Bitcoin experienced a highly volatile yet bullish week, capturing market attention with dramatic price movements. The cryptocurrency dropped to as low as $89,100 on Monday, only to stage an impressive recovery and reach a new local high around $105,900 by Friday. This sharp rebound has reignited investor optimism, with many expecting BTC to continue its upward trajectory in the coming weeks.

The post-halving year is historically a period of strong performance for BTC, often delivering high returns as the market aligns with cyclical patterns. Investors are banking on this trend, positioning themselves for what could be a transformative phase for the leading cryptocurrency.

Renowned analyst Axel Adler has shared key insights supporting this bullish outlook. According to Adler, the average Funding Rate remains firmly in positive territory at 0.010, a clear indication that bulls are dominating the BTC futures market. This metric highlights growing confidence among leveraged traders, suggesting that market sentiment remains skewed toward further price appreciation.

As Bitcoin holds above key support levels and technical indicators signal strength, market participants are closely watching for confirmation of a sustained rally. With bulls in control and momentum building, the stage is set for an exciting phase in Bitcoin’s ongoing journey toward new heights.

Bitcoin Prepares To Rally

Bitcoin is on the brink of entering its final and most bullish phase, fueled by a combination of political and market dynamics. As President-elect Donald Trump prepares to assume office, his pro-crypto stance has sparked optimism across the cryptocurrency market. Many investors believe his administration will usher in a more favorable regulatory environment, further driving institutional adoption and mainstream confidence in BTC. This bullish backdrop aligns with Bitcoin’s cyclical trend, setting the stage for a potentially explosive rally.

The price action reflects this growing optimism, with Bitcoin maintaining a strong upward trajectory. Fundamentals also reinforce the bullish outlook. CryptoQuant analyst Axel Adler recently shared insights on X, revealing that the average Funding Rate remains firmly in positive territory at 0.010. This indicates that bulls have maintained dominance in the BTC futures market throughout the bullish cycle, which began in January 2023. Such sustained bullish momentum in the derivatives market is a powerful signal of market confidence.

If the current trend continues, BTC is poised to break out into price discovery, a phase where it explores new all-time highs with no historical resistance to cap its growth. Investors are closely monitoring these developments, anticipating that the combination of favorable fundamentals and political support will catalyze a significant surge.

As Bitcoin approaches this critical phase, the market is abuzz with anticipation. The coming months could mark a transformative period for the cryptocurrency, driven by bullish market dynamics and the prospect of a more crypto-friendly administration. If BTC clears key resistance levels, it could solidify its position as the centerpiece of the digital asset market, with the potential for unprecedented growth. The stage is set for BTC to make history once again.

BTC Testing Crucial Liquidity Levels

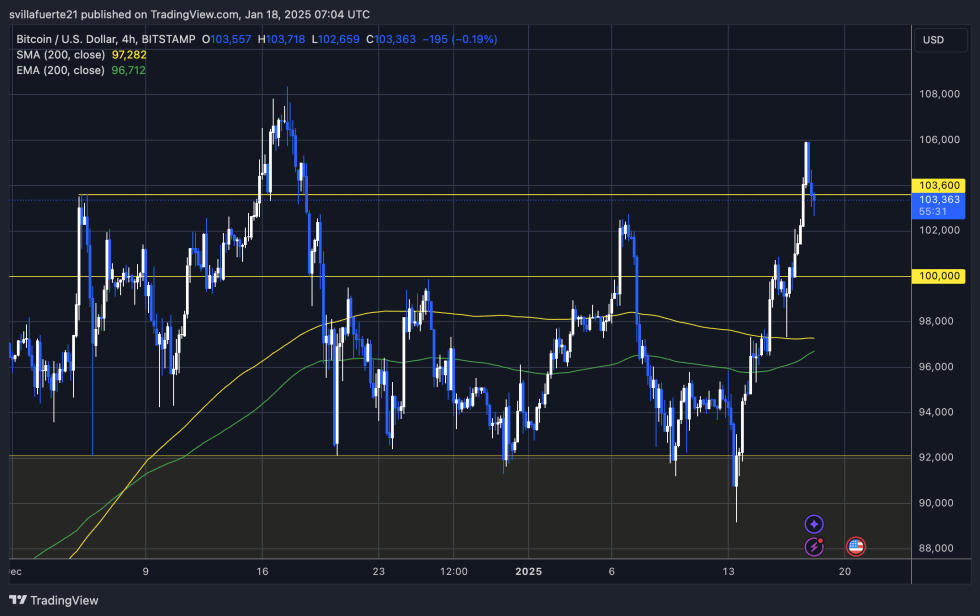

Bitcoin (BTC) is currently trading at $103,600, following a strong move that saw it reach a local high of $105,900 earlier this week. The price action suggests that bulls are firmly in control, driving optimism for further gains. With BTC now hovering near critical levels, market participants are eyeing the next logical target: a push above its all-time high (ATH).

For Bitcoin to maintain its bullish momentum, holding above the $102,000 support level is crucial. This level serves as a key short-term indicator of strength and provides a foundation for the ongoing uptrend. A sustained hold here would signal that buyers remain confident, reinforcing the long-term bullish outlook for the cryptocurrency.

If Bitcoin can keep its momentum and reclaim the $105,900 level, the path toward new ATHs becomes clearer. Breaking into price discovery would likely trigger heightened market activity as investors capitalize on Bitcoin’s upward trajectory.

As BTC consolidates near these pivotal levels, the market is watching closely for signs of the next breakout. The combination of strong bullish sentiment and solid technical support sets the stage for Bitcoin to challenge its previous records, reaffirming its status as the dominant force in the cryptocurrency market.

Featured image from Dall-E, chart from TradingView