Quick Take

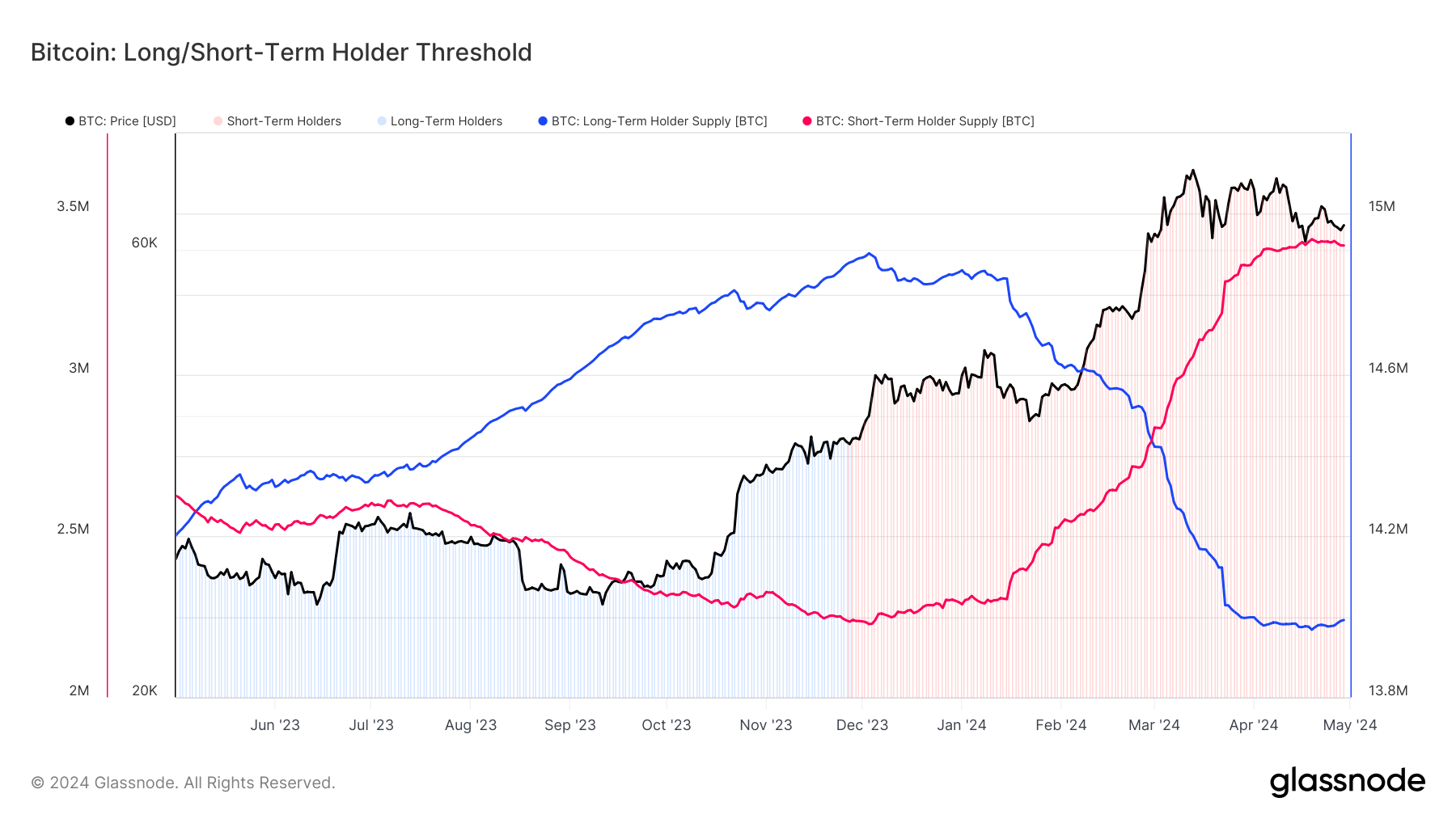

While Bitcoin currently trades approximately 20% below its all-time high, the more compelling narrative unfolds within the dynamic flow of coins between short-term holders (STHs) and long-term holders (LTHs)

LTHs, holding Bitcoin for over 155 days, typically accumulate during bear markets and distribute during bulls. Their supply peaked at 14.9 million BTC in December 2023 before dropping to 13.9 million in April 2024. This 1 million BTC reduction was driven by the Grayscale Bitcoin Trust ETF (GBTC) selling over 320,000 coins and LTHs taking profits or losses on the remaining two-thirds.

Conversely, STHs, holding for under 155 days, tend to buy during bullish euphoria. Their supply surged from 2.2 million to 3.4 million BTC, absorbing the LTH distribution plus an additional 200,000 coins.

A pivotal moment looms on June 15, marking 155 days since Bitcoin’s ETF launch. We can expect LTH supply to climb until then as the new cohort of STH buyers transitions to LTH status. Given the price where it is, it’s likely that STHs will exert selling pressure.

The post Bitcoin market absorbs 1 million BTC in 5 months appeared first on CryptoSlate.