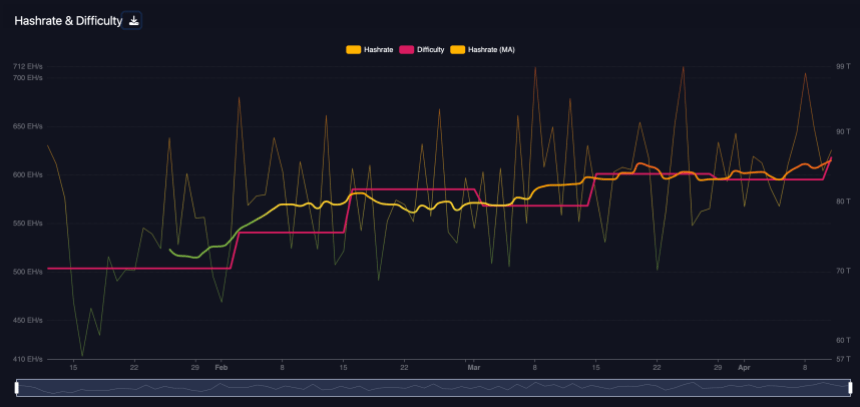

The Bitcoin network mining difficulty has surged nearly 4% to hit an all-time high just a few days before the highly anticipated Halving event. This adjustment, recorded at 86.4 trillion, marks a crucial milestone in the cryptocurrency’s history.

Decrypting Bitcoin’s Mining Complexity

Notably, Bitcoin mining difficulty measures miners’ complexity in solving mathematical puzzles to validate transactions and add new blocks to the blockchain.

This latest surge reflects the increasing computational power dedicated to securing the network as miners brace themselves for the impending Halving event scheduled for April 20.

As the mining difficulty continues to soar, miners ramp up their hash rate, representing the total computational power contributed to the network.

This surge in hash rate underscores the growing interest and investment in Bitcoin mining infrastructure, highlighting miners’ commitment to secure the network and reap rewards amidst the evolving landscape of crypto mining.

Bitcoin Bullish Sentiment Amid Rising Mining Difficulty

The surge in mining difficulty and hash rate comes amidst a bullish sentiment surrounding Bitcoin’s price and its potential for further growth.

The impending Halving event will see block subsidy rewards reduced from 6.25 BTC to 3.125 BTC, potentially impacting miner revenues and the overall network dynamics.

Despite these uncertainties, as the halving event draws nearer, Bitcoin has demonstrated resilience, maintaining its upward trajectory. Over the past week, the cryptocurrency has surged approximately 2.5%, with a 1.5% increase in the last 24 hours alone.

As of this writing, Bitcoin trades at $69,921, reflecting its bullish momentum. Amidst these slight positive price movements and the impending Halving, Bitcoin enthusiasts and analysts have continued to express optimism, instilling confidence in investors and traders awaiting a potential BTC price spike.

Notably, prominent figures like Robert Kiyosaki, author of “Rich Dad, Poor Dad,” have recently echoed bullish sentiments, endorsing the price predictions put forth by Ark Invest founder Cathie Wood.

Wood forecasted that Bitcoin’s price could skyrocket to $2.3 million, emphasizing the cryptocurrency’s potential amidst a global investment base valued at roughly $250 trillion. Kiyosaki expressed his confidence in Wood’s prediction, highlighting her intelligence and expertise.

Kathie Wood quarantees Bitcoin will hit $2.3 million per BTC. Do I believe her? Yes I do. Kathie Wood is very smart. I trust her opinion. Could she be wrong? Yes. She could be. So what? The more important question is “ What do you believe?” What if Kathie is right? What if…

— Robert Kiyosaki (@theRealKiyosaki) April 11, 2024

Featured image from Unsplash, Chart from TradingView