Data shows social media users had become overly excited about Bitcoin after the recent rally, which may be why BTC has retraced.

Bitcoin Topped Out As Hype Around The Coin Shot Up

According to data from the analytics firm Santiment, crowd sentiment around BTC has noted a sharp surge recently. The indicator of relevance here is the “Positive vs. Negative Sentiment Ratio,” which keeps track of the difference between the positive and negative comments related to Bitcoin that are being made on social media platforms.

The indicator separates posts related to negative and positive sentiments by putting them through a machine-learning model devised by the analytics firm.

When the value of this metric is greater than 0, it means the social media users are participating in more positive talks than negative ones. On the other hand, it being under this threshold suggests the dominance of bearish sentiment on these platforms.

Now, here is a chart that shows what the Positive vs. Negative Sentiment Ratio’s recent trajectory has been like:

As displayed in the above graph, the Bitcoin Positive vs. Negative Sentiment Ratio had observed a significant surge during the cryptocurrency’s earlier run toward the $66,000 level.

Yesterday, when Santiment shared the post, social media users made 1.8 bullish posts for every 1 bearish post. Thus, the traders had become quite optimistic after the price surge. This, however, may not have been an ideal development for the coin.

Historically, BTC has tended to move in the direction opposite to what the crowd is expecting, with the probability of a contrary move only rising the more lopsided the sentiment gets.

Today, Bitcoin has retraced back under the $64,000 level, a possible indication that the earlier hype that the social media users had shown has backfired, just like it has done many times.

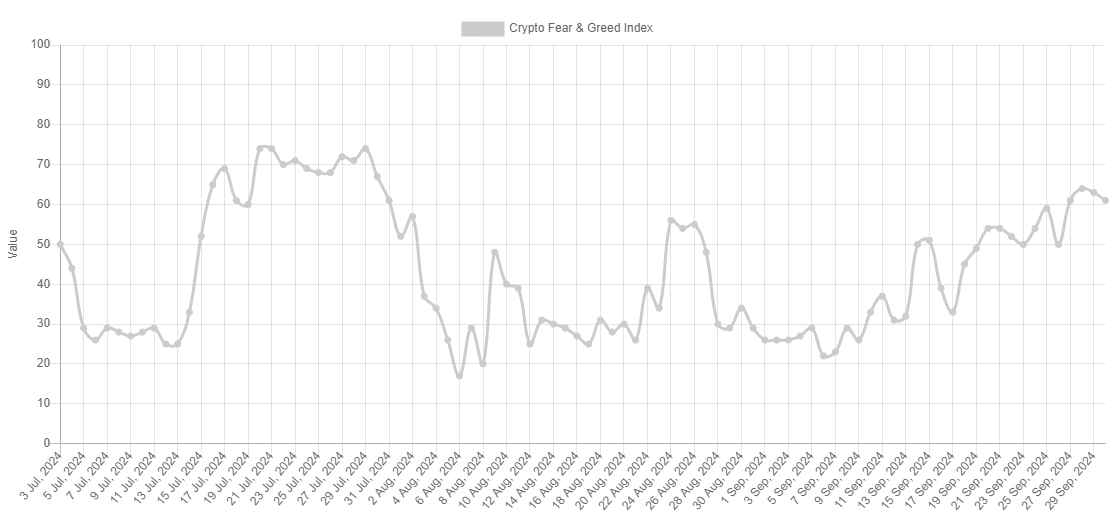

It’s also not just the social media users that have been excited recently, as the Fear & Greed Index, an indicator created by Alternative that considers more factors than just social media, has also been showing a rising optimism in the sector.

The Fear & Greed Index currently sits at a value of 61, which suggests that the investors are leaning towards being bullish around Bitcoin and the cryptocurrency sector in general.

The sentiment-related indicators could follow in the coming days, as they may dictate whether BTC can regain its bullish momentum. The crowd calming down would be a sign in the right direction if history is to go by.

BTC Price

After the latest plunge, Bitcoin has returned to the $63,400 level.