In contrast to popular bullish sentiments, Bitcoin began October on a bearish note, recording a price decline of over 7% in the first three days of the month. However, while the BTC market experienced an uptick on Friday as data from the US Labor Department indicated incoming rate cuts, investors have generally retained a cautionary approach.

Bitcoin Fear And Greed Index Touches 37 As Investors Become Uncertain

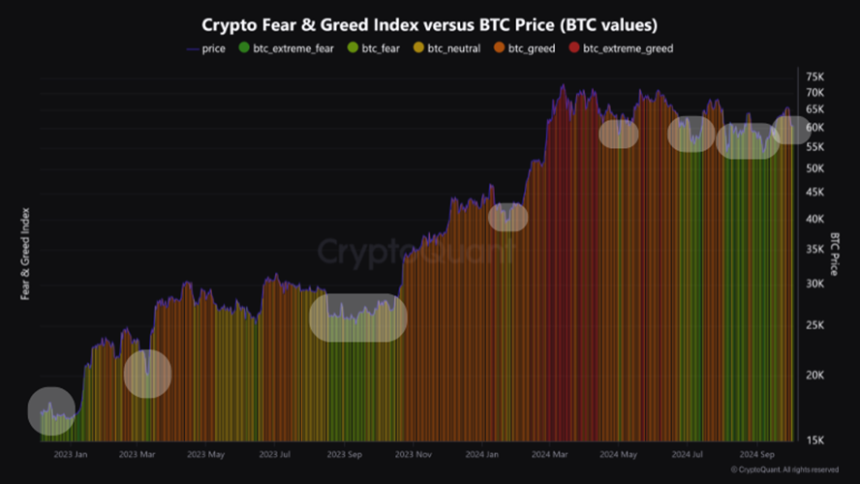

In a Quicktake post on CryptoQuant, an analyst with username maartunn shared that the Bitcoin Fear and Greed Index currently signals fear following the asset’s recent price slump

The Fear and Greed Index generally measures the emotions, moods, and behaviors of the crypto market as well as predicts potential trends based on investor sentiment. The index operates on a 0-100 scale, where values above 50 indicate greed, with anything over 74 representing extreme greed, while values below 50 signal fear, and under 24, extreme fear.

According to maartunn, the Fear and Greed Index is presently at 37, indicating that many investors are cautious about adding the leading cryptocurrency to their portfolio. In particular, the analyst notes that each time the Fear and Greed Index reached the fear level since 2023, Bitcoin’s price has formed a bottom, i.e. reached the lowest point during a price decline, and is set for price reversal.

Notably, Bitcoin already showed an upward movement on Friday after starting October with a price decline. However, it cannot be said that the price bottom has now occurred as Bitcoin’s daily chart shows the asset is still far above its next significant support level following months of consolidation between $55,000 – 70,000.

Although, if the premier cryptocurrency has bottomed out, it could be heading for a price breakout in line with popular expectations for a bullish “uptober”. For context, October has proven to be the most frequent bullish month for Bitcoin resulting in an average gain of 22.90% in the last 11 years.

Related Reading: Bitcoin Price Dip Explained: Key Causes And Where To Expect A Bounce Back To $70,000

Dominant Activity Of Stablecoins Supports Fear And Uncertainty Among Investors

In addition to the Bitcoin Fear and Greed Index of 37, the crypto market has also experienced an increase in market activity of stablecoins namely the Tether USD (USDT) and USD Coin (USDC).

This development indicates that investors are opting for less volatile assets than risky coins such as Bitcoin, which is often due to uncertainty and fear of impending price crash. CryptoQuant analyst BaroVirtual has attributed this fear to several factors including weak retail market participation, rising geopolitical tensions in the Middle East, as well as the SEC’s hesitation to launch a Spot Ethereum ETF Options.

At the time of writing, Bitcoin continues to exchange hands at 62,071 following a 2.17% gain in the last day. Meanwhile, the token’s daily trading volume is down 17.91% and valued at $29.71 billion.