The post Bitcoin Leverage Trading Hits New Highs: Is a Volatility Storm Coming? appeared first on Coinpedia Fintech News

The leverage usage on cryptocurrency exchanges has seen a significant rise lately, indicating that the number of traders willing to take high-risk bets has increased. The trend has been brought into discussion by a recent post from Ali, a crypto expert, on the X platform. What are the key implications of this trend? Here is everything you should know!

Leverage Usage on the Rise Across Crypto Exchanges

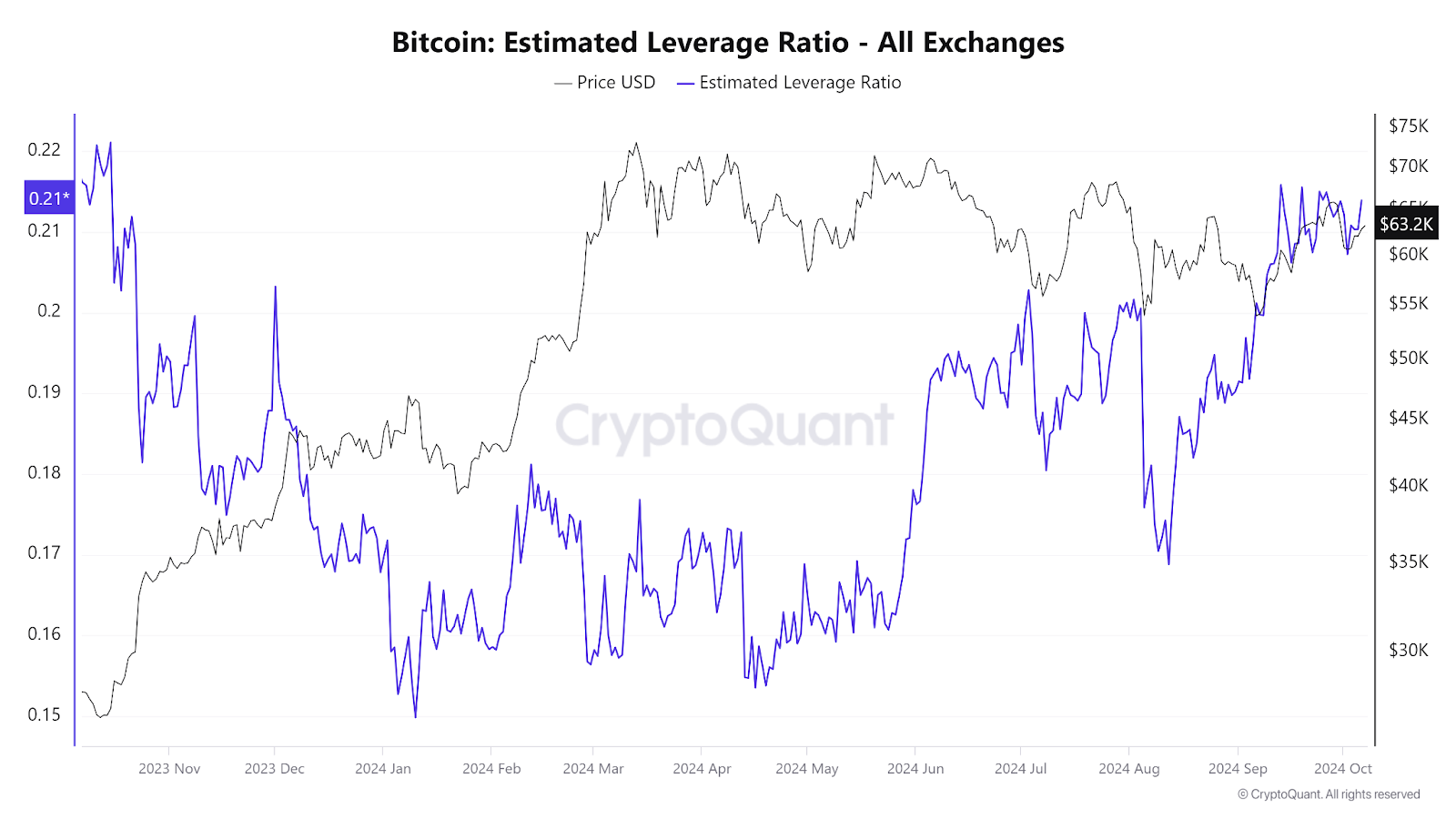

\Ali’s post showcases the Bitcoin Estimated Leverage Ratio – All Exchanges chart as a reference. Looking at the chart, it is clear that leverage usage on crypto exchanges has witnessed a sharp increase. The chart shows that on January 10, the Estimated Leverage ratio was just 0.1498. It climbed to 0.1811 on February 12. In mid-March, when the BTC price touched an all-time high, the ratio was around 0.1768. Between May 24 and June 11, a sharp increase in the ratio was observed.

On June 11, it reached a peak of 0.19. It further moved upward to 0.20 on July 3. However, it slipped back to a low of 0.16 on August 12. But between August 12 and September 13, once again the ratio experienced a sharp rise. This time, it peaked at 0.2158. Since then, the ratio has been mostly oscillating between 0.21 and 0.20. Currently, the Estimated Leverage ratio stands at 0.21.

High-Risk Bets Increasing as Traders Dive Into Leverage

What the chart indicates is simple: at this point of the year more investors are engaging in Bitcoin trades with borrowed funds.

Trading with borrowed funds can be highly lucrative, but it is also extremely risky.

Generally, traders tend to show the courage to enter a market with borrowed money when they are fully confident about the market’s future prospects.

What Does This Mean for the Crypto Market?

This trend could increase the risk of volatility in the crypto market, particularly in the Bitcoin market. As more traders use borrowed funds, price swings are likely to become extreme.

In conclusion, although the surge in leverage trading suggests that more investors are confident about the future of BTC, it may also expose the market to heightened volatility.

Stay tuned to Coinpedia for more updates!

This signals a surge in high-risk bets as more investors dive into leveraged trades!

This signals a surge in high-risk bets as more investors dive into leveraged trades!