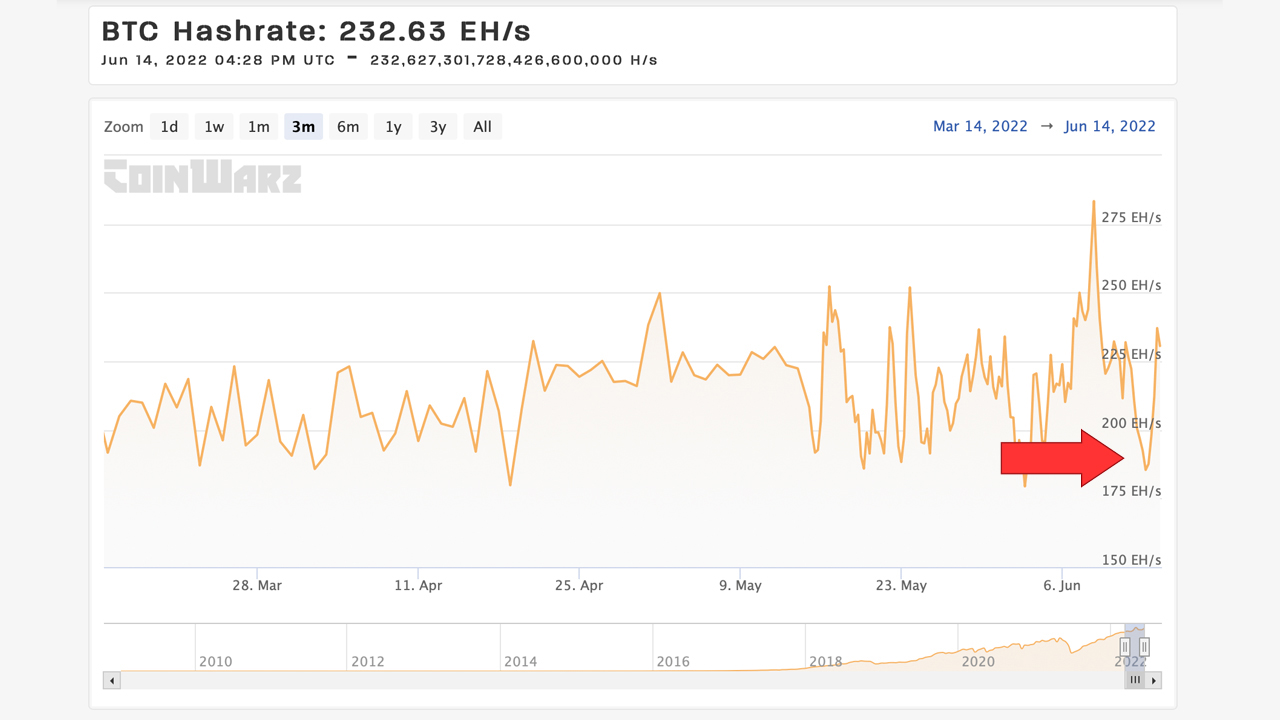

After reaching an all-time high on June 8, Bitcoin’s hashrate dropped during the recent bitcoin price drop on June 12-13 to a low of 182 exahash per second (EH/s). While bitcoin’s USD value remains under the $23K zone, Bitcoin’s hashrate has managed to climb back above the 200 EH/s region.

Hashrate Drops to 182 EH/s and Bounces Back Above 200 EH/s, Over 741 Million Bitcoin Transactions Confirmed

Close to a week ago, Bitcoin’s hashrate tapped an all-time high at 292.02 EH/s at block height 739,928 and since then, it has dropped down to just above the 200 EH/s zone. Currently, the hashrate is coasting along at 232.63 EH/s on Tuesday, June 14, 2022.

For a brief moment during the crypto market carnage on June 12-13, the network’s computational power slipped down to 182 EH/s from 231 EH/s. The network saw a 21% loss in hashrate during that period of time but quickly rebounded.

At current speeds, the network’s mining difficulty is expected to increase by 0.67% to 30.49 trillion. There’s still a whole week left until the difficulty adjustment algorithm (DAA) changes, which means current estimates could shift. The DAA change is expected to happen on or around June 22, 2022, or 1,050 block rewards to go until the shift.

Furthermore, there’s now less than 100K block rewards left to be found until the next halving or approximately 99,214 blocks at the time of writing. The block subsidy will change after those blocks are mined from 6.25 bitcoins per block to 3.125 bitcoins per block post halving.

Currently, Foundry USA is the top bitcoin mining pool today with 22.52% of the global hashrate after it found 93 of the 413 blocks discovered during the last three days. Poolin is the second-largest mining pool with 13.80% of the global hashrate.

12 known mining pools are currently mining BTC while 0.73% of the global hashrate or 1.62 EH/s is operated by stealth miners. Unknown miners have found three blocks out of the 413 over the last three days.

Over the last 30 days, miners confirmed 7,692,044 BTC transactions and BTC has seen 741,438,457 confirmed transactions over the course of its lifetime. There’s currently 15,679 reachable nodes and 8,290 Tor nodes.

Miners and non-mining nodes that are securing the BTC blockchain have to store 467.6 GB of data at the time of writing. At the time of writing, there’s been 19,067,210.93 BTC minted into circulation and there’s 1,932,574.98 that remains left to be discovered by miners.

What do you think about the current state of the Bitcoin network’s hashrate and mining pools? Let us know what you think about this subject in the comments section below.