An analyst has warned that support levels weaken the more they are retested and Bitcoin is now doing a third consecutive retest of a major such level.

Bitcoin Is Again Retesting The Short-Term Holder Realized Price

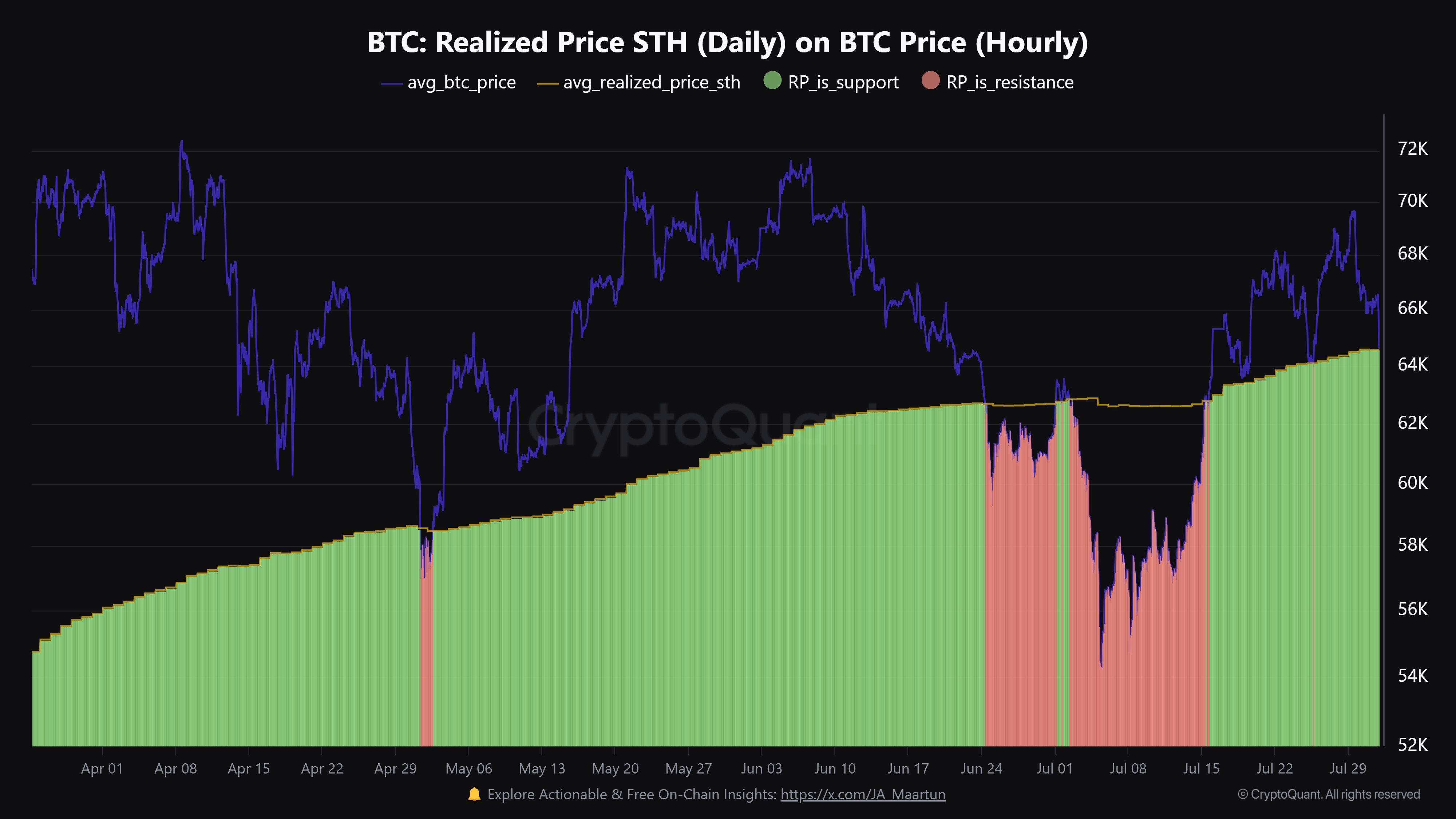

As explained by CryptoQuant community manager Maartunn in a new post on X, BTC’s latest drawdown has led to it doing another retest of the short-term holder Realized Price. The “Realized Price” here refers to an indicator that, in short, keeps track of the average cost basis of the investors or addresses on the Bitcoin network.

When the value of this metric is greater than the spot price of the cryptocurrency, it means the average investor in the market could be assumed to be holding a net unrealized profit. On the other hand, the indicator being below the asset’s value suggests the dominance of losses on the blockchain.

In the context of the current topic, the Realized Price of the entire userbase isn’t of interest, but that of a specific segment of it: the short-term holders (STHs). The STHs include all the investors who bought their coins within the past 155 days.

Now, here is a chart that shows the trend in the Bitcoin Realized Price for the STHs over the last few months:

As displayed in the above graph, the Bitcoin spot price had slipped under the STH Realized Price in June, but it finally managed to break above the line halfway through last month.

In the weeks since the asset has seen a couple of pullbacks back to the line, but it has managed to find rebounds each time. Now, after the latest decline, the coin’s price is once again retesting the level.

Historically, the STH Realized Price has been a reliable point of support for the cryptocurrency during bullish periods. The explanation behind this pattern may lie in how investor psychology works.

The STHs represent the fickle-minded side of the sector, who are sensitive to change. As such, whenever the price retests their cost basis, they may be prone to making panic moves.

In times when the atmosphere in the market is bullish, the STHs may believe such a retest to merely be a dip opportunity, so they could decide to accumulate more. This could be why Bitcoin has found rebounds at the level in the past.

While the level has generally been reliable indeed, this latest retest that BTC is facing is already the third within a narrow period. “Each time a level is tested, it becomes weaker,” notes Maartunn.

It now remains to be seen if the Bitcoin STHs still carry a bullish outlook on the cryptocurrency or if the constant pullbacks have put fear on their minds.

BTC Price

Bitcoin has continued its recent bearish momentum in the past 24 hours as its price has slid another 2% to reach the $64,700 level.