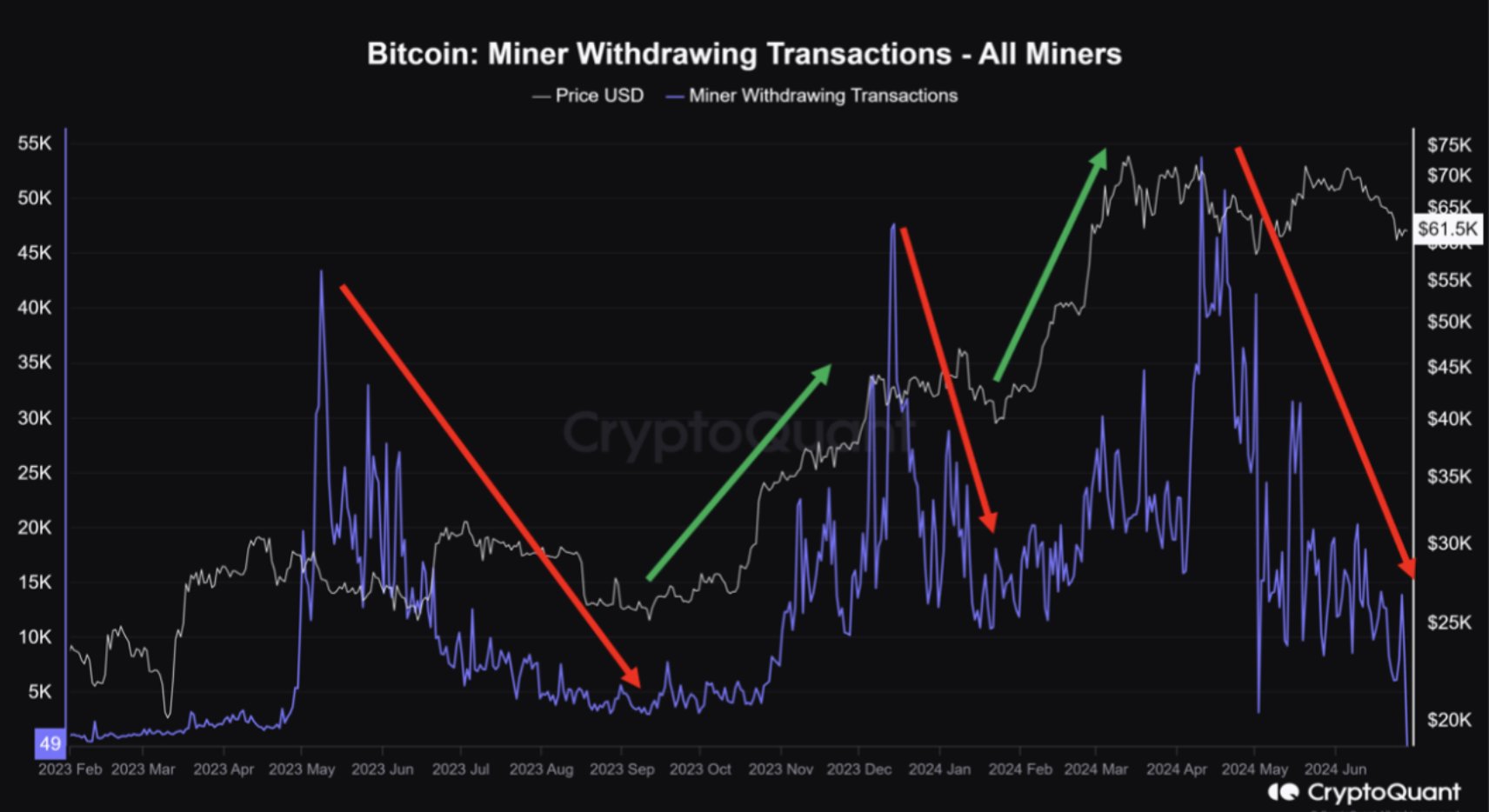

In an analysis provided by CryptoQuant, a significant change in Bitcoin miner behavior has been noted, potentially indicating a turning point. CryptoQuant analyst, known as Crypto Dan, outlined a reduction in miners’ selling pressure, which has historically been a pivotal factor affecting Bitcoin’s price trajectory.

Bitcoin Mining Selling Pressure Decreases

According to Crypto Dan, “Miners’ selling pressure decreases. One of the whales that have caused the cryptocurrency market to fall recently have been miners.” He explained that the BTC halving, which halved mining rewards, led to a decrease in the use of older, less efficient mining rigs, subsequently reducing overall mining activity. This change forced miners to sell Bitcoin in over-the-counter (OTC) transactions to sustain their operations.

The analysis suggests that the market is currently absorbing the sell-off, with a notable decline in the volume and frequency of Bitcoin being transferred out of miners’ wallets. “The current market can be seen as being in the process of digesting this sell-off, and fortunately, the quantity and number of Bitcoins miners are sending out of their wallets has been rapidly decreasing recently,” Crypto Dan stated.

The implications of this shift are significant. Crypto Dan added, “In other words, the selling pressure of miners is weakening, and if all of their selling volume is absorbed, a situation may be created where the upward rally can continue again.” He projected optimism for the market, predicting positive movements in the third quarter of 2024.

Historical data from CryptoQuant corroborates the analysis. BTC has previously shown a similar pattern where miner selling activity exerted a strong influence on market prices, particularly noted from May to September 2023 and from December 2023 to January 2024. During these periods, prolonged sideways movement in BTC prices was observed, aligning with peaks in miner selling. Notably, when these selling activities diminished, Bitcoin prices resumed an upward trend.

This pattern suggests that the recent decrease in miner selling could be the precursor to another significant bullish phase for Bitcoin, as market conditions appear ripe for a similar reversal of fortunes.

Key Price Level For A Bullish Breakout

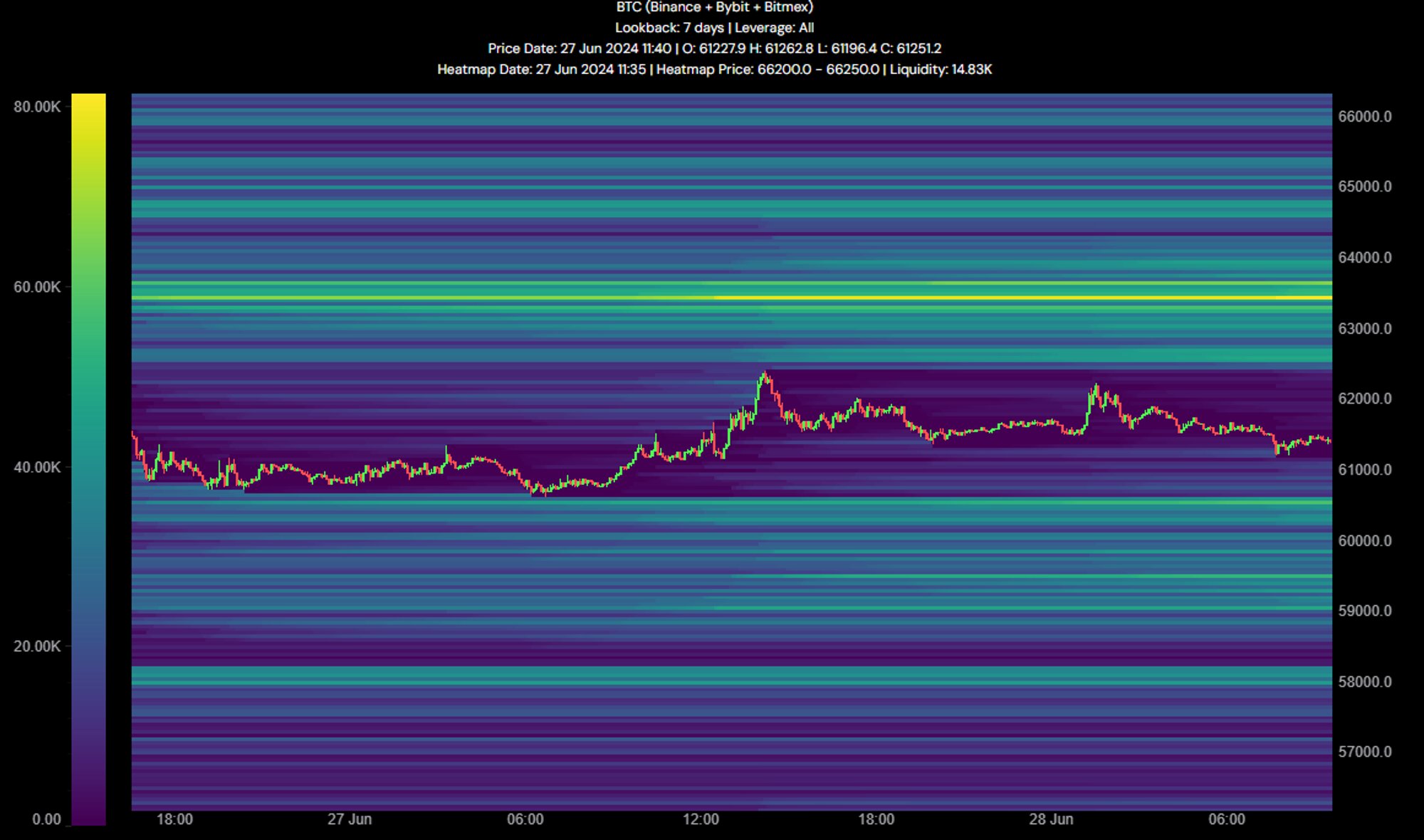

Further insights from technical analysts at alpha dōjō provide a granular view of the market conditions. Their daily update on Bitcoin through X underscores the current market indecision, characterized by Bitcoin “chopping around” without clear directional movement. However, the analysts have identified critical price levels which could indicate future market movements: “If BTC reclaims the $63.5k area, it would be bullish; if it loses the $60k level, it would be bearish.”

The technical analysis also reveals that the liquidity in the Bitcoin market is currently dispersed, with few substantial clusters of orders. The most notable concentration of orders is around the $63.5k level, suggesting that this price point is pivotal for market sentiment and potential bullish momentum.

The order book data provided by alpha dōjō highlights a current dominance of sell orders, indicating a bearish sentiment among traders. Conversely, the bid side is described as weak, with fewer buy orders supporting upward price movements. This imbalance suggests that the market is currently cautious, potentially awaiting more definitive signals before committing to more substantial positions.

At press time, BTC traded at $61,704.