On-chain data shows that Bitcoin investors have ended their net profit-taking spree recently, a potential sign that a price reversal could occur soon.

Bitcoin Daily Realized Profit Loss Ratio Has Dipped Below 1 Recently

As explained by CryptoQuant author Axel Adler Jr in a new post on X, realized losses have started to exceed profits recently. The on-chain metric of interest here is the “Daily Realized Profit Loss Ratio,” which, as its name suggests, tells us about how the Bitcoin investors’ profits compare against the losses.

The metric works by going through the transaction history of each coin sold to see what price it was moved at before this. If this previous selling price for any coin was less than the current spot price, then that particular coin is being moved at a profit.

Similarly, sales of coins of the opposite type lead to loss realization. The indicator adds these profits and losses for the entire market and takes their ratio to produce its value.

When the indicator is above 1, the investors realize more profits than losses with their selling. On the other hand, this threshold implies the dominance of loss-taking in the market.

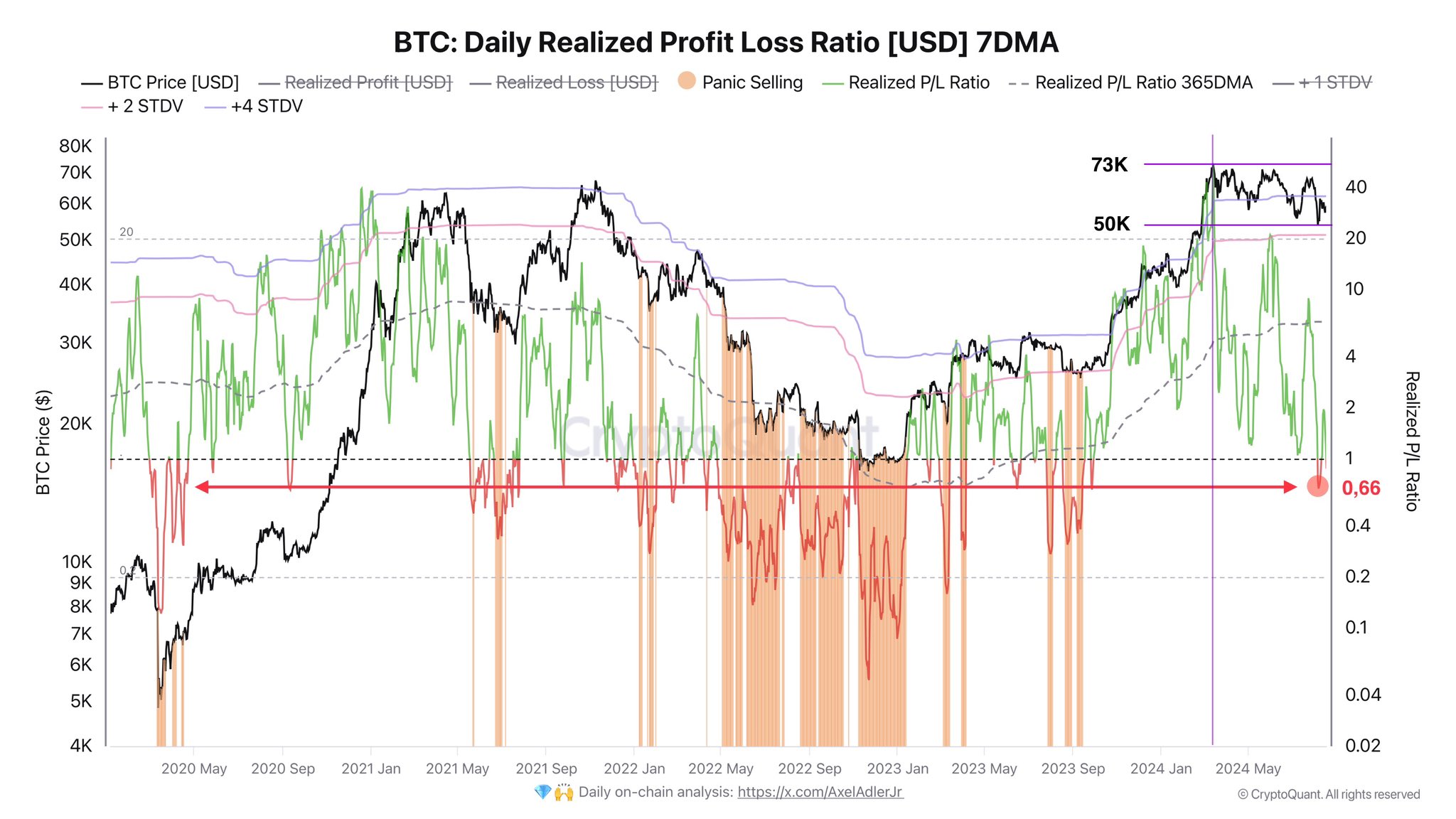

Now, here is a chart that shows the trend in the Bitcoin Daily Realized Profit Loss Ratio over the past few years:

As displayed in the above graph, the Bitcoin Daily Realized Profit Loss Ratio has mostly been above 1 for the past year. Not just that, the indicator has been significantly above the mark for a lot of this time, which suggests profit realization has been quite notable.

The reason behind this is the appreciation the BTC price has enjoyed during this period. From the chart, it’s visible that peak profit-taking coincided with the all-time high (ATH) in March, as would be expected.

Interestingly, profit-taking still massively outweighed the loss-taking in the months that followed the ATH, where BTC price consolidated inside a range. It would appear that this appetite for taking profits has run out recently, a potential result of the sideways trajectory showing no signs of ending.

The ratio has now started to flip the other way, with losses taking center stage. The analyst has noted that such a shift towards loss-taking generally occurs at the end of consolidation periods.

So far, the lowest the ratio has gone is 0.66, which is not too low compared to past loss-taking events. Thus, the capitulation may deepen before Bitcoin can start a fresh rally.

BTC Price

Bitcoin has recently continued to be locked in a sideways trajectory as its price still trades around $58,400.