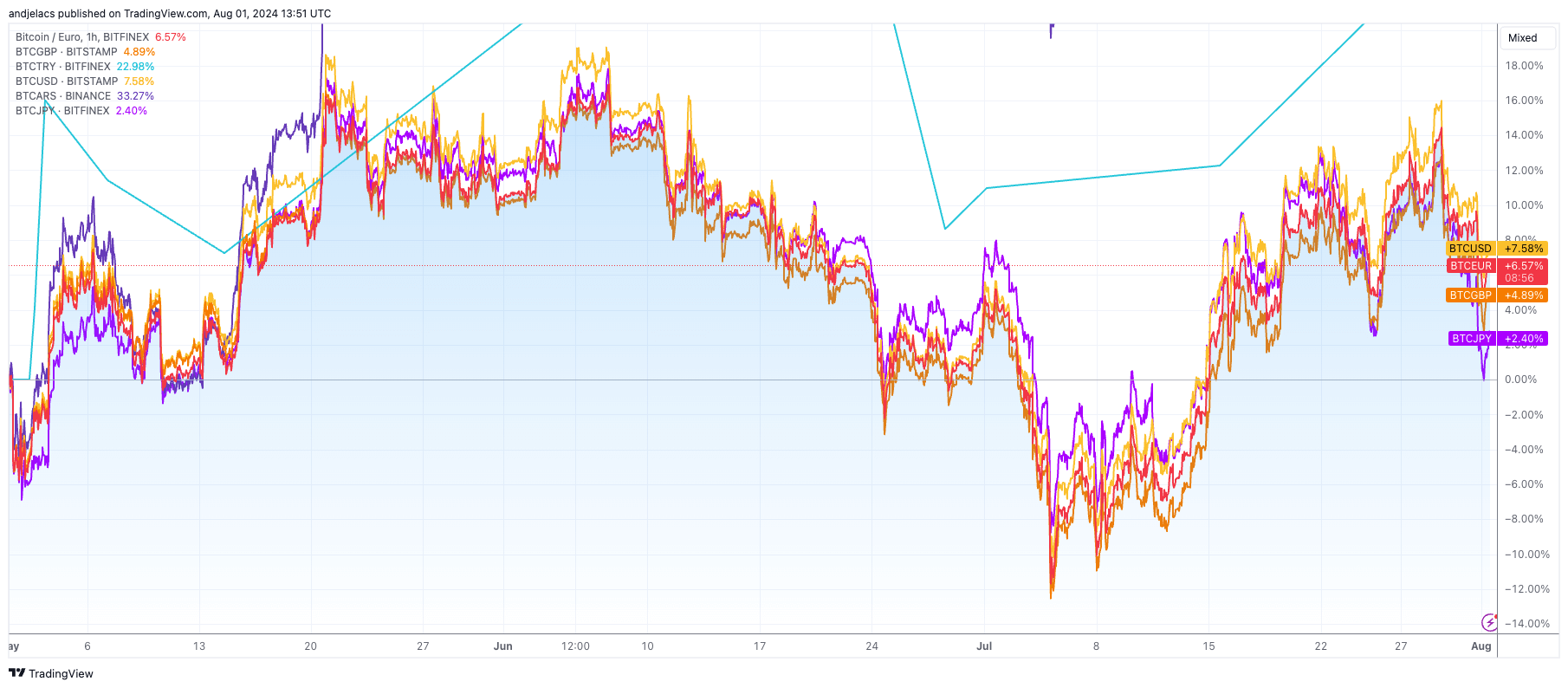

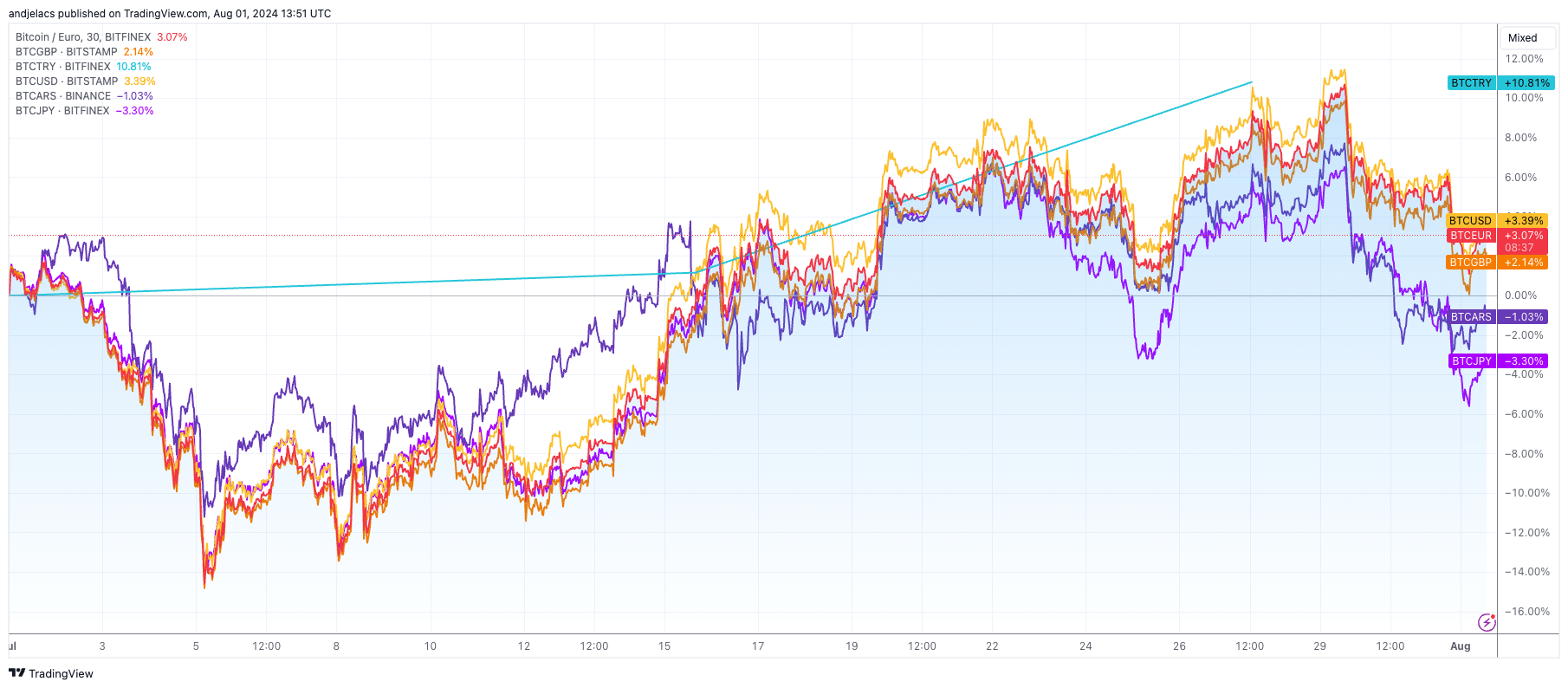

The one-month performance presents a mixed picture, with BTCTRY up by 10.81%, BTCUSD up by 2.97%, BTCEUR up by 2.72%, and BTCGBP up by 2.03%, while BTCARS and BTCJPY have declined by -0.85% and -3.89%, respectively.

The standout performance of Bitcoin against the Argentine peso, especially year-to-date, can be attributed to the country’s severe inflation. With inflation rates exceeding 100% annually, the Argentine peso’s rapid devaluation has driven investors to seek refuge in Bitcoin.

This behavior is consistent with historical trends where citizens of countries experiencing hyperinflation or economic instability turn to crypto as a hedge against their local currency’s depreciation. While the economic and political policies of Argentina’s newly elected president, Javier Milei, have slowed inflation, the demand for Bitcoin remains strong.

Similarly, BTCTRY’s strong YTD performance comes from Turkey’s economic challenges. Turkey has been grappling with high inflation, with recent reports indicating inflation rates surpassing 75%. The Turkish lira’s depreciation has led to increased adoption of Bitcoin among Turkish investors looking to preserve their wealth.

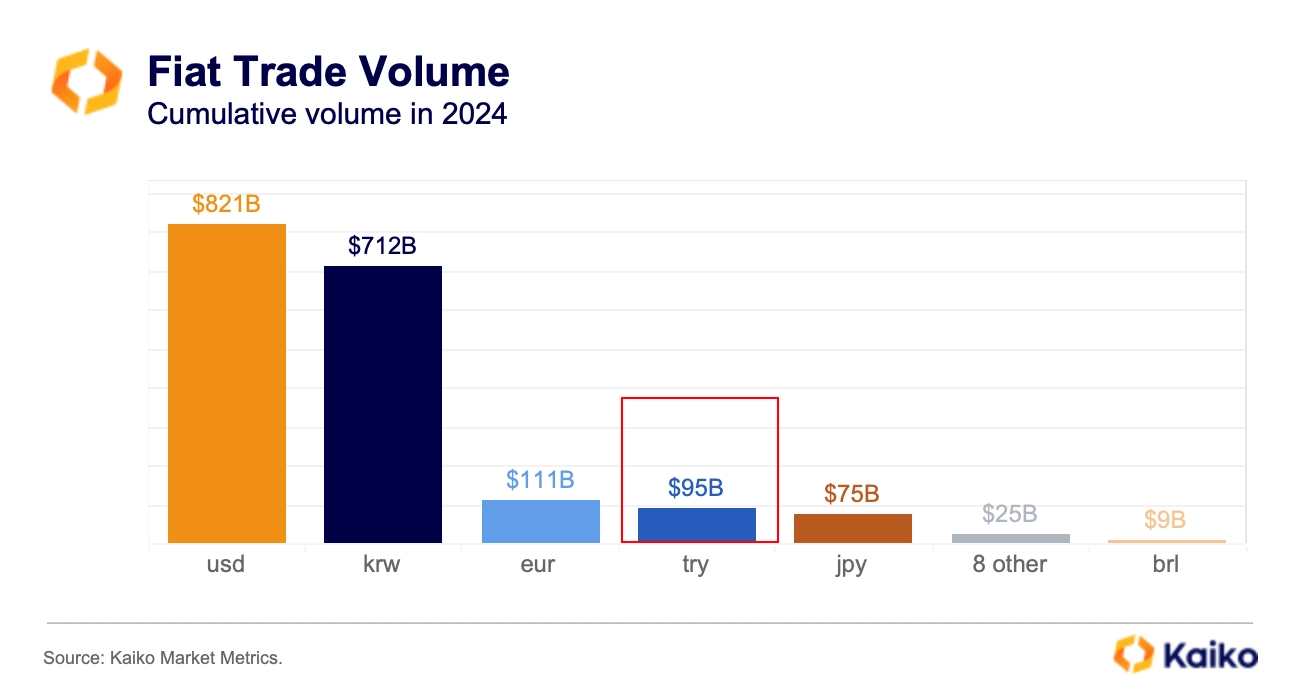

This trend is further supported by the fact that Turkey has one of the world’s highest rates of crypto adoption. Data from Kaiko showed that the Turkish lira trade volume exceeded $10 billion for eight consecutive months, with the cumulative Lira volume reaching $95 billion across seven exchanges.

The yen’s weakening against the dollar, driven by a dovish stance from the Bank of Japan, has affected the BTCJPY pair. Japan’s intervention in the currency market to stabilize the yen has also contributed to the fluctuations observed in Bitcoin’s value relative to the yen. The negative 3M and 1M performance indicate short-term volatility and the impact of these interventions.

The euro, the US dollar, and the British pound’s more modest YTD gains and mixed shorter-term performances can be linked to the relatively stable economic conditions and robust financial infrastructures in the Eurozone, the US, and the UK.

The US dollar’s recent strength has affected the BTCUSD pair, leading to its subdued performance over the shorter term. The euro and pound seem to have experienced slightly more pressure from economic challenges and central bank policies, leading to their higher performance when compared to the dollar.

Liquidity also plays a crucial role in the performance of fiat trading pairs. Highly liquid markets like BTCUSD and BTCEUR tend to exhibit lower volatility and more stable pricing. This is because high liquidity allows larger transactions to be executed without significantly impacting the market price.

Conversely, pairs with lower liquidity, such as BTCARS, are more susceptible to large price swings and greater volatility. This higher volatility can lead to larger gains during periods of high demand, as seen in the YTD performance of BTCARS and BTCTRY.

The post Bitcoin fiat pair performance highlights economic and political challenges appeared first on CryptoSlate.