Data shows the sentiment among the Bitcoin investors has exited the greed territory following the latest crash in the asset below $61,000.

Bitcoin Fear & Greed Index Is Now Sitting Inside The Neutral Region

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment that the traders in the Bitcoin and wider cryptocurrency market share right now.

This index considers the data of five factors to determine this sentiment: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

To represent the sentiment, the indicator uses a scale that runs from zero to a hundred. All values below the 47 mark suggest the presence of fear among the investors, while those above 53 signify greed in the market.

The region is in-between these two zones naturally belongs to the neutral mentality. The Bitcoin Fear & Greed Index appears to be inside this third zone.

As is visible above, the Fear & Greed Index is 51 right now. This is a notable change from the value of 55 seen yesterday, as the market had held a sentiment of greed then.

The worsening sentiment is because cryptocurrency prices have faced strong bearish momentum in the past 24 hours. This drop in the metric is in line with the trend from the past week, as the latest drawdown in the asset is just a continuation of the recent bearish trend.

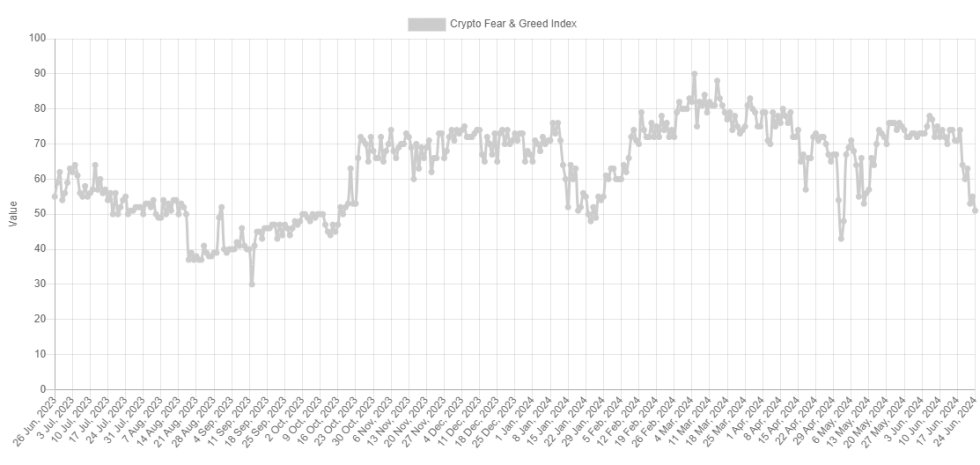

The chart below shows how the Bitcoin Fear & Greed Index has seen its value change during the past year.

As is apparent from the graph, the latest decline in the Bitcoin Fear & Greed Index has been quite sharp. On 18 June, at the start of this plunge, the metric had a value of 74, which was pretty deep into the greed zone.

This value was right on the edge of the “normal” greed region, as above 75, the indicator starts reflecting the presence of “extreme greed” among the investors. Historically, this region has been quite important for the cryptocurrency.

This is because the price of the asset tends to move against the expectations of the majority, and the chances of such a contrary move going up, the stronger this expectation becomes.

In the extreme greed zone, the investors experience euphoria; thus, a top in the asset becomes all the more likely to happen. The all-time high (ATH) in the asset back in March also occurred when the index was inside this region.

While extreme greed can lead to corrections in the asset, “extreme fear,” which takes place under 25, can help the cryptocurrency reach bottoms instead. However, the indicator tends to stay inside or near the greed region during bull markets.

Thus, while the sentiment hasn’t quite worsened into the extreme fear or even the fear zone with the latest plunge, the fact that it has cooled off to neutral could still be an optimistic sign for the coin to reach an end to its decline, assuming a bullish trend remains the dominant force in the long-term.

BTC Price

At the time of writing, Bitcoin is floating around $60,300, down more than 10% over the past week.