Lately, the Bitcoin market has been seeing some notable adjustments in its price and key metrics even as volatility continues to overshadow the broader crypto market. With positive developments emerging in the market, bullish momentum appears to be building as the price reclaims the $85,000 mark again.

CME Open Interest Decline Hints At Consolidation Phase

Bitcoin’s price is gaining traction due to growing bullish sentiment in the market. Prior to the renewed price shift toward the upside, BTC’s CME Open Interest has declined significantly in the past few months, indicating a slowdown in institutional trading activity.

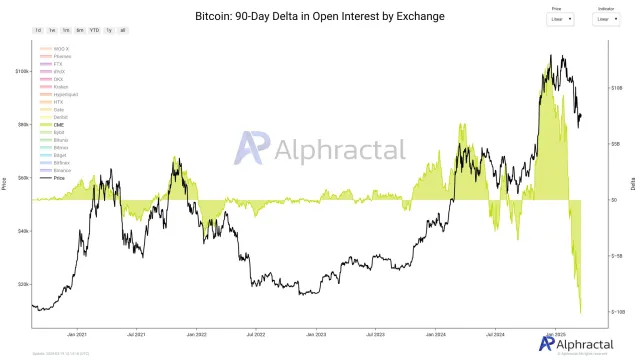

Alphractal, an advanced investment and on-chain data platform highlighted that the recent drop in open interest is the largest that flagship asset has ever seen. This substantial decline indicates that traders may be adopting a cautious approach in light of ongoing market uncertainties and price fluctuations.

A fall in open interest typically implies a shift in behavior, with some investors abandoning holdings. The development coincides with a renewed upward move, signaling that the market might be cooling off after a prolonged bearish performance.

After examining the Bitcoin Open Interest Delta metric in the 90-day time frame, the platform noted that the drop is valued at around $10 billion. Such a notable value reflects the huge positions closed by institutional investors over the 3-month period.

While the 90-day Open Interest Delta reveals a sharp drop, the 30-day Open Interest Delta seems to have stopped its descent. Furthermore, the Open Interest Delta in the 7-day time frame is now transitioning into positive territory.

In other words, the BTC CME data is still pessimistic in the medium term, while positions seem to be entering a consolidation phase in the short term. In this scenario, selling pressure is likely to reduce in the short term even though it is still present in the overall view.

Thus far investors are monitoring the trend’s influence on BTC as prices move to challenge key resistance levels. This is because the market’s reaction to this drop in open interest could pave the way for Bitcoin’s next major move.

New BTC Whales Are Entering The Market

Recent data shows that new Bitcoin whales are entering the market in spite of the drop in open interest. Market expert Onchained revealed that wallet addresses holding at least 1,000 BTC are aggressively accumulating more coins, which signals strong confidence in its long-term prospects. This persistent buying reflects a rising demand for the asset among institutional and high-net-worth players.

Over time, these holders have established themselves as some of the most significant players in the market with a total of 1 million BTC acquired since November 2024. Their accumulation rate has significantly increased as the whales purchased 200,000 BTC this month alone in recent weeks.