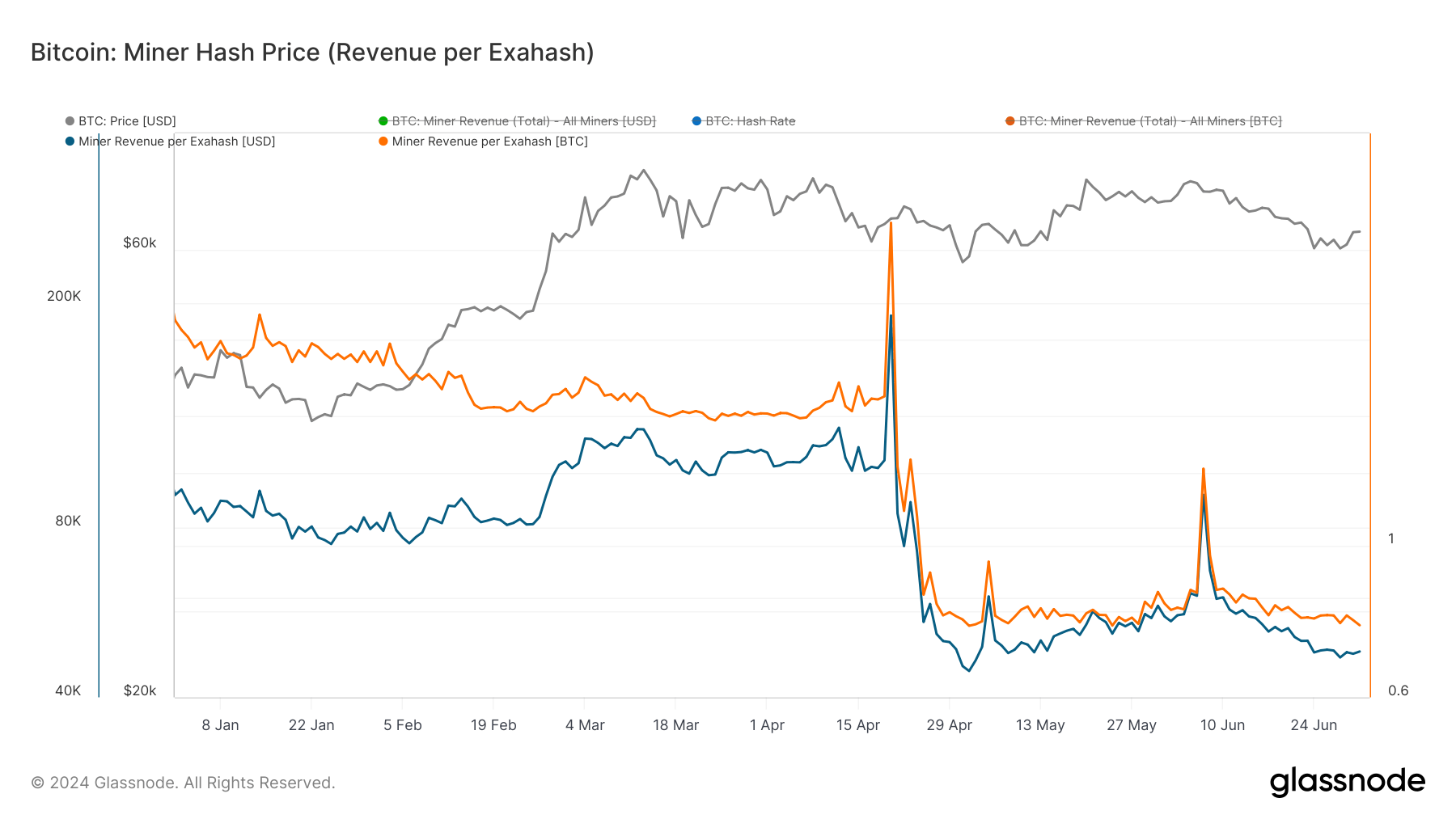

Miner revenue per exahash measures miners’ daily income relative to their contribution to the network’s hash rate, showing how much miners earn per unit of computational power they contribute. This metric is important because it reflects the profitability and economic viability of Bitcoin mining, directly influencing decisions on resource allocation, investment, and operational strategies. Given the size of the Bitcoin mining sector and the performance of public mining companies, these metrics become even more significant.

Since Bitcoin’s fourth halving on April 20, miner revenue per exahash has declined steeply. While this decline was anticipated and miners have been preparing for it, it caused significant economic pressure for miners. Initially, on April 20, the miner revenue per exahash was $190,620 or 2.96 BTC. However, by May 2, it had plummeted to an all-time low of $44,538 or 0.76 BTC.

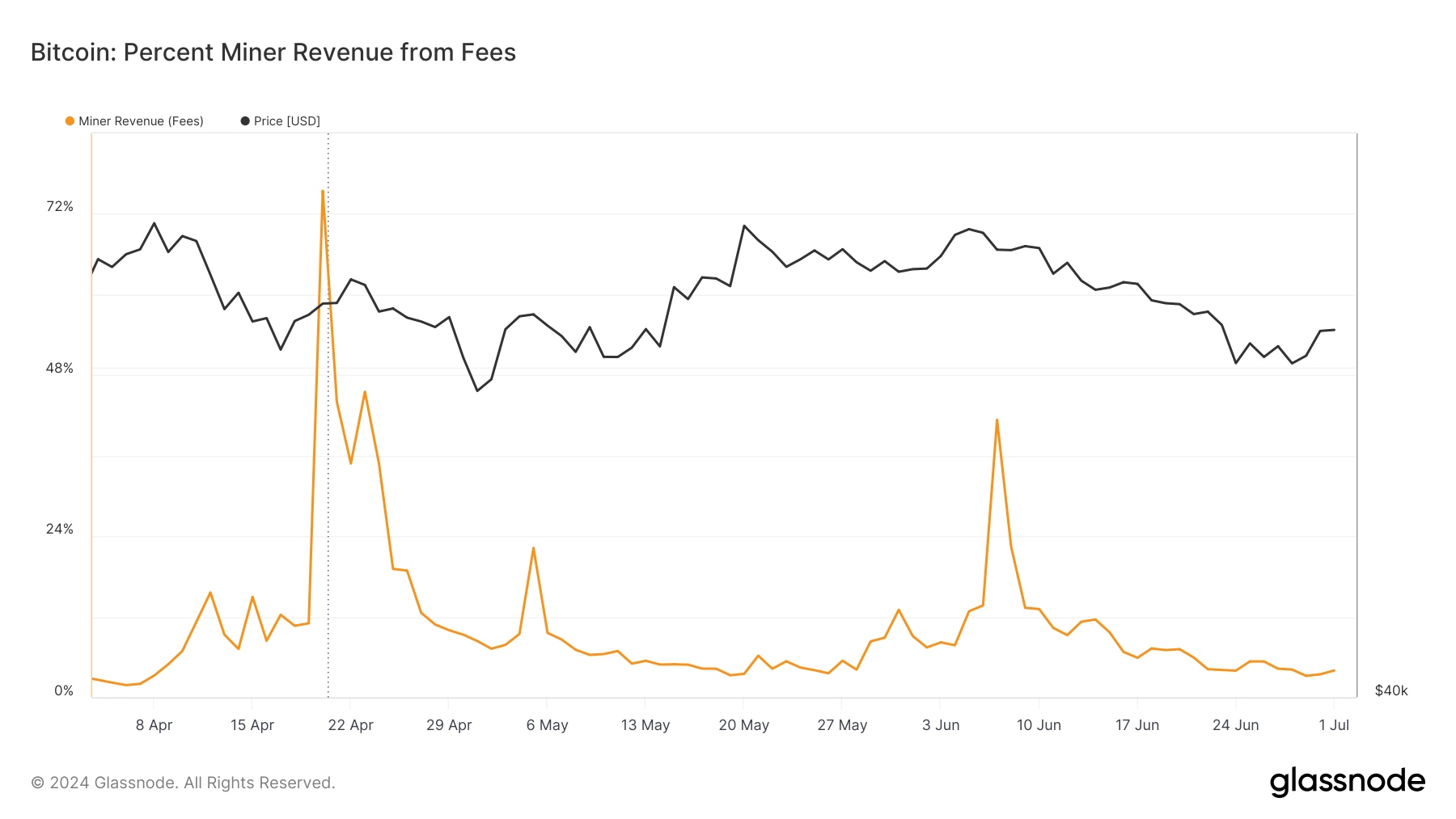

Glassnode’s data showed a brief revenue recovery peaking on June 7 with $91,774 or 1.29 BTC per exahash. This temporary increase was driven by a significant surge in transaction fees due to network congestion, with fees comprising 41.335% of miner revenue on that day, a substantial rise from just 7% three days earlier. This peak shows the occasional spikes in miner revenue due to network activity and highlights the importance of transaction fees as a supplementary income stream for miners, significantly when block rewards diminish.

As of July 1, miner revenue per exahash stands at $48,230 or 0.76 BTC, indicating a lower stabilization level than pre-halving figures. This prolonged period of reduced revenue poses challenges for miners, particularly those with higher operational costs or less efficient hardware.

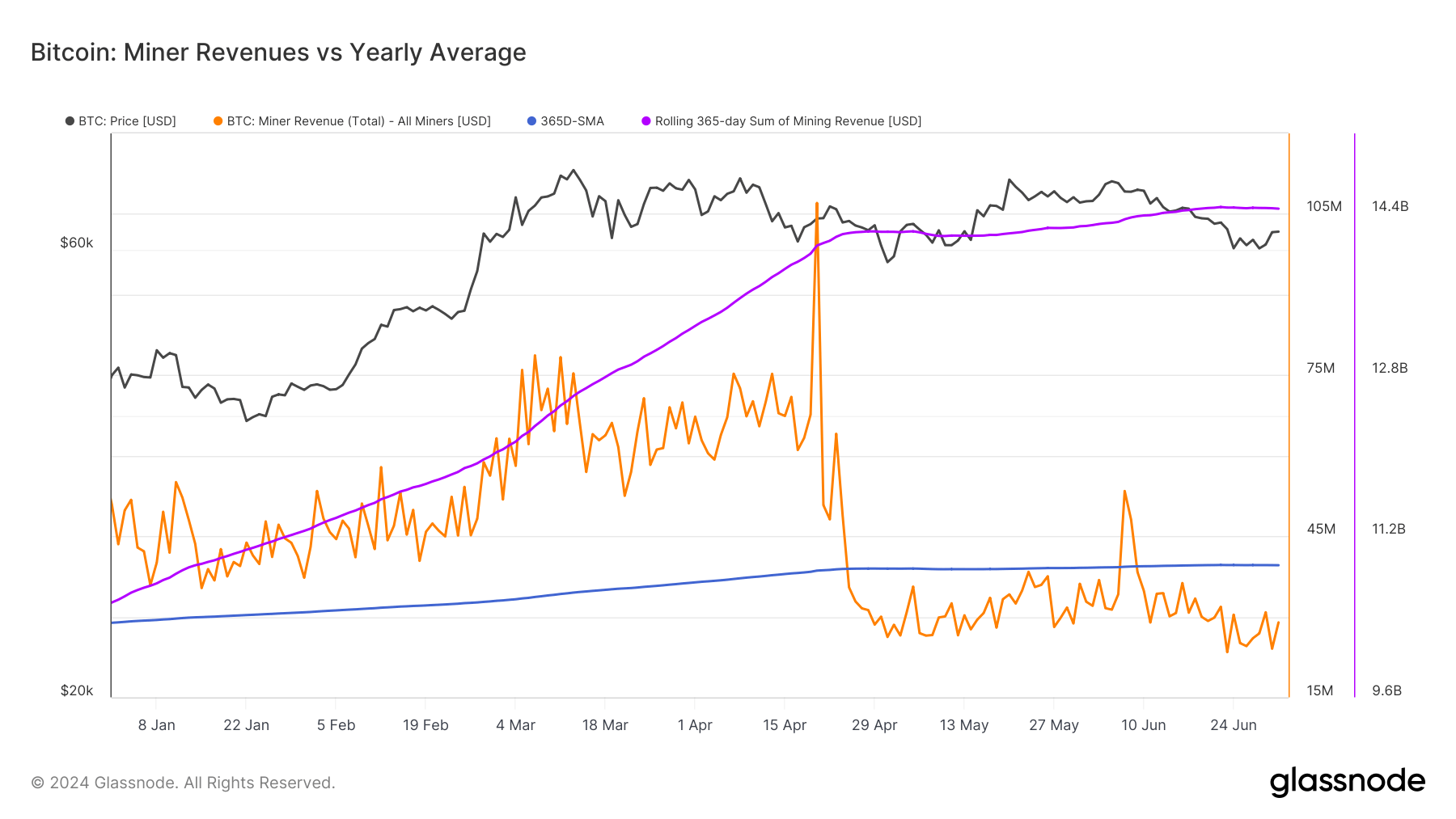

In comparing miner revenue against the yearly average, we see that total daily USD revenue paid to Bitcoin miners has remained below the 365-day simple moving average since April 25, except for the spike on June 7. This significant trend marks a departure from the previous 15 months, where miner revenue generally exceeded the yearly average. Sustained revenue below the annual average suggests a period of reduced profitability for miners, which could lead to broader implications for the mining industry and the Bitcoin network.

The drop in revenue relative to the yearly average highlights increased volatility and the potential for financial strain on miners. In response to these economic pressures, Bitcoin miners have been undertaking various strategies to mitigate the impact of reduced revenues. CleanSpark’s acquisition of GRIID Infrastructure for $155 million shows companies are consolidating to leverage economies of scale. Bitdeer’s announcement of a 570 MW expansion in Ohio demonstrates the same strategic approach: increasing operational capacity to enhance overall output and mitigate the effects of lower revenue per unit of hash power.

Marathon’s diversification into mining altcoins like Kaspa is another example of miners seeking alternative revenue streams. By not solely relying on Bitcoin, Marathon Digital is hedging against Bitcoin-specific market risks and broadening its revenue base. Core Scientific signed a $3.5 billion deal with CoreWeave to diversify beyond Bitcoin mining into AI-related activities, showcasing another shift in strategy.

The marginal drop in Bitcoin mining difficulty shows that several miners find it challenging to remain operational. This difficulty adjustment could help rebalance the network, allowing remaining miners to benefit from slightly reduced competition and potentially higher revenues if the Bitcoin price or transaction fees increase.

However, the confidence in the mining sector only seems to grow. US-listed Bitcoin miners saw a massive surge in stock price over the past week, reaching a record market capitalization of $22.8 billion. This indicates investors are optimistic about the long-term prospects of Bitcoin mining companies, likely due to their strategic adaptations and the potential for future revenue growth as network congestion and transaction fees fluctuate.

The post Bitcoin miners diversify and consolidate to survive revenue drop appeared first on CryptoSlate.