Bitcoin is holding firm above the $82,000 level, showing resilience after weeks of volatility. However, the bulls have so far failed to reclaim the critical $88,000 resistance zone, and price action remains indecisive. With no major macroeconomic catalyst in sight, financial markets are caught in a holding pattern, awaiting clarity before committing to a new trend.

Some analysts are warning that Bitcoin could continue its recent downtrend, as global economic conditions remain weak. Trade tensions between the U.S. and China, persistent inflation risks, and fragile investor sentiment are all weighing on broader market activity — including crypto.

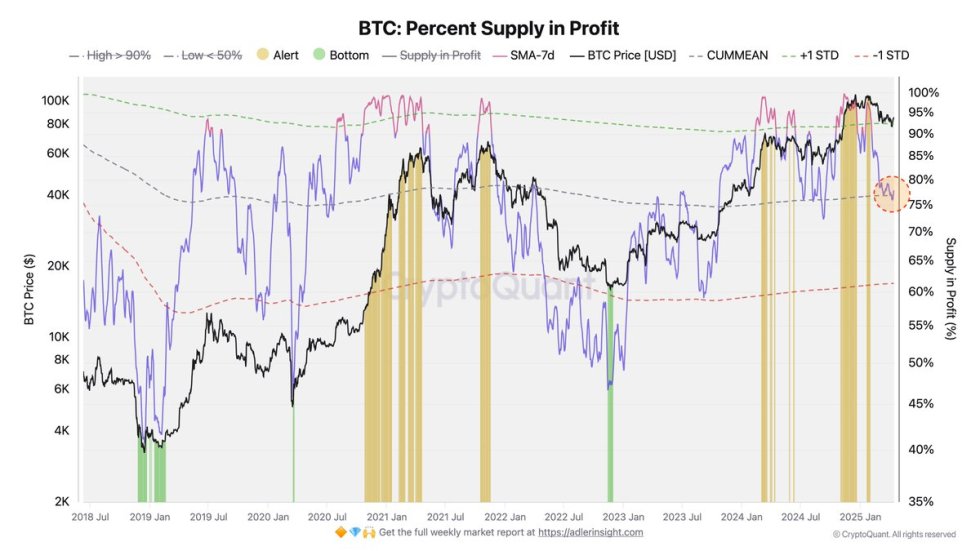

According to CryptoQuant data, the Percent Supply in Profit metric shows that approximately 80% of the Bitcoin supply remains profitable, while 20% is currently at a loss. Historically, when this metric rises to 95–98%, the market enters overheated territory, often triggering large-scale profit-taking. The current balance reflects a cooling market, but not yet in full capitulation.

Until Bitcoin breaks above $88K or loses support near $81K-$80K level, traders may continue to see sideways price movement and uncertain momentum in the days ahead.

Bitcoin Holds Firm Amid Trade Tensions

Bitcoin continues to show resilience above the $82K level, but risks remain elevated as global macroeconomic headwinds intensify. Tensions between the United States and China are reshaping global trade expectations, and uncertainty over tariffs and foreign policy continues to weigh heavily on financial markets.

While inflation is gradually declining, the fragility of the US stock market may soon push the Federal Reserve to pivot toward interest rate cuts to avoid an economic downturn. Still, that scenario could take time to develop, and geopolitical dynamics are evolving quickly.

In the meantime, on-chain data suggests Bitcoin’s current market structure may be entering a transitional phase. Top analyst Axel Adler pointed to CryptoQuant metrics and referenced the Pareto Principle — which posits that 20% of causes typically generate 80% of results — to illustrate current market sentiment. At present, 20% of the Bitcoin supply is at an unrealized loss, while 80% remains profitable.

Historically, when the share of coins in profit exceeded 95–98%, markets became overheated and significant profit-taking followed, as shown by the yellow bars in Adler’s chart. After Bitcoin’s all-time high earlier this year, the market cooled and the metric returned to its average range, signaling consolidation rather than capitulation.

BTC Price Faces Resistance Amid Bearish Pressure

Bitcoin is currently trading at $83,600 after failing to reclaim the 200-day exponential moving average (EMA) near the $85,000 mark. This key technical rejection signals growing bearish strength, as bulls struggle to build momentum for a clear breakout. Despite last week’s bullish attempt to climb above resistance, the market remains stuck within a wide consolidation range, and sentiment continues to shift cautiously.

For now, the $81,000 support level stands as the most important line of defense. Holding above this zone is essential to sustain the current consolidation structure and avoid a renewed push toward lower levels. If this support breaks, Bitcoin could be exposed to a deeper correction, potentially revisiting the $75,000 range.

On the upside, reclaiming the $85K level and closing firmly above it would be the first step toward a bullish reversal. However, the real confirmation of strength would require a breakout above the $90,000 mark — a level that would indicate renewed buyer conviction and invalidate the recent downtrend.

Until then, Bitcoin remains in a neutral-to-bearish zone, with both macroeconomic uncertainty and technical resistance keeping bulls on the defensive.

Featured image from Dall-E, chart from TradingView