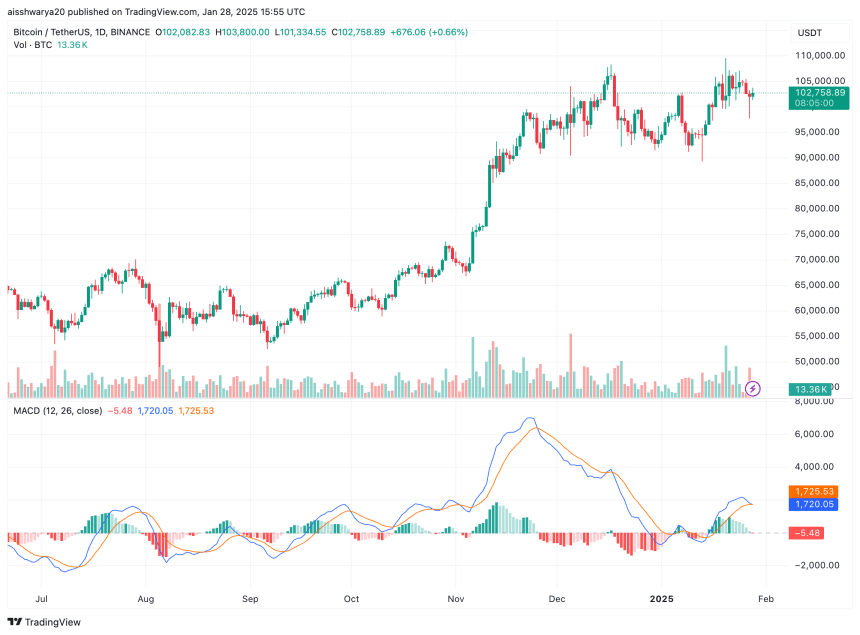

Yesterday, the NASDAQ slid 3% as China’s low-cost AI model, DeepSeek, sent shockwaves through the tech industry, triggering a steep sell-off in US chipmakers. While Bitcoin (BTC) also dipped to a low of $97,777, the flagship cryptocurrency has since recovered most of its losses, trading above the key $100,000 price level.

Bitcoin Holding Strong Despite NASDAQ Sell-Off

Bitcoin’s resiliency amid the stock market sell-off is ‘extremely bullish’, says Bitwise’s European Head of Research, Andre Dragosch. They highlighted that the leading digital asset has outperformed NASDAQ over the past two days and is currently showing limited downside risk.

It is worth noting that BTC has gained close to $5,000 since yesterday’s dip to $97,777, trading at $102,758 at the time of writing. In contrast, the S&P 500 closed yesterday’s last trading session down 1.5%.

The decoupling between BTC and the stock market is further evidenced by differing investor sentiments. According to the ‘Fear & Greed Index’, the stock market currently sits at 44/100, indicating lingering fear among investors after yesterday’s market downturn.

Conversely, the Index’s reading for the crypto market stands at 72/100, suggesting a sentiment of greed toward digital assets. However, this could also indicate that the crypto market is lagging behind the stock market and may experience a further drawdown while the stock market seeks stability.

Meanwhile, Keith Alan, co-founder of Material Indicators, shared a post on X, viewing BTC’s brief slump as a dip-buying opportunity and adding to his BTC position. Alan noted:

That wick to $97,750 should not shake your confidence in this Bitcoin bull run, but it should remind you that a deep correction can, and most likely will, develop when the market gets over hyped.

Similarly, seasoned crypto trader and analyst Rekt Capital shared insights on Bitcoin’s current price momentum, stating that it is “still relatively early” in BTC’s parabolic phase for this market cycle. Historically, this phase has lasted about 300 days on average, and BTC is currently at day 82.

BTC Top Not In Yet?

Although BTC reached a new all-time high (ATH) of $108,786 on January 20, some analysts believe the top is not yet in for the cryptocurrency. According to analysis by Stockmoney Lizards, BTC could reach a cycle peak of $400,000 by November 2025.

A further rally for BTC seems plausible, as ‘whales’ have started accumulating the cryptocurrency since Donald Trump’s inauguration. Other projections suggest BTC may peak at $249,000 under the Trump administration.

On a longer-term horizon, BTC could reach as high as $1.5 million according to Metcalfe’s Law. At press time, BTC trades at $102,758, up 1.1% in the past 24 hours.