Quick Take

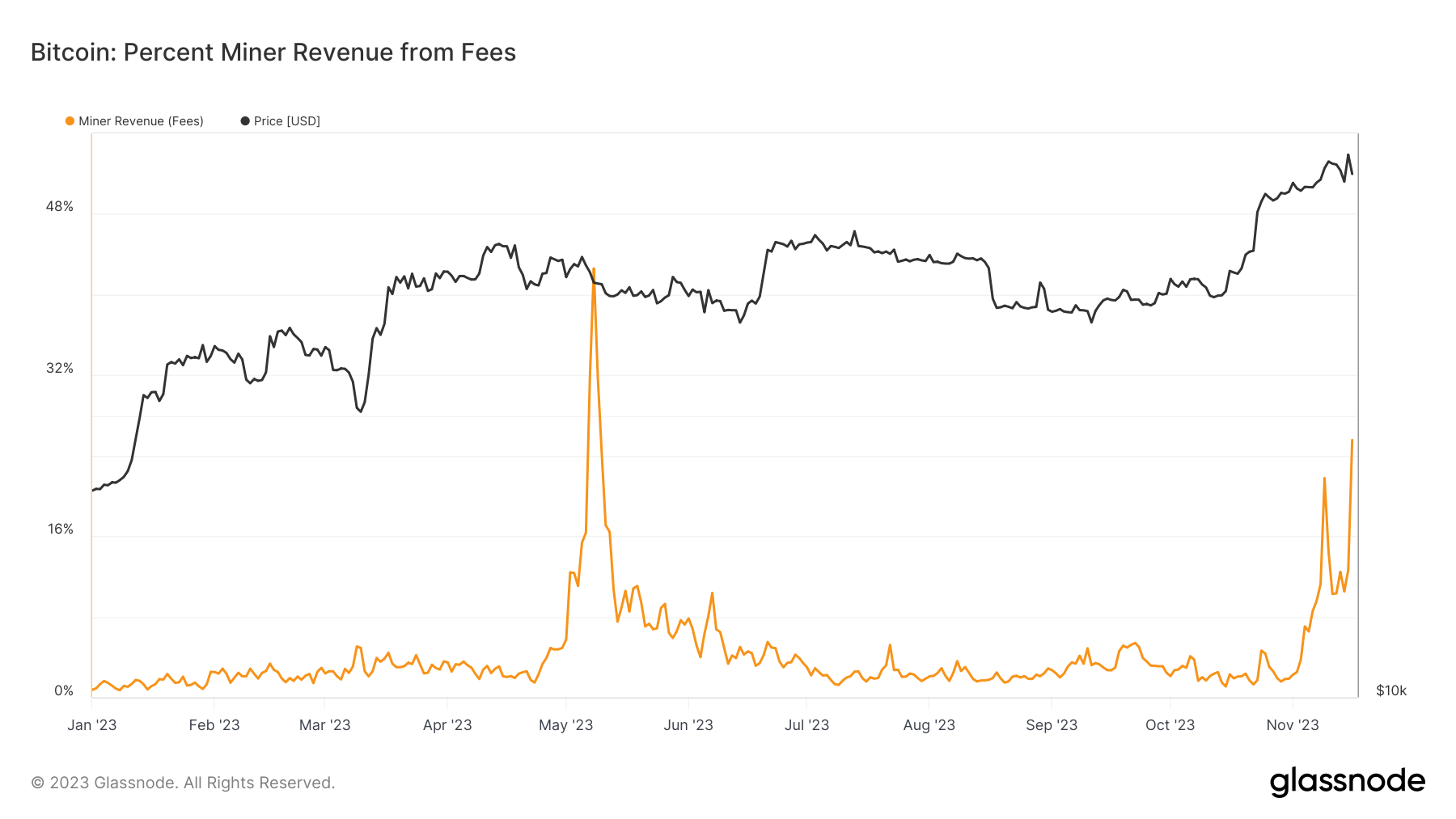

Bitcoin’s financial ecosystem is witnessing a transformative phase, particularly for miners whose revenue streams are evolving. Traditionally reliant on block rewards, miners now see a substantial portion of their income—over 25%—coming from transaction fees. This shift is intricately linked to the burgeoning use of Inscriptions and BRC-20 tokens within the network, which are not only driving transaction volumes but also the value of these transactions.

The rise in fee-based revenue is a boon for the Bitcoin network’s security. As block rewards are set to decrease over time, the increasing fee revenue provides a sustainable financial model, ensuring robust security for the blockchain. This security budget, funded by transaction fees and block rewards, is crucial for maintaining network integrity and resilience against potential attacks, thus underpinning user confidence in the system.

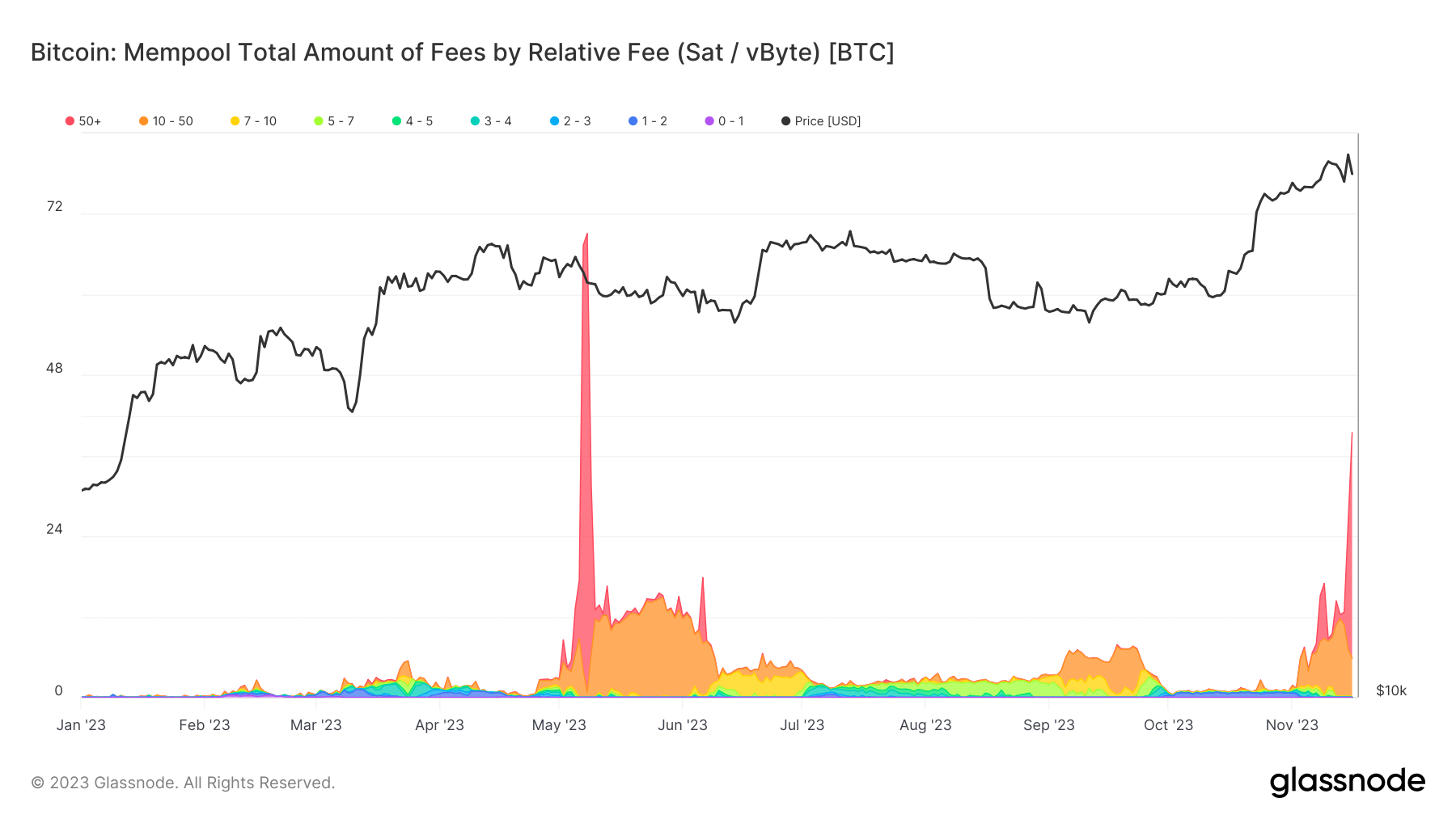

Moreover, the current mempool data sheds light on user behavior in the network. The dominance of transactions with fees around 50 sat/vByte indicates an apparent willingness among users to pay a premium. This trend reflects the value users place on the network’s efficiency and contributes to the growing fee-based revenue stream for miners.

The post Bitcoin miners revenue increasingly fueled by transaction fees amid token inscription surge appeared first on CryptoSlate.