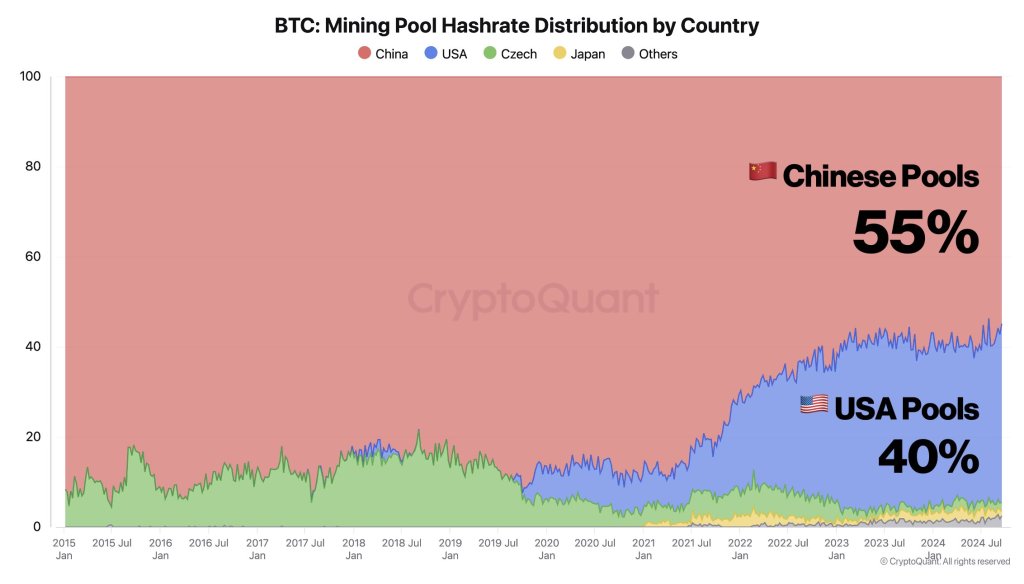

As Ki Young Ju notes, Bitcoin mining activity is shifting to the United States, though Chinese miners still dominate. In a post on X, Ju, the founder of CryptoQuant, a crypto analytics platform, observes that more United States mining pools are gaining market share from their Chinese counterparts, based on the Bitcoin hash rate dominance.

Bitcoin Hashrate Shifting To The US After China Ban

As of September 23, Chinese Bitcoin mining pools controlled 55% of all Bitcoin hash rates. At the same time, those operating from inside the United States control 40% of the total. This means that the two countries dominate all Bitcoin mining activities, controlling 95% of all hash rate–a huge risk to the operation and security of the blockchain.

Bitcoin is secured by distributed and decentralized miners who often channel their computing power (hash rate) to a pool for a chance to win block rewards. These miners have to purchase gear and meet all operational costs.

However, as an incentive, the network distributes 3.125 BTC and the associated block fees roughly every 10 minutes to the successful mining pool or miner. In this way, the network remains secure and, in theory, equally decentralized.

As trends show, the shift in hash rate dominance coincides with the crackdown on crypto mining activity in China in May 2021. Citing various concerns, the Chinese government banned all crypto mining and staking forms.

Specifically, they said the proliferation of crypto made it harder for them to curb financial crime and seal capital flight. At the same time, the Chinese government alleged that crypto and Bitcoin would destabilize the economy.

Following this, most Chinese miners were forced to shut down operations and relocate to other regions. Most found themselves in the United States and Kazakhstan. Although there are still pockets of mining activity in China, the pro-crypto stance and favorable regulations mean crypto mining in the United States is booming.

Favorable Policy, Donald Trump Vouches Support For Crypto Mining

Notably, Bitcoin mining activity in the United States is institutionalized. Some of the top public crypto mining firms mining thousands of BTC annually include Marathon Digital and Riot Platforms.

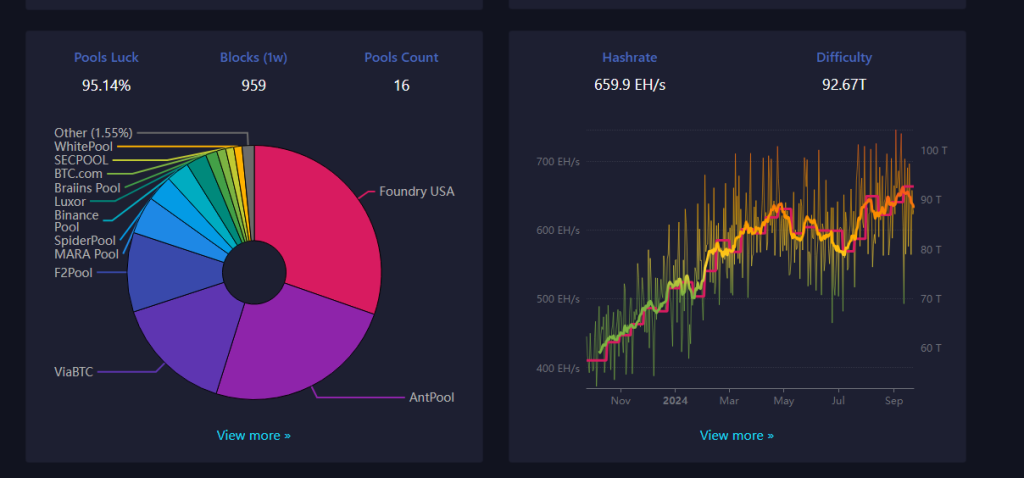

Meanwhile, more independent miners are connecting to United States-based mining pools. According to Mempool.space, Foundry USA is the largest mining pool, contributing over 30% of the hash rate.

In June, Donald Trump, the Republican Presidential nominee, met with crypto mining executives in Florida. During the private meeting, it was reported that Trump said his administration, if elected, would ensure the sector is treated fairly.