Quick Take

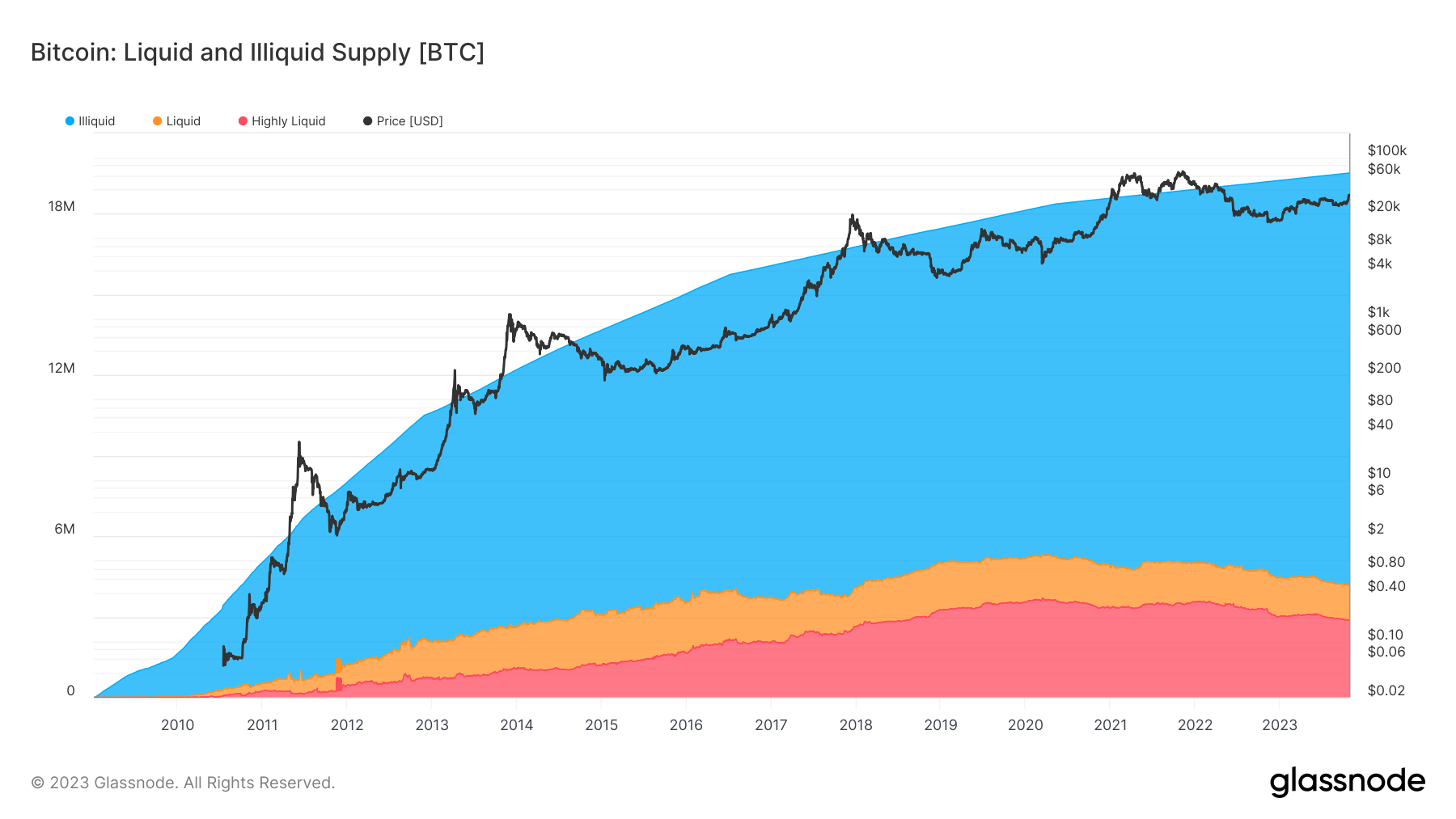

The Bitcoin market is currently witnessing pivotal changes in its liquidity dynamics. With the illiquid supply reaching an all-time high at 15.3 million BTC, representing approximately 78% of the Bitcoin circulating supply, it suggests a growing pool of holders committed to their long-term Bitcoin investments.

Concurrently, the liquid supply has retraced to 2012 levels at 1.3 million BTC. This decreasing trend implies a potential shift in the market’s operating behavior, with more entities transitioning to longer-term holding strategies, thus joining the ranks of the ‘illiquid entities’.

Furthermore, the highly liquid supply has seen a significant reduction over the past three years, down from 3.7 million BTC in March 2020 to the current 2.9 million BTC. This decline may signify a thinning of active traders or entities that rapidly move Bitcoin.

These liquidity dynamics collectively hint at a constriction of Bitcoin’s active supply. The combination of a growing illiquid supply and shrinking liquid and highly liquid supplies can create a ‘short squeeze’ scenario. This occurs when the market’s limited active supply struggles to satisfy trading demand, potentially triggering sharp upward price movements as traders scramble to cover their short positions.

The post Bitcoin illiquid supply hits all-time high reaching 15.3 million BTC appeared first on CryptoSlate.