On-chain data shows the Bitcoin long-term holder supply has seen a turnaround recently. Here’s what history says this could mean.

Bitcoin Long-Term Holder Supply May Have Reached A Bottom

In a new post on X, analyst James Van Straten has talked about the latest trend in the supply of the BTC long-term holders. The “long-term holders” (LTHs) refer to the investors who have been holding onto their coins since more than 155 days ago.

The LTHs make up for one of the two main divisions of the market done on the basis of holding time, with the other side being known as the “short-term holders” (STHs).

Historically, the STHs have proven to contain the fickle-minded hands of the market who tend to easily sell at the sight of any FUD or FOMO in the sector. The LTHs, on the other hand, contain the resolute entities who can hold through crashes and rallies alike.

That said, even these HODLers don’t sit tight forever, as they are also in it to make some profits eventually. One such event of an LTH selloff occurred during the recent all-time high exploration of the cryptocurrency, implying the rally was too good for the diamond hands to pass on.

There are many ways to track LTH behavior, with one method being by measuring the combined amount of supply that members of the cohort have in their wallets.

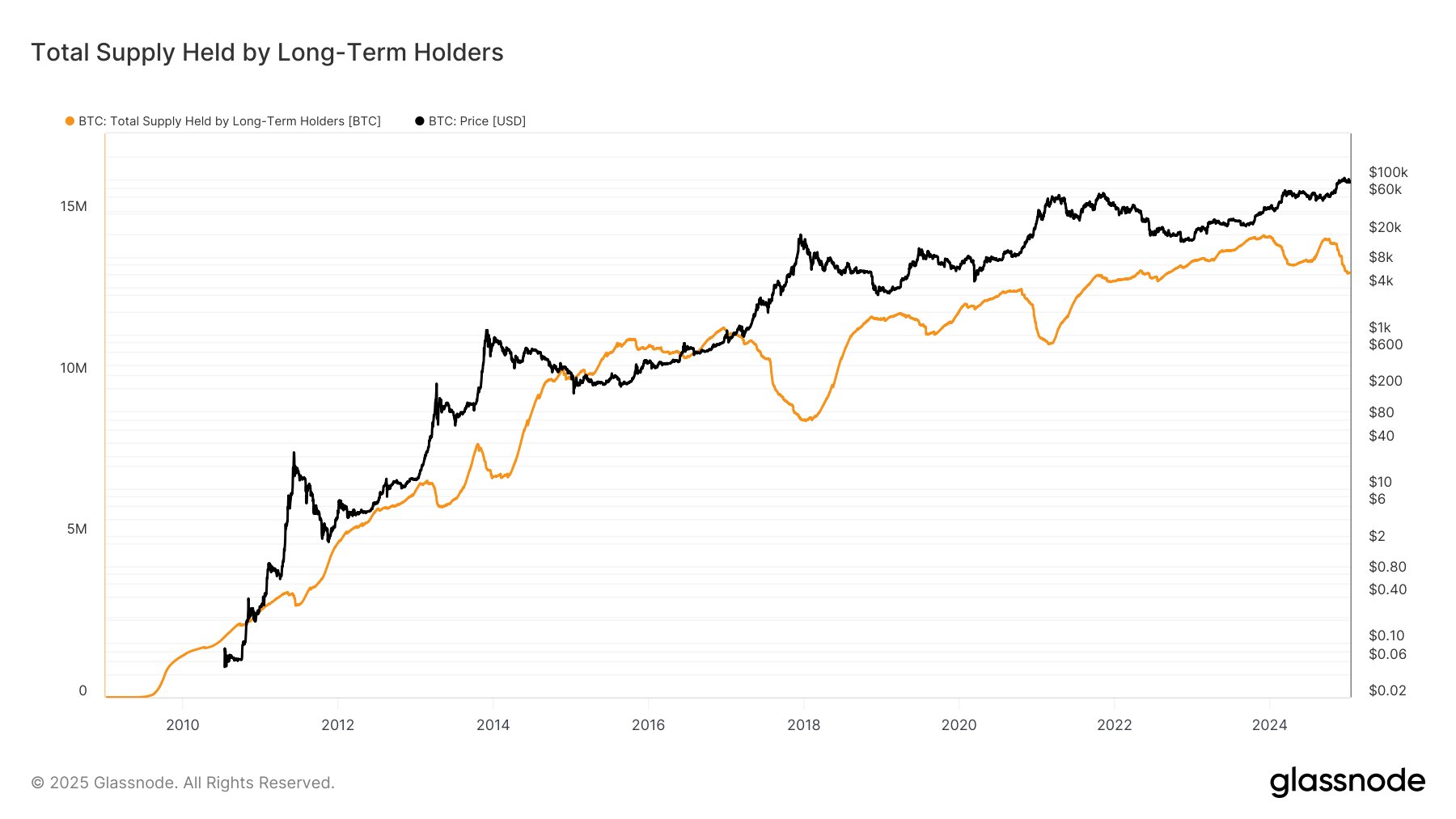

Below is the Glassnode chart for the metric shared by the analyst, that shows the trend in its value over the history of Bitcoin.

From the graph, it’s visible that the Bitcoin LTH supply was declining during the last couple of months of 2024 as these investors took their profits from the rally, but recently, the indicator has shown a small turnaround as the holdings of the group have increased by around 20,000 BTC.

This could suggest that the cohort’s supply has now bottomed out and reversed its trajectory toward the upside. Historically, though, bottoms in the metric have tended to occur around tops in the cryptocurrency’s price, meaning that this may not exactly be bullish for BTC.

Nonetheless, not all of the Bitcoin tops coinciding with lows in the LTH supply were cyclical tops. The peak in the first quarter of last year, for instance, also took place alongside a bottom in the indicator.

It only remains to be seen whether the latest pattern in the indicator implies that the most recent top was a cyclical one or if it was simply another local top on the way to the main peak.

BTC Price

Bitcoin has continued its recovery rally from yesterday as its price has now surged beyond the $99,000 level.