Bitcoin bears have gained control over the last few weeks, at least in the short term, and the battle seems to be on. After Bitcoin failed again at the $30,000 level on Sunday as part of a “weekend pump,” the bears are pushing towards $27,000.

As of press time, Bitcoin was hovering around $28,000, having already tested key support at $27,800 yesterday evening (EST). The long-term trend continues to be clearly in favor of the Bitcoin bulls, for which a price above $25,000 speaks. However, in the short term, the key is to defend the $27,800 level to avoid a deeper correction to $25,000, as also indicated by analyst XO.

$BTC pic.twitter.com/OKS791fYEi

— XO (@Trader_XO) May 1, 2023

Bitcoin Remains In Trading Range

For technical analyst Michaël van de Poppe, founder of Eight Global, breaking through $28,400 on the shorter time frame is the trend-setting price level. “Breaking through $28.4K and we could be back to $30K in a few days. Not breaking and folding coming days, $25K next. Big volatility on the horizon,” the analyst warns.

However, the current weakness that Bitcoin is displaying with hovering around $28,000 could be an indication that another sweep of the lows is needed to generate new upside momentum. “Still eyeing $27.8K for a potential long here, or a break and flip of $28.4 for Bitcoin,” van de Poppe notes.

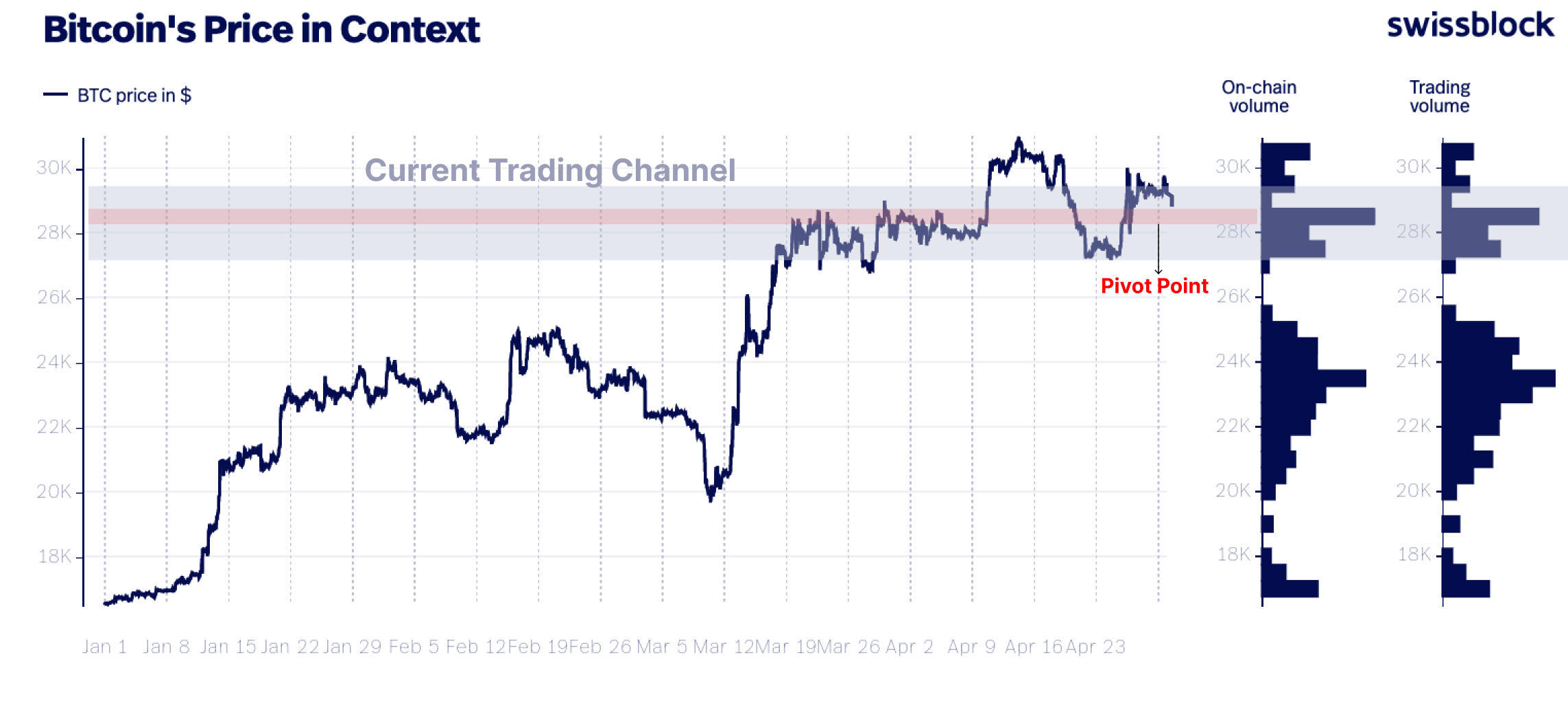

Glassnode co-founders Yann Allemann and Jan Happel write in their latest analysis that Bitcoin’s April monthly close was a major sign for the bulls. BTC closed in green for the fourth consecutive month. According to the analysts, the short-term trading channel is between $27,000 – $29,200.

[B]ut we are confident that we will be over $30k in no time. Our thesis solidifies the longer we’re above the highly active $28 – $28.2k level. Notice the large horizontal bar.

All Eyes On The Fed

Key to the price action in the coming weeks may be the FOMC meeting tomorrow, Wednesday, and the subsequent press conference by Fed Chairman Jerome Powell. The market expects a final hike of 25 basis points. This will put the U.S. benchmark interest rate at the same level as before the financial crisis in 2007.

However, the decision is likely to be priced in already. More important will be the FOMC press conference at 2:30 pm EST, when Powell will give his remarks for the coming months.

The market will be hoping for a comment from Powell that this was the last rate hike and that the first rate cuts will come later this year (very unlikely). The focus will also be on Powell’s comments on the banking crisis and how the credit crunch is intensifying.

Most likely, Powell will play both sides, as he did at the March FOMC meeting. Comments such as “inflation is not quite where we want it to be,” “monitoring developments in the banking sector,” and “data dependence” are virtually guaranteed. On the bullish side, Powell could signal a pause in June and leave a door open for rate hikes if data grants it.

Lol … volatile day coming tomorrow, and perhaps a decisive trend setter for the coming weeks. The start of a new #Bitcoin rally? https://t.co/Dd8FWOjsDa

— Jake Simmons (@realJakeSimmons) May 2, 2023

At the time of writing, Bitcoin was trading at $28,100, below the mid-range after rejecting at the range high again. Until the FOMC decision, it seems rather unlikely that BTC will make a major move unless there is another short or long squeeze due to the madness in the futures market. A recapture of the upper range would be a bullish sign going into the FOMC.