Bitcoin is alive and kicking, spewing out impressive hashrate numbers like never before.

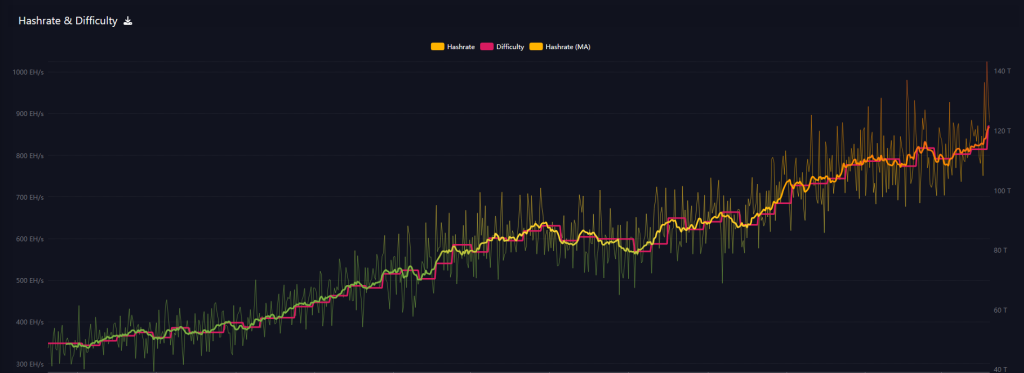

Bitcoin’s network processing power has reached an unprecedented 1 Zetahash per second (ZH/s), marking a major milestone in the cryptocurrency’s 16-year history.

Multiple blockchain tracking services confirmed the achievement between April 4-5, 2023, though they disagree on the exact timing of when the threshold was crossed.

Different Trackers Report Varying Dates For Historic Milestone

A Zetahash (ZH/s) is a unit of computational power used to measure Bitcoin’s hashrate, which reflects how much computing power is being used to secure the Bitcoin network through mining.

According to mempool.space data, Bitcoin’s hashrate peaked at 1.025 ZH/s on April 5. BTC Frame’s metrics showed a slightly earlier breakthrough at 1.02 ZH/s on April 4.

Meanwhile, Coinwarz reported an even higher peak of 1.1 ZH/s on April 4 at block height 890,915, but also suggested the network first hit the 1 ZH/s mark on March 24.

The differences stem from how each service calculates hashrate. Blockchain analyst Jameson Lopp previously pointed out that using one “trailing block” versus five blocks for estimation can result in differences exceeding 0.04 ZH/s.

Mitchell Askew, head analyst at Blockware Solutions, said viewing the raw Hashrate metric can be deceiving due to random variations in block times. He noted that Bitcoin’s 30-day moving average hashrate remains around 0.845 ZH/s.

Network Shows Massive Growth Since 2016

This achievement represents remarkable growth for the Bitcoin network. The current hashrate of 1 ZH/s equals 1,000 Exahashes per second, marking a 1,000-fold increase since late January 2016 when the network first reached 1 EH/s.

To put this computational power in perspective, Bitcoin now processes approximately 40,000 times more calculations per second than Litecoin, the second-largest proof-of-work cryptocurrency network. Based on Coinwarz data, Litecoin currently operates at just 2.49 Petahashes per second.

Commercial Mining Operations Drive Hashrate Growth

According to Askew, the surge in hashrate has coincided with increased competition among commercial Bitcoin mining firms. Miners are doubling down, and expanding sites and plugging in more efficient machines, he said. However, he warned that less efficient miners might struggle unless Bitcoin prices increase in the coming months.

At least 24 publicly listed companies now operate Bitcoin mining equipment, according to CompaniesMarketCap.com. MARA Holdings leads the pack with more than 50 EH/s of computing power. Other major contributors include Riot Platforms, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf.

Most of the network’s hashrate flows through major mining pools, with Foundry USA Pool and AntPool controlling the largest shares, according to the Hashrate Index.

Record Hashrate Coincides With Market Downturn

The network’s technical achievement occurred during a sharp market decline. Bitcoin’s price fell 8% over a 24-hour period to $77,210, while US stocks experienced what analysts called the largest two-day loss ever.

Featured image from Gemini Imagen, chart from TradingView