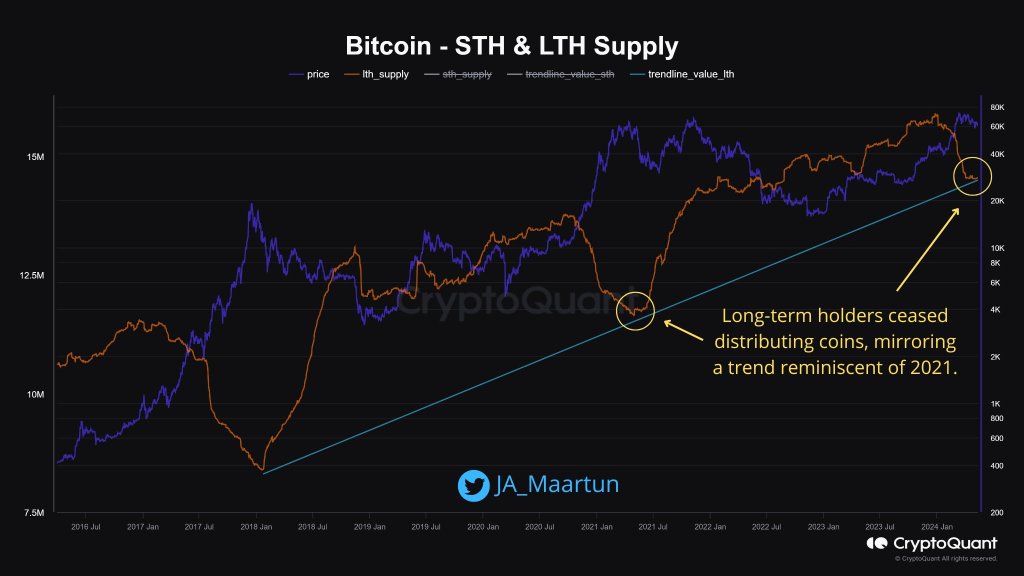

Bitcoin is moving sideways, posting drab price action, forcing participation to taper. But amid this consolidation and even fear of more losses, one analyst has shared data suggesting that long-term holders are accumulating at spot rates.

Are We Back To 2021? Bitcoin Long-Term Holders Accumulating

In a post on X, the analyst noted that this re-accumulating pace is picking up momentum, mirroring a welcomed trend that preceded the impressive 2021 bull run.

Therefore, if long-term holders, or HODLers, accumulate, the probability of BTC rallying in the sessions ahead is elevated. Thus far, BTC has been trending above $60,000, up 10% from the May 2024 lows.

For clarity, the data shared by the analyst uses Unspent Transaction Outputs (UTXOs) to classify long-term and short-term holders. Analyzing the age of UTXOs makes it easier to gauge the behavior of different investor groups.

Usually, UTXOs older than 155 days have “diamond hands” or long-term holders. Meanwhile, those who hold BTC for less than 155 days are short-term holders or often classified as “weak” hands.

They are usually traders or speculators interested in riding on price volatility, like in the first half of Q1 2024.

When long-term holders stopped distributing BTC in 2021, prices rose sharply. By November 2021, the coin had peaked at around $70,000, lifting prices by nearly 1,500% from 2020 lows. It is unclear if BTC is ready for another 15X surge from spot rates, a move that would propel it to over $700,000.

BTC Has Strong Support At $60,000, Analyst Urges Patience

While the on-chain data paints a bullish picture, some analysts advocate caution. Taking to X, one analyst notes that Bitcoin has strong support at around the psychological $60,000 mark. The coin could stabilize if bulls soak in selling pressure and reject attempts for lower lows.

However, if prices dump below $60,000, triggered by a news event, BTC may fall to as low as the $52,000 to $55,000 zone.

Despite the potential for short-term volatility, the analyst encourages investors to maintain a long-term perspective. Accumulating Bitcoin at these levels and exercising patience could be a winning strategy, the analyst says.

This preview would be especially true now that on-chain data shows that long-term holders are accumulating.

Before then, traders should watch price action. The coin is moving sideways, finding rejection at $66,000. Even though prices are lower, the last day’s series of higher highs is encouraging and might spark demand.