Bitcoin price can be unpredictable. But shockingly, a specific model managed to predict the peak in 2021 at above $60,000 as far back as 2019.

That same model is now pointing to a peak range near $732,000 per coin. Is this a realistic estimate, or pure hope? Let’s take a closer look at the model and find out.

Predicting The Last Bull Market Peak Years In Advance

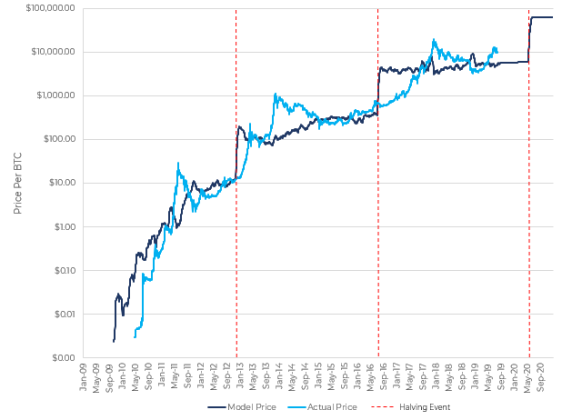

Back in 2019, the go to model for predicting future Bitcoin pricing was Plan B’s now debunked Stock-To-Flow (S2F) model. But around the same time, Greg Cipolaro took a stab at modifying the S2F model with highly accurate results.

While Plan B’s take failed to bring the price per BTC above the projected $100,000 or more, Cipolaro’s model nailed a peak range near $60,000.

Bitcoin reached $65,000 in April 2021 and then $68,000 in November 2021. If anything BTCUSD overshot his modest estimates, while price undershot Plan B’s by miles.

The model is based on post-halving supply reduction price targets. More importantly than what happened after the 2020 halving, however, is what Cipolaro’s model predicts after the next halving.

Could Bitcoin Reach $732,000 After The 2024 Halving?

While getting it right just one time per Cipolaro’s model is notable, it could be a matter of luck or coincidence. If the model works again, the higher the likelihood he’s onto something significant.

Especially when the next projected target is $732,000 per BTC. The target is much higher than most estimates out there, which point to between $100,000 and $200,000 per coin.

This is roughly an 1,800% increase from currently levels. From the Black Thursday low at $3,800 to the 2021 peak at $68,000 represents nearly a 1,600% return, so such numbers aren’t outside the realm of possibility for the king of crypto.

During the year of 2017 alone, Bitcoin surged by over 2,000%. And this occurred after price had appreciated by over 400% already. Today, Bitcoin is up 140% off 2022 lows. Could the top cryptocurrency by market cap add another 1,800% on top of that to reach the model’s predicted peak?