On-chain data shows the Bitcoin Mining Hashrate has witnessed a sharp rise towards a new all-time high amid all the chaos in the market.

Bitcoin Mining Hashrate Has Shot Up Recently

The “Mining Hashrate” refers to a metric that keeps track of the total amount of computing power that the Bitcoin miners as a whole have connected to the network. The indicator is measured in units of hashes per second (H/s) or the larger and more practical terahashes per second (TH/s).

When the value of this metric rises, it means new miners are joining the network and/or existing ones are expanding their facilities. Such a trend implies these chain validators are finding the blockchain an attractive opportunity.

On the other hand, the indicator going down suggests some of the miners have decided to disconnect their machines from the chain, potentially because they are no longer making a profit on BTC mining.

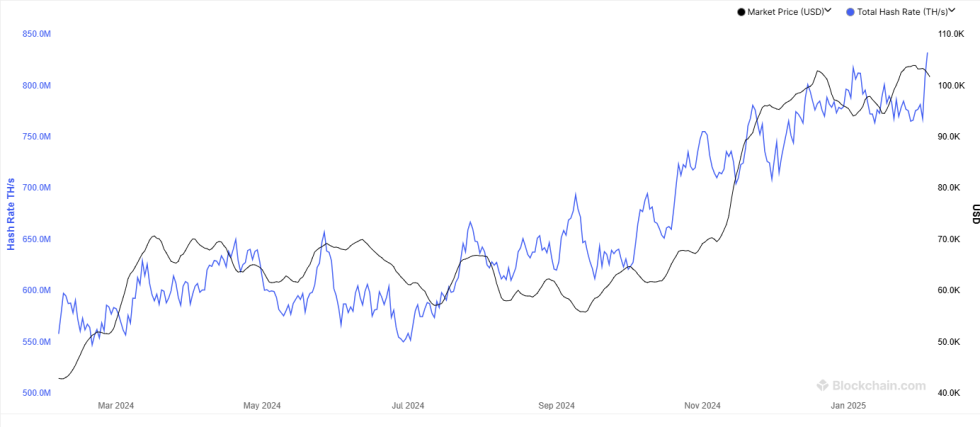

Now, here is a chart from Blockchain.com that shows the trend in the 7-day average Bitcoin Mining Hashrate over the past year:

As displayed in the above graph, the 7-day average Bitcoin Mining Hashrate rose to an all-time high (ATH) of around 817,700 TH/s during the starting days of the year, but the metric couldn’t sustain at these levels as its value soon registered a plunge.

The indicator showed consolidation about its lows for the rest of January, but it would appear February has finally brought fresh winds as its value has seen a steep uptrend and has smashed past its previous peak to set a new record of about 832,600 TH/s.

This renewed expansion from the miners has interestingly come while the cryptocurrency has been going through an uncertain period with its price displaying high volatility in both directions.

The Mining Hashrate serves as a look into the sentiment among the miners, so this latest increase would imply these chain validators believe the asset would ultimately come out of this volatile period in the bullish direction.

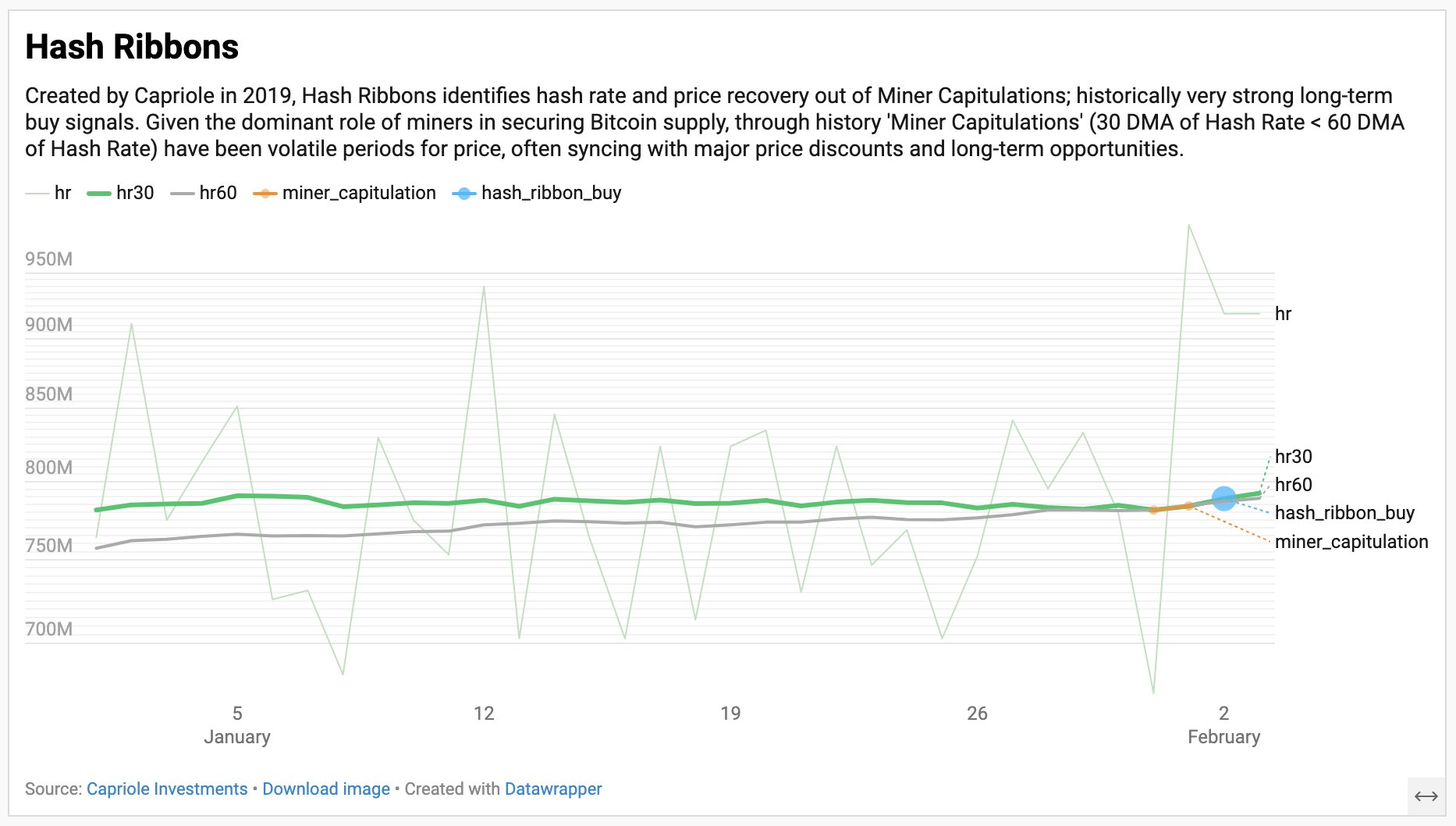

An indicator that makes it easy to use the Hashrate for tracking the situation of the miners is the Hash Ribbons. This metric is made up of two moving average (MAs) of the Hashrate: 30-day and 60-day.

As Capriole Investments founder Charles Edwards has explained in an X post, the Hash Ribbons flashed a very brief capitulation signal at the beginning of the month.

Miner ‘capitulation’ occurs when the 30-day MA falls under the 60-day one. This crossover couldn’t last for long this time as the Hashrate observed a sharp increase, leading to a reverse crossover taking place. Historically, this has served as a buying signal for Bitcoin.

BTC Price

At the time of writing, Bitcoin is trading around $100,000, down 3% in the last week.