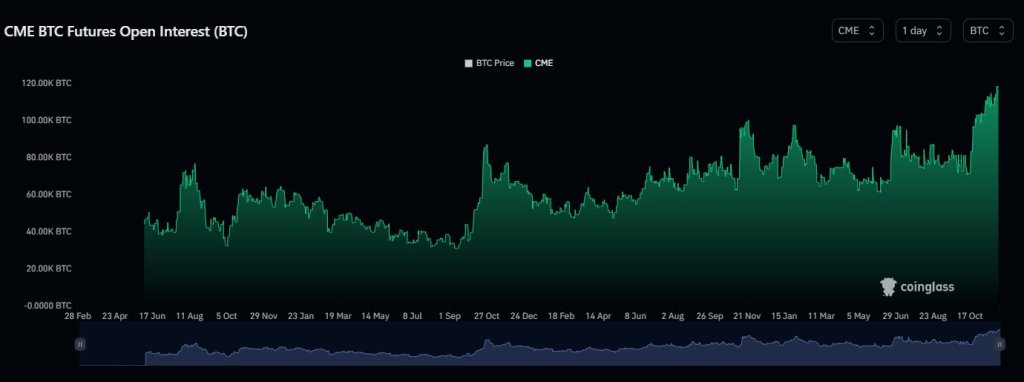

Bitcoin futures open interest on CME, a derivatives exchange approved by the Commodity Futures Trading Commission (CFTC), jumped to an all-time high of 118,540 BTC, worth over $4.42 billion, according to data from CoinGlass on November 27.

Bitcoin Futures Open Interest Rising On CME

Since crypto activity on CME, considering its approval by one of the United States’ agencies is a proxy to institutional activity and interest, the rise in open interest may suggest that more heavyweights explore Bitcoin in late November. Open interest aggregates the total number of unsettled long or short positions. Traders track this reading, using it to gauge overall sentiment.

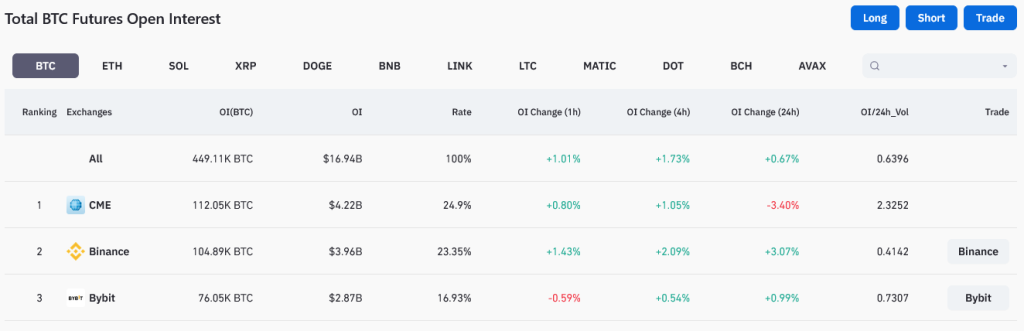

On November 28, the Bitcoin futures open interest contracted to 112,050 BTC worth $4.22 billion. Despite this drop, CME remains the largest exchange for Bitcoin futures, reading from the number of open interest. Notably, it has eclipsed Binance, the world’s largest cryptocurrency exchange.

Meanwhile, Bitcoin prices remain volatile at spot rates, moving inside a narrow range in lower time frames. However, the uptrend remains when price action is analyzed from a top-down preview. For now, BTC has a ceiling of $40,000 but is firm above $35,000 as buyers seem to double down.

If bulls press on, at the back of improving fundamental factors, BTC prices could spring above $40,000, registering new 2023 highs. On the back of this rising interest, Bitcoin could find the momentum that will likely lift it to $45,000 or better before the end of the year.

Institutions Readying For More Expansion?

One of the key factors driving the current leg up is institutional interest and the nature of products, chiefly in-the-spot Bitcoin exchange-traded funds (EFTs), that the United States Securities and Exchange Commission (SEC) could approve in the next few weeks.

Moreover, Bitcoin has posted solid gains this year, doubling from 2022 lows at spot rates. If Bitcoin continues to extend gains, open interest will likely continue rising.

The CME Bitcoin futures contracts are derivatives, allowing investors to speculate on or hedge against BTC’s volatility. Over time, CME has been gaining popularity among institutional investors because they are regulated by the CFTC and, conveniently, cash-settled.

For the risk-averse institutional investors, they provide a convenient way to gain exposure to Bitcoin without the complexities of managing the underlying coin.

The recent surge in open interest in CME suggests that institutional investors increasingly view Bitcoin as a legitimate and worthy asset class. This preview is further endorsed by BlackRock and Fidelity, among other traditional Wall Street firms, choosing to apply for a spot Bitcoin ETF with the US Securities and Exchange Commission (SEC).