The price of Bitcoin hasn’t quite started the month as widely expected, falling to around the $60,000 mark on Thursday, October 3rd. This bearish pressure is believed to have been triggered by the escalating tension in the Middle East after Iran fired missiles into Israel.

However, the premier cryptocurrency seems to be making a turnaround to close the week, bouncing back above $62,000 on Friday. The latest on-chain observation shows that this latest recovery seen with the Bitcoin price is connected to dwindling selling pressure.

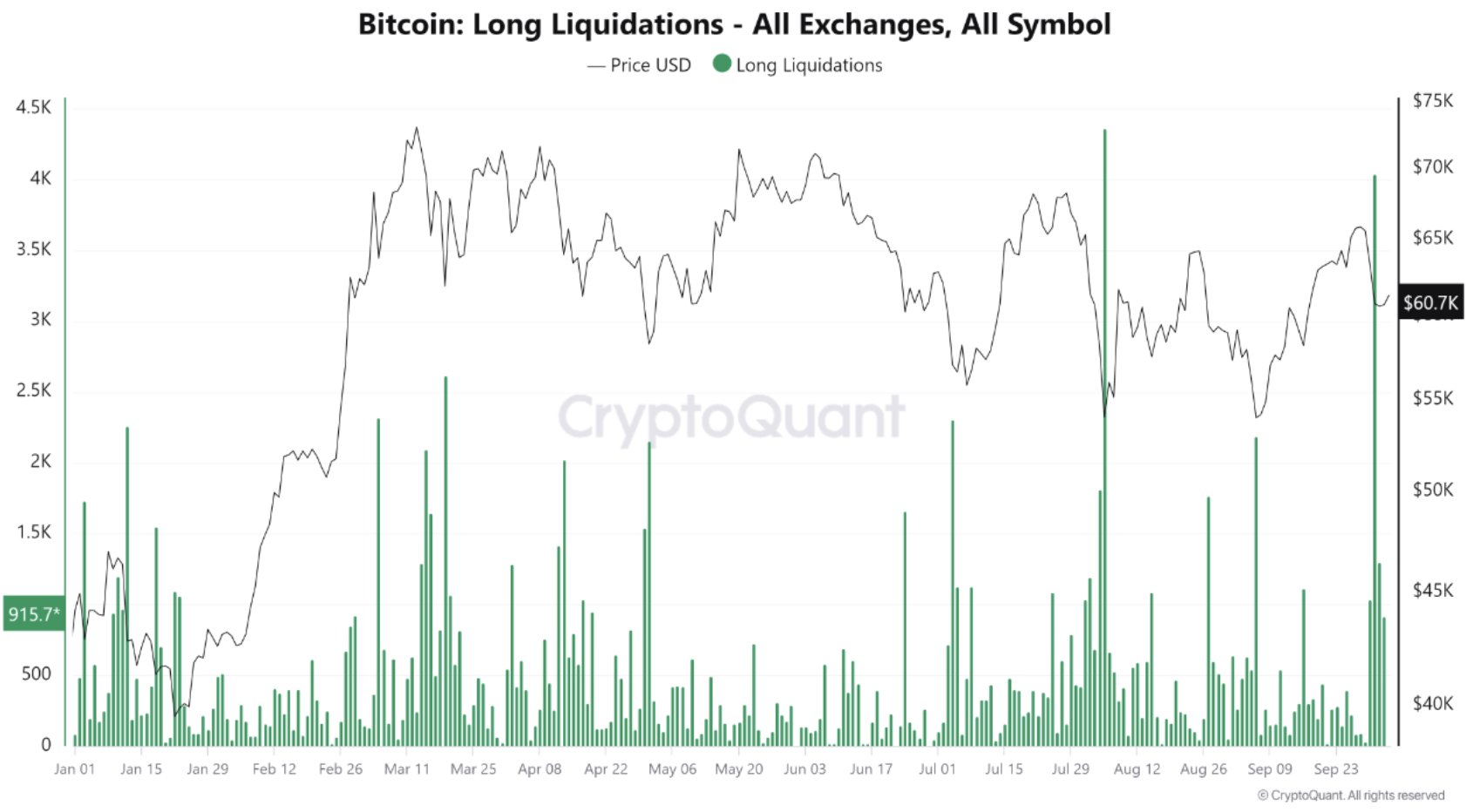

4,000 Long Positions Liquidated On October 1 — What Next?

In a new Quicktake post on the CryptoQuant platform, an analyst with the pseudonym Caueconomy discussed the impact of the recent liquidations of long positions in the Bitcoin futures market. According to the analyst, the ongoing liquidations have reduced the bearish pressure on the Bitcoin price.

For context, futures allow investors to speculate on the price of a specific asset (Bitcoin, in this scenario). A long position is taken when a BTC trader buys a futures contract, predicting the coin’s price to rise at a later date. The trader incurs a loss when the asset’s price falls below the purchase price specified in the futures contract.

According to data from CryptoQuant, more than 4,000 long positions were liquidated following the latest price decline on Tuesday, October 1, representing the second-largest liquidation event so far this year. Although liquidations reflect significant selling activity and investor losses, they can also signal pivotal shifts in market sentiment.

The CryptoQuant analyst noted that periods of severe losses and market liquidations often lead to the formation of local price bottoms. “During significant price declines, the number of contracts purchased tends to drop sharply due to liquidations, which reduces selling pressure in the market,” Caueconomy said.

Furthermore, the analyst mentioned that the price of Bitcoin might be gearing up for a short-term recovery due to the reduced selling pressure. However, Caueconomy highlighted the importance of increasing buying strength from the investors for the Bitcoin price to make a full comeback.

Bitcoin Price At A Glance

It does appear like the price of Bitcoin established a local bottom around the psychological $60,000 level before a pivotal rebound. As of this writing, the premier cryptocurrency trades around the $62,000 mark, reflecting an over 2.5% increase in the past day.

However, this single-day performance has not been enough to wipe Bitcoin’s 5% price decline over the past week. With selling pressure dropping and the positive price history in October, though, it seems like only a matter of time before the flagship cryptocurrency returns to $65,000.