The post Bitcoin Mining Difficulty Surges to New Highs: Here’s Why It Matters appeared first on Coinpedia Fintech News

The Bitcoin mining difficulty has jumped to an all time high. It has peaked at 101.65 trillion and it is putting bitcoin miners in a very tight spot. Especially the private miners are feeling intense pressure. They have to battle against the soaring costs and stiff competition. Let’s explore the facts behind this rise in mining difficulty and what it means for bitcoin.

Unprecedented Mining Difficulty

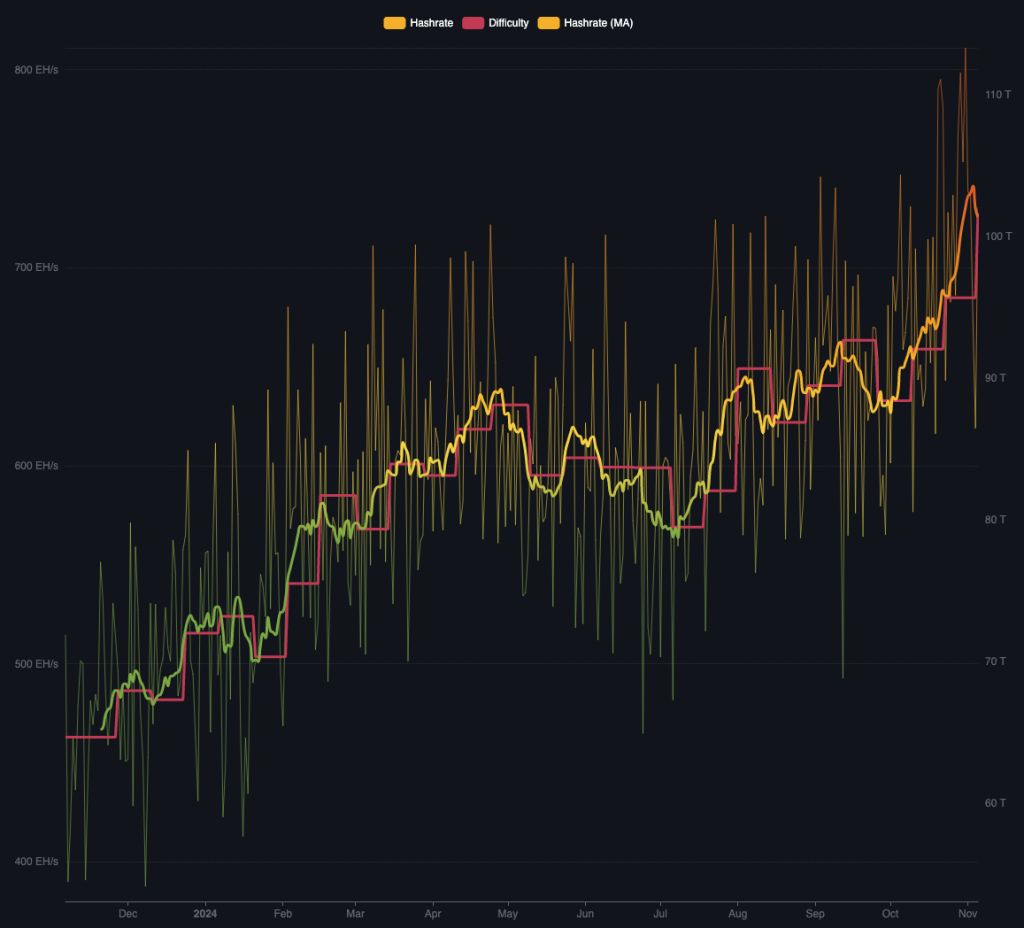

For those new to the concept, mining difficulty measures how hard it is to find new blocks on the Bitcoin blockchain. It adjusts roughly every two weeks (after 2,016 blocks) to ensure blocks are discovered at around 10-minute intervals. This year, out of 23 adjustments, nearly 60% were increased. That alone shows how competitive the field is becoming.

But what’s really making waves? The hashrate. This is the total computational power miners contribute to the network. By the end of October, it hit an average of 755 EH/s over seven days, an all-time record. A one-day spike of 12% capped off the month, underlining how intense the competition has become.

Pressure Mounts on Miners

This surge in difficulty isn’t just numbers on a chart—it has real consequences. On average, miners are selling off nearly all the bitcoin they mine, a clear sign that many are under financial stress. After August and September sell-offs, there was only a brief pause when miners managed to hold onto some of their BTC in October.

The April 20 halving event dealt another blow. The event cut block rewards from 6.25 BTC to 3.125 BTC, slashing potential earnings significantly. Miners who once earned $72.4 million a week are now making between $25 to $35 million. This reduction in revenue has pushed out less efficient players and piled pressure on smaller mining firms that can’t match the resources of larger, publicly traded companies.

What to Expect

The path ahead isn’t looking easy, particularly for smaller miners. With rising costs from increased difficulty and hashrate, many may need to sell their BTC holdings just to stay afloat. Only more financially stable companies may endure, while others face a tough decision: adapt or exit the market.

In short, the record-high Bitcoin mining difficulty and post-halving revenue cuts are reshaping the landscape. The coming months will be telling for who can survive these demanding conditions and who can’t.